5 Aetna Health Plan Tips

Introduction to Aetna Health Plans

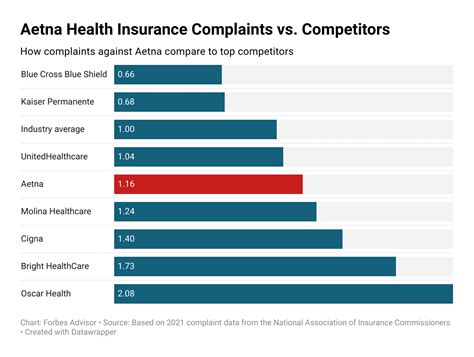

Aetna is one of the most recognized health insurance providers in the United States, offering a wide range of health plans to individuals, families, and employers. With a history dating back to 1853, Aetna has established itself as a leader in the health insurance industry, known for its comprehensive coverage options and affordable premiums. Whether you’re looking for individual coverage or group coverage for your employees, Aetna health plans are definitely worth considering. In this article, we will provide you with 5 essential tips to help you navigate Aetna health plans and make an informed decision.

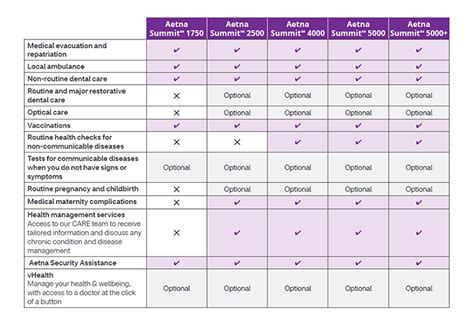

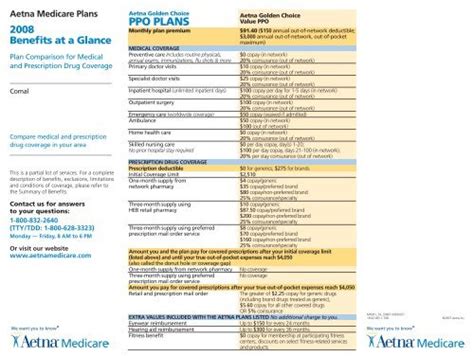

Tip 1: Understand Your Coverage Options

Aetna offers a variety of health plans, each with its own set of benefits and drawbacks. It’s essential to understand your coverage options to choose the plan that best suits your needs. Some of the most common types of Aetna health plans include: * Health Maintenance Organization (HMO) plans: These plans require you to receive medical care from a specific network of providers. * Preferred Provider Organization (PPO) plans: These plans offer more flexibility, allowing you to see any healthcare provider you choose, although you may pay more for out-of-network care. * Exclusive Provider Organization (EPO) plans: These plans combine elements of HMO and PPO plans, offering a balance between network flexibility and cost savings. * Point of Service (POS) plans: These plans allow you to choose between receiving care from a network provider or an out-of-network provider, with different cost-sharing arrangements for each option.

Tip 2: Consider Your Network Needs

When selecting an Aetna health plan, it’s crucial to consider your network needs. If you have a preferred healthcare provider or hospital, make sure they are part of the plan’s network. You can use Aetna’s online tools to search for in-network providers and facilities. Additionally, consider the following factors: * Provider directory: Check the plan’s provider directory to ensure it includes a wide range of specialists and primary care physicians. * Network size: A larger network may offer more options, but it may also increase costs. * Out-of-network coverage: If you need to see a provider outside of the network, understand the costs and coverage limitations.

Tip 3: Evaluate Your Cost-Sharing Options

Aetna health plans come with various cost-sharing arrangements, including deductibles, copays, and coinsurance. It’s essential to evaluate these options carefully to ensure you can afford the costs. Consider the following: * Deductible: The amount you must pay out-of-pocket before the plan starts covering costs. * Copay: A fixed amount you pay for each healthcare service, such as doctor visits or prescriptions. * Coinsurance: The percentage of costs you pay after meeting the deductible. * Maximum out-of-pocket (MOOP) limit: The maximum amount you’ll pay for healthcare expenses within a calendar year.

Tip 4: Review Additional Benefits and Services

Aetna health plans often include additional benefits and services that can enhance your overall healthcare experience. Some of these benefits may include: * Preventive care services: Routine check-ups, screenings, and vaccinations may be covered at no additional cost. * Telehealth services: Access to virtual healthcare consultations may be available, reducing the need for in-person visits. * Wellness programs: Aetna may offer wellness programs, such as fitness discounts or health coaching, to help you maintain a healthy lifestyle. * Mental health and substance abuse services: Aetna plans often include coverage for mental health and substance abuse treatment.

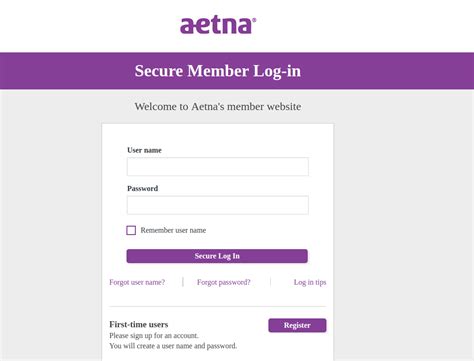

Tip 5: Take Advantage of Aetna’s Online Tools and Resources

Aetna offers a range of online tools and resources to help you manage your health plan and make informed decisions. Some of these resources include: * Plan comparison tools: Use Aetna’s online tools to compare different plans and choose the one that best suits your needs. * Provider search: Find in-network providers and facilities using Aetna’s online directory. * Claims and billing: Manage your claims and billing information online, reducing paperwork and hassle. * Health and wellness resources: Access Aetna’s library of health and wellness resources, including articles, videos, and webinars.

📝 Note: Always review your plan documents and contact Aetna directly if you have questions or concerns about your coverage.

As you navigate the world of Aetna health plans, remember to take your time, do your research, and carefully consider your options. By following these 5 tips, you’ll be well on your way to finding the perfect plan for your needs and budget. Whether you’re an individual, family, or employer, Aetna has a range of health plans to suit your unique requirements. With its comprehensive coverage options, affordable premiums, and additional benefits, Aetna is an excellent choice for anyone seeking reliable and flexible health insurance.

What is the difference between an HMO and PPO plan?

+

An HMO (Health Maintenance Organization) plan requires you to receive medical care from a specific network of providers, while a PPO (Preferred Provider Organization) plan offers more flexibility, allowing you to see any healthcare provider you choose, although you may pay more for out-of-network care.

How do I find in-network providers with Aetna?

+

You can use Aetna’s online provider directory to search for in-network providers and facilities. Simply visit Aetna’s website, enter your location and plan details, and browse the list of participating providers.

What is the maximum out-of-pocket (MOOP) limit, and how does it work?

+

The maximum out-of-pocket (MOOP) limit is the maximum amount you’ll pay for healthcare expenses within a calendar year. After meeting the MOOP limit, your health plan will cover 100% of eligible expenses, reducing your financial burden.

Related Terms:

- Aetna individual plans

- Aetna health insurance

- Aetna PPO plans

- Aetna health insurance reviews

- Aetna does not cover anything

- Aetna login