30 Days Travel Health Insurance

Introduction to 30 Days Travel Health Insurance

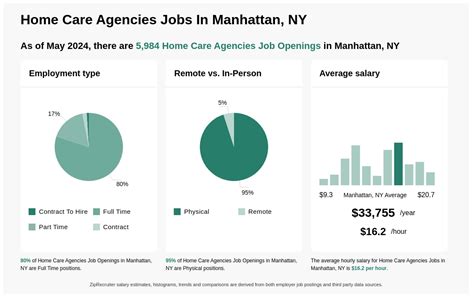

When planning a trip abroad, whether for leisure, business, or educational purposes, one crucial aspect to consider is travel health insurance. This type of insurance provides coverage for unexpected medical emergencies that may arise during your travels. Among the various options available, 30 days travel health insurance is a popular choice for short-term travelers. This post will delve into the details of 30 days travel health insurance, including its benefits, what it covers, how to choose the right policy, and important considerations for travelers.

Benefits of 30 Days Travel Health Insurance

The primary benefit of 30 days travel health insurance is the financial protection it offers against medical emergencies. Unexpected illnesses or injuries can lead to significant medical bills, which can be a substantial burden for travelers. With this insurance, travelers can receive the necessary medical care without worrying about the costs. Additionally, 30 days travel health insurance often includes benefits such as: - Emergency medical evacuations: In cases where the local medical facilities are not equipped to handle the patient’s condition, the insurance covers the cost of transporting the patient to a more suitable medical facility. - Trip interruptions: If a medical emergency forces the traveler to cut their trip short, the insurance may cover the cost of returning home. - Assistance services: Many policies include 24⁄7 assistance services to help travelers navigate foreign healthcare systems, find medical providers, and deal with language barriers.

Coverage Details

The coverage provided by 30 days travel health insurance can vary depending on the insurer and the specific policy. However, most policies typically cover: - Hospital stays: Room and board, as well as hospital services and supplies. - Surgical procedures: Costs associated with surgical interventions, including the surgeon’s fees, anesthesiologist’s fees, and operating room costs. - Doctor visits: Outpatient services, including doctor visits and prescribed medications. - Emergency dental care: In cases of sudden and unexpected dental pain or emergencies.

🚨 Note: Pre-existing conditions are often excluded from coverage, so it's essential to disclose any medical conditions when purchasing the policy.

Choosing the Right Policy

Selecting the right 30 days travel health insurance policy involves several considerations: - Policy limits: Ensure the policy has sufficient coverage limits to handle potential medical expenses. - Deductibles and copays: Understand the out-of-pocket expenses you’ll need to pay for medical services. - Network of providers: Check if the insurer has a network of healthcare providers in your destination country. - Exclusions and limitations: Carefully review what is not covered by the policy, including pre-existing conditions, certain medical procedures, and adventure activities.

Important Considerations

Before purchasing 30 days travel health insurance, consider the following: - Age and health status: Older travelers or those with pre-existing conditions may face higher premiums or limited coverage options. - Destination: Traveling to areas with high medical costs or limited healthcare facilities may require a policy with higher coverage limits. - Length of stay: Even if you’re planning a shorter trip, consider the possibility of extending your stay and choose a policy that can be extended if necessary.

| Insurer | Premium | Coverage Limit | Deductible |

|---|---|---|---|

| Insurer A | $50 | $100,000 | $0 |

| Insurer B | $70 | $200,000 | $100 |

| Insurer C | $30 | $50,000 | $50 |

Final Thoughts

30 days travel health insurance is a vital component of any short-term travel plan, offering protection against unexpected medical emergencies. By understanding the benefits, coverage details, and considerations for choosing the right policy, travelers can ensure they have the necessary financial protection to enjoy their trip without undue worry. Whether you’re traveling for leisure or business, investing in 30 days travel health insurance can provide peace of mind, knowing that you’re prepared for any medical situation that may arise during your travels.

What does 30 days travel health insurance typically cover?

+

30 days travel health insurance typically covers unexpected medical emergencies, including hospital stays, surgical procedures, doctor visits, and emergency dental care, as well as emergency medical evacuations and trip interruptions.

How do I choose the right 30 days travel health insurance policy?

+

When choosing a 30 days travel health insurance policy, consider the policy limits, deductibles and copays, network of providers, exclusions and limitations, and your age and health status. It’s also crucial to read reviews and compare different policies to find the one that best suits your needs.

Can I extend my 30 days travel health insurance policy if I decide to stay longer?

+

Yes, many insurers offer the option to extend a 30 days travel health insurance policy, but this may depend on the specific policy and insurer. It’s essential to check the policy’s terms and conditions before purchasing to ensure it can be extended if needed.

Related Terms:

- Cheapest long term travel insurance

- 6 month travel insurance price

- Best long stay travel insurance

- 3 month travel insurance

- travel insurance long term stay

- travel insurance over 30 days