5 Tips United Health Plans

Introduction to United Health Plans

United Health Plans are designed to provide individuals and families with comprehensive health insurance coverage. With a wide range of plans to choose from, it can be overwhelming to select the right one. In this article, we will discuss 5 tips to help you navigate the process of choosing a United Health Plan that suits your needs.

Tip 1: Assess Your Health Needs

Before selecting a United Health Plan, it’s essential to assess your health needs. Consider the following factors: * Your age and health status * Any pre-existing medical conditions * The number of dependents you have * Your budget for healthcare expenses * Your lifestyle and health habits By evaluating these factors, you can determine what type of coverage you need and what features are essential to you.

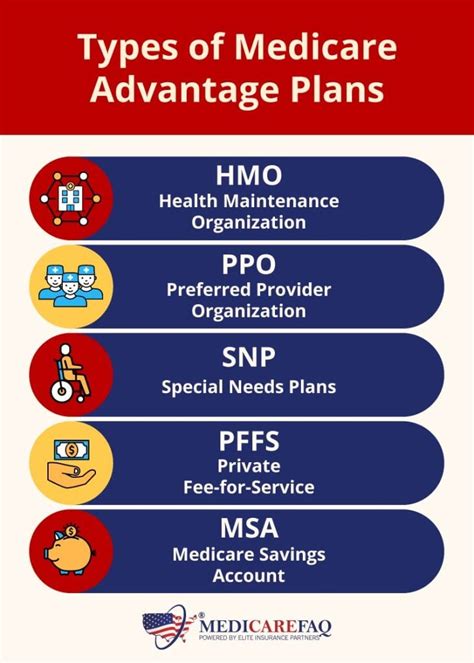

Tip 2: Understand the Different Types of Plans

United Health Plans offer a variety of plans, including: * HMO (Health Maintenance Organization) plans: These plans require you to receive care from a specific network of providers. * PPO (Preferred Provider Organization) plans: These plans offer more flexibility, allowing you to see any healthcare provider, but with higher out-of-pocket costs for out-of-network care. * POS (Point of Service) plans: These plans combine elements of HMO and PPO plans, offering a balance between network and out-of-network care. * HDHP (High-Deductible Health Plan) plans: These plans have lower premiums but higher deductibles, often paired with a Health Savings Account (HSA). Understanding the differences between these plans can help you choose the one that best fits your needs.

Tip 3: Evaluate the Network of Providers

When selecting a United Health Plan, it’s crucial to evaluate the network of providers. Consider the following: * Are your current healthcare providers part of the network? * Are there enough specialists and hospitals in the network to meet your needs? * What are the credentials and quality ratings of the providers in the network? A strong network of providers can ensure that you receive high-quality care when you need it.

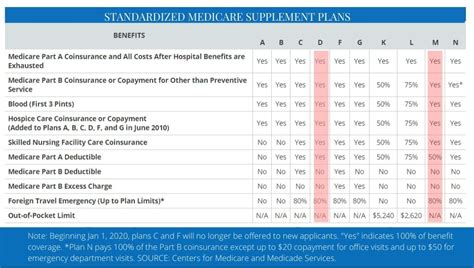

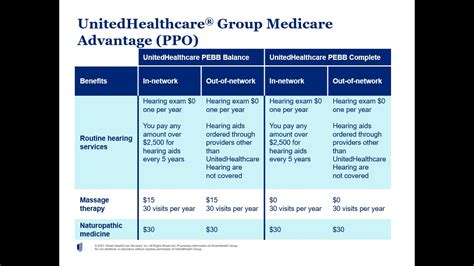

Tip 4: Review the Plan’s Benefits and Coverage

Each United Health Plan offers different benefits and coverage. Review the plan’s: * Coverage for essential health benefits, such as preventive care, hospitalization, and prescription medication * Out-of-pocket costs, including deductibles, copays, and coinsurance * Maximum out-of-pocket expenses to protect you from high medical bills * Additional benefits, such as vision, dental, or hearing coverage By carefully reviewing the plan’s benefits and coverage, you can ensure that you have the protection you need.

Tip 5: Consider the Cost and Value

Finally, consider the cost and value of the United Health Plan. Evaluate the following: * Premium costs: How much will you pay each month for the plan? * Out-of-pocket costs: How much will you pay for deductibles, copays, and coinsurance? * Value-added services: Does the plan offer additional services, such as wellness programs or telehealth services? By weighing the costs and benefits, you can determine which plan offers the best value for your money.

| Plan Type | Premium Costs | Out-of-Pocket Costs | Value-Added Services |

|---|---|---|---|

| HMO | $300-$500 per month | $1,000-$2,000 per year | Wellness programs, telehealth services |

| PPO | $500-$700 per month | $2,000-$3,000 per year | Wellness programs, telehealth services, out-of-network coverage |

| POS | $400-$600 per month | $1,500-$2,500 per year | Wellness programs, telehealth services, balance of network and out-of-network coverage |

| HDHP | $200-$400 per month | $3,000-$5,000 per year | Health Savings Account (HSA), wellness programs, telehealth services |

📝 Note: When selecting a United Health Plan, it's essential to carefully review the plan's benefits, coverage, and costs to ensure that you choose the right plan for your needs.

In summary, choosing a United Health Plan requires careful consideration of your health needs, the type of plan, network of providers, benefits and coverage, and cost and value. By following these 5 tips, you can make an informed decision and select a plan that provides you with the protection and care you need.

What is the difference between an HMO and PPO plan?

+

An HMO plan requires you to receive care from a specific network of providers, while a PPO plan offers more flexibility, allowing you to see any healthcare provider, but with higher out-of-pocket costs for out-of-network care.

How do I evaluate the network of providers for a United Health Plan?

+

To evaluate the network of providers, consider whether your current healthcare providers are part of the network, the number of specialists and hospitals in the network, and the credentials and quality ratings of the providers.

What is a Health Savings Account (HSA), and how does it work with a United Health Plan?

+

A Health Savings Account (HSA) is a tax-advantaged savings account that can be paired with a High-Deductible Health Plan (HDHP). It allows you to set aside pre-tax dollars to pay for qualified medical expenses, reducing your taxable income and lowering your healthcare costs.

Related Terms:

- unitedhealthcare supplemental plans 2025

- unitedhealthcare medicare plans for 2025

- united health dual complete 2025

- bcbs marketplace plans 2025