0 Deductible Health Insurance Plans

Introduction to 0 Deductible Health Insurance Plans

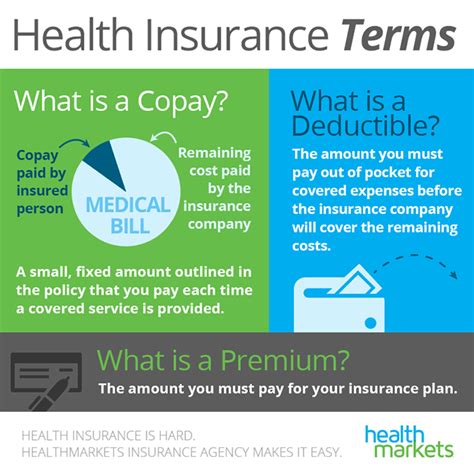

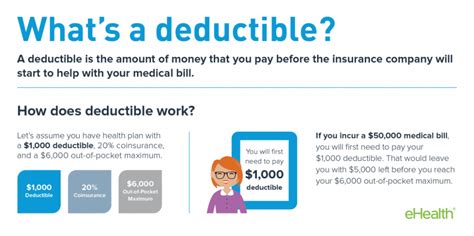

When it comes to health insurance, one of the most critical factors to consider is the deductible. The deductible is the amount you must pay out of pocket for medical expenses before your insurance plan starts covering costs. For many, high deductibles can be a significant barrier to accessing necessary healthcare. This is where 0 deductible health insurance plans come into play, offering a solution for those seeking to minimize their upfront medical expenses. In this article, we will delve into the world of 0 deductible health insurance plans, exploring what they are, how they work, and their potential benefits and drawbacks.

Understanding 0 Deductible Health Insurance Plans

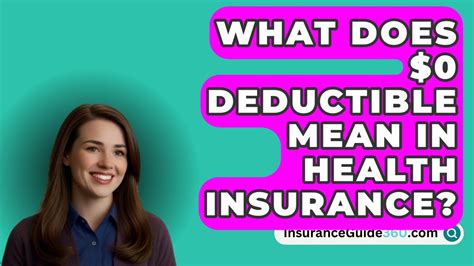

0 deductible health insurance plans are a type of health insurance policy where you do not have to pay any deductible for medical services. This means that from the first dollar spent on healthcare, your insurance plan covers the costs, without requiring you to meet a deductible amount first. These plans are particularly attractive to individuals and families who require frequent medical care or have chronic conditions, as they can help manage healthcare costs more effectively.

How 0 Deductible Plans Work

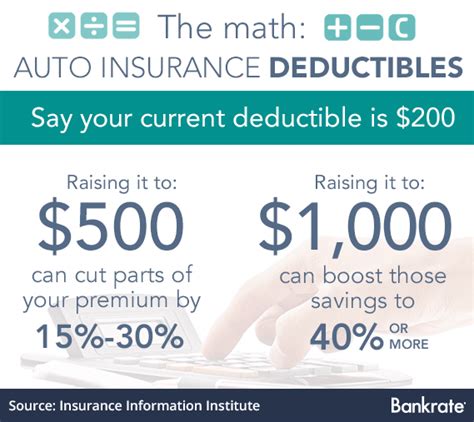

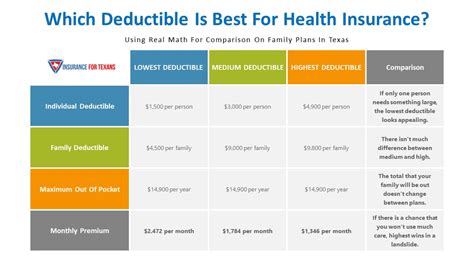

The mechanism behind 0 deductible health insurance plans is straightforward. Unlike traditional health insurance plans that require you to pay a certain amount out of pocket before insurance coverage kicks in, these plans eliminate the deductible requirement. This can lead to lower out-of-pocket costs for policyholders, especially in the short term. However, to compensate for the lack of a deductible, these plans might have higher monthly premiums compared to plans with deductibles.

Benefits of 0 Deductible Health Insurance Plans

There are several benefits associated with 0 deductible health insurance plans: - Lower Out-of-Pocket Costs: The most apparent advantage is the reduction in out-of-pocket expenses for medical care. Without a deductible, you can access healthcare services without a significant initial cost. - Predictable Expenses: With no deductible to worry about, your healthcare expenses become more predictable, as you primarily concern yourself with copays and coinsurance. - Increased Accessibility to Healthcare: For those who might delay seeking medical care due to high deductibles, 0 deductible plans can increase accessibility to necessary healthcare services. - Reduced Financial Stress: Knowing that your insurance covers medical expenses from the start can reduce financial stress related to healthcare costs.

Potential Drawbacks of 0 Deductible Health Insurance Plans

While 0 deductible health insurance plans offer several advantages, there are also potential drawbacks to consider: - Higher Premiums: The trade-off for not having a deductible is often higher monthly premiums. This can be a significant consideration for those on a tight budget. - Limited Availability: 0 deductible plans might not be as widely available as other types of health insurance plans, and their availability can vary by state and insurance provider. - Network Restrictions: Some 0 deductible plans might have strict network restrictions, limiting your choice of healthcare providers. - Potential for Higher Coinsurance: After the insurance kicks in, you might face higher coinsurance rates for certain services, which can still result in significant out-of-pocket costs.

Eligibility and Enrollment

Eligibility for 0 deductible health insurance plans and the process of enrollment can vary. Generally, these plans are available through the health insurance marketplace, directly from insurers, and sometimes through employers. Key factors to consider during enrollment include: - Open Enrollment Periods: Typically, you can enroll in a 0 deductible plan during the annual open enrollment period. - Special Enrollment Periods: Certain life events, such as losing other coverage, getting married, or having a baby, might qualify you for a special enrollment period. - Employer-Sponsored Plans: If your employer offers a 0 deductible health insurance plan, you can enroll during your company’s open enrollment period or when you become eligible.

Comparing 0 Deductible Plans

When comparing different 0 deductible health insurance plans, it’s essential to look beyond the deductible and consider other factors: - Premium Costs: How much will you pay each month for the plan? - Out-of-Pocket Maximum: What is the maximum amount you’ll pay for healthcare expenses in a year? - Copays and Coinsurance: What are the costs for doctor visits, prescriptions, and other services? - Network Providers: Are your preferred healthcare providers part of the plan’s network?

| Plan Feature | 0 Deductible Plan | Traditional Plan |

|---|---|---|

| Deductible | $0 | $1,000 - $5,000 |

| Premiums | Higher | Lower |

| Out-of-Pocket Maximum | Varies | Varies |

| Copays and Coinsurance | Vary by Service | Vary by Service |

📝 Note: When choosing between a 0 deductible plan and a traditional plan, consider your healthcare needs and budget. If you expect to use a lot of healthcare services, a 0 deductible plan might be more cost-effective, despite higher premiums.

Making the Most of Your 0 Deductible Health Insurance Plan

To maximize the benefits of your 0 deductible health insurance plan: - Understand Your Plan: Familiarize yourself with what is covered, copays, coinsurance, and any limitations. - Stay In-Network: Whenever possible, use healthcare providers within your plan’s network to minimize costs. - Preventive Care: Take advantage of preventive care services, which are often covered at no additional cost to you. - Review and Adjust: Annually review your plan during open enrollment and adjust as necessary to ensure it continues to meet your healthcare and financial needs.

In summary, 0 deductible health insurance plans offer a unique set of benefits, particularly for those with frequent medical needs or chronic conditions. While they may come with higher premiums and potential drawbacks, they can provide more predictable and lower out-of-pocket healthcare costs. By understanding how these plans work, their advantages and disadvantages, and carefully selecting a plan that meets your needs, you can make informed decisions about your health insurance coverage.

What is a 0 deductible health insurance plan?

+

A 0 deductible health insurance plan is a type of health insurance policy that does not require you to pay any deductible for medical services, meaning your insurance coverage starts from the first dollar spent on healthcare.

How do 0 deductible plans differ from traditional health insurance plans?

+

0 deductible plans differ primarily in that they do not have a deductible, which can lead to lower out-of-pocket costs for policyholders but often results in higher monthly premiums compared to traditional plans with deductibles.

What are the benefits of choosing a 0 deductible health insurance plan?

+

The benefits include lower out-of-pocket costs for healthcare services, more predictable expenses, increased accessibility to healthcare, and reduced financial stress related to medical expenses.

Related Terms:

- No deductible health insurance cost

- Best no deductible health insurance

- No deductible vs deductible health insurance

- 0 deductible car insurance

- what does zero deductible mean

- 0 copay meaning