8333660360 Health Insurance Plans

Understanding Health Insurance Plans

Health insurance plans are designed to provide financial protection against medical expenses. With the rising cost of healthcare, having a health insurance plan is essential to avoid financial hardship. In this post, we will delve into the world of health insurance plans, exploring the different types, benefits, and factors to consider when choosing a plan.

Types of Health Insurance Plans

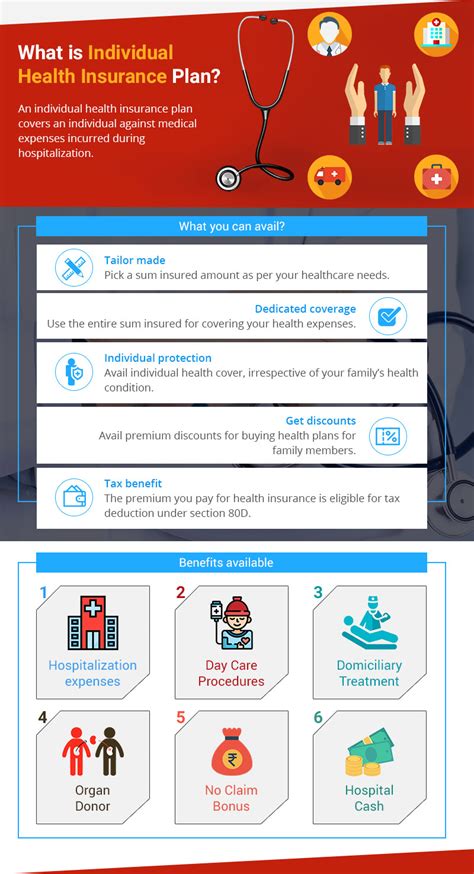

There are several types of health insurance plans available, each with its own unique features and benefits. Some of the most common types of plans include: * Individual and Family Plans: These plans are designed for individuals and families who are not covered by an employer-sponsored plan. * Group Plans: These plans are offered by employers to their employees and are often more affordable than individual plans. * Medicare Plans: These plans are designed for seniors and people with disabilities, providing coverage for hospital stays, doctor visits, and other medical expenses. * Medicaid Plans: These plans are designed for low-income individuals and families, providing coverage for essential health benefits.

Benefits of Health Insurance Plans

Health insurance plans offer a range of benefits, including: * Financial Protection: Health insurance plans provide financial protection against medical expenses, reducing the risk of financial hardship. * Access to Healthcare: Health insurance plans provide access to healthcare services, including doctor visits, hospital stays, and prescription medications. * Preventive Care: Many health insurance plans cover preventive care services, such as annual check-ups and screenings, to help prevent illness and detect health problems early. * Chronically Ill Benefits: Some health insurance plans offer benefits for chronically ill patients, including coverage for prescription medications and medical equipment.

Factors to Consider When Choosing a Health Insurance Plan

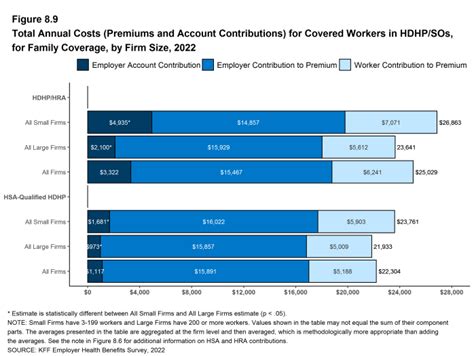

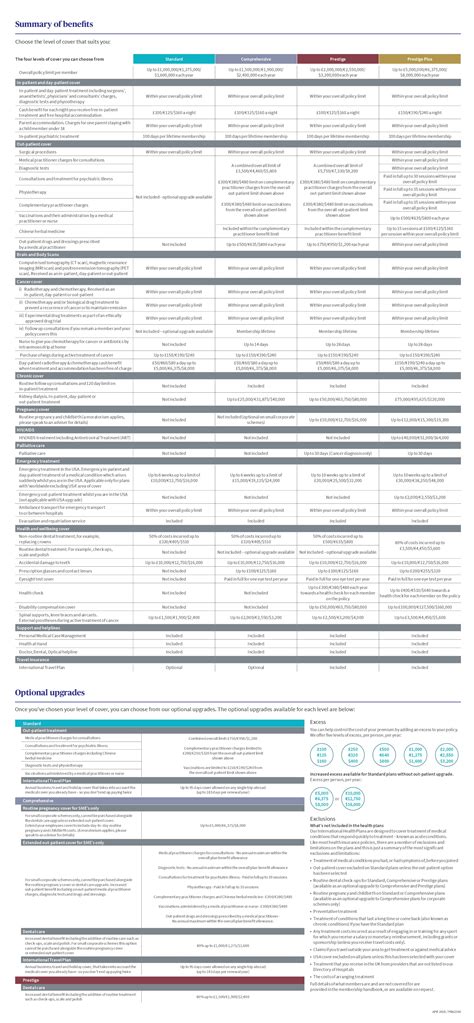

When choosing a health insurance plan, there are several factors to consider, including: * Premium Costs: The cost of the plan, including the monthly premium and any out-of-pocket expenses. * Network of Providers: The network of healthcare providers participating in the plan, including doctors, hospitals, and specialists. * Coverage and Benefits: The types of medical expenses covered by the plan, including doctor visits, hospital stays, and prescription medications. * Deductible and Copayment: The amount of money that must be paid out-of-pocket before the plan begins to pay, as well as any copayment or coinsurance requirements.

How to Choose the Right Health Insurance Plan

Choosing the right health insurance plan can be a daunting task, but by considering the following steps, you can make an informed decision: * Assess Your Needs: Consider your healthcare needs, including any chronic conditions or ongoing medical expenses. * Research Plans: Research different health insurance plans, including the types of coverage and benefits offered. * Compare Plans: Compare the costs and benefits of different plans, including the premium, deductible, and copayment requirements. * Read Reviews: Read reviews from other policyholders to get a sense of the plan’s reputation and level of customer service.

| Plan Type | Premium Cost | Network of Providers | Coverage and Benefits |

|---|---|---|---|

| Individual Plan | $300-$500 per month | Medium-sized network | Basic coverage, including doctor visits and hospital stays |

| Group Plan | $200-$400 per month | Large network | Comprehensive coverage, including prescription medications and specialist care |

| Medicare Plan | $100-$300 per month | Small network | Basic coverage, including hospital stays and doctor visits |

📝 Note: When choosing a health insurance plan, it's essential to carefully review the plan's documentation, including the policy and any applicable riders or endorsements.

As we have seen, health insurance plans are complex and multifaceted, offering a range of benefits and coverage options. By understanding the different types of plans, benefits, and factors to consider, you can make an informed decision when choosing a health insurance plan. Ultimately, the right plan will depend on your individual needs and circumstances, so it’s essential to take the time to research and compare different options.

What is the difference between a deductible and a copayment?

+

A deductible is the amount of money that must be paid out-of-pocket before the plan begins to pay, while a copayment is a fixed amount paid for a specific service, such as a doctor visit or prescription medication.

Can I change my health insurance plan at any time?

+

No, you can only change your health insurance plan during the open enrollment period or if you experience a qualifying life event, such as a change in employment or marriage.

What is the purpose of a health insurance plan’s network of providers?

+

The network of providers is the group of healthcare providers participating in the plan, including doctors, hospitals, and specialists. The network determines which providers are covered by the plan and at what cost.