Aetna Health Savings Account Benefits

Introduction to Aetna Health Savings Account Benefits

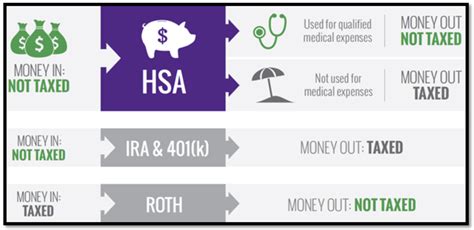

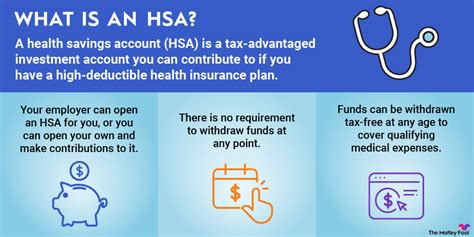

The Aetna Health Savings Account (HSA) is a valuable tool for individuals and families looking to manage their healthcare expenses while also saving for the future. An HSA is a type of savings account that allows you to set aside pre-tax dollars to pay for qualified medical expenses. In this blog post, we will explore the benefits of an Aetna HSA and how it can help you take control of your healthcare costs.

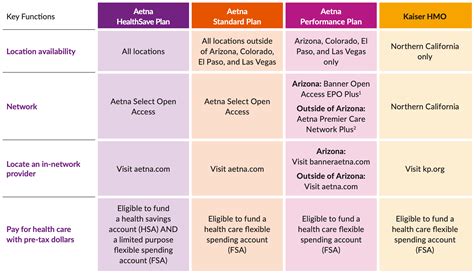

How Aetna Health Savings Accounts Work

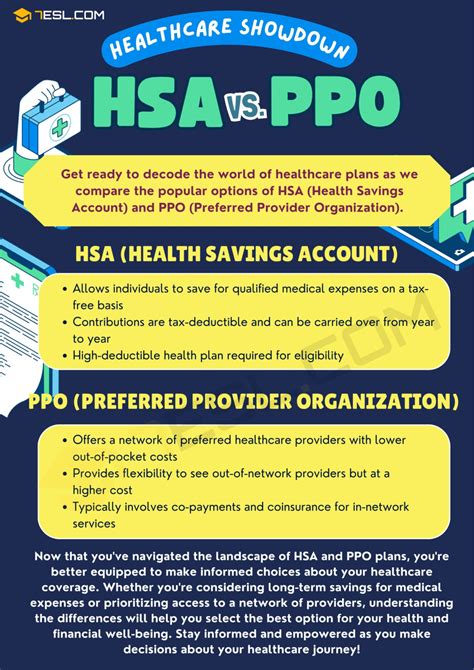

To be eligible for an Aetna HSA, you must be enrolled in a High Deductible Health Plan (HDHP). This type of plan has a higher deductible than a traditional health insurance plan, but it also has lower premiums. Once you have an HDHP, you can open an HSA and start contributing to it. The money in your HSA can be used to pay for qualified medical expenses, such as doctor visits, prescriptions, and hospital stays. One of the key benefits of an HSA is that the money in the account grows tax-free, and you can use it to pay for medical expenses in retirement.

Benefits of Aetna Health Savings Accounts

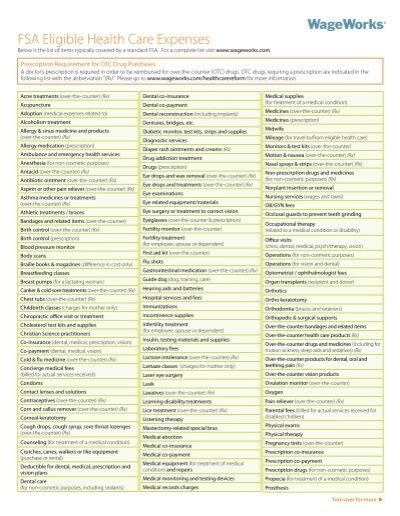

There are several benefits to having an Aetna HSA. Some of the most significant advantages include: * Tax advantages: Contributions to an HSA are tax-deductible, and the money in the account grows tax-free. * Flexibility: You can use the money in your HSA to pay for a wide range of qualified medical expenses, including doctor visits, prescriptions, and hospital stays. * Portability: An HSA is portable, which means you can take it with you if you change jobs or retire. * Investment opportunities: Some HSAs offer investment options, which can help your money grow over time. * No “use it or lose it” rule: Unlike a Flexible Spending Account (FSA), an HSA does not have a “use it or lose it” rule, which means you can keep the money in your account from year to year.

Aetna HSA Eligibility and Contribution Limits

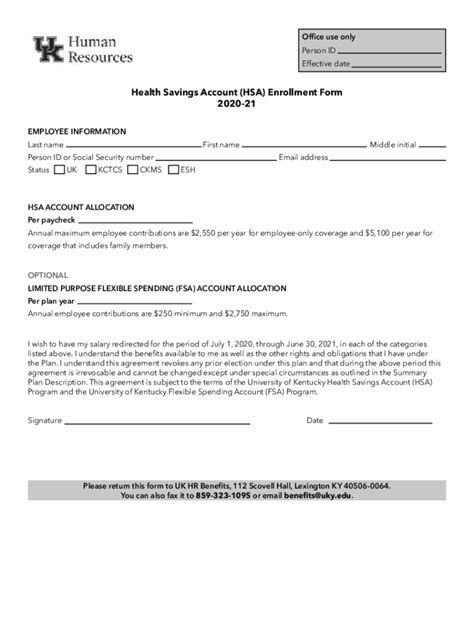

To be eligible for an Aetna HSA, you must meet certain requirements. These include: * Being enrolled in an HDHP * Not being eligible for Medicare * Not being claimed as a dependent on someone else’s tax return * Not having any other health coverage, except for certain exceptions, such as dental or vision coverage The contribution limits for an Aetna HSA vary from year to year. For 2022, the contribution limits are: * 3,650 for individual coverage * 7,300 for family coverage You can also make catch-up contributions if you are 55 or older.

How to Use Your Aetna HSA

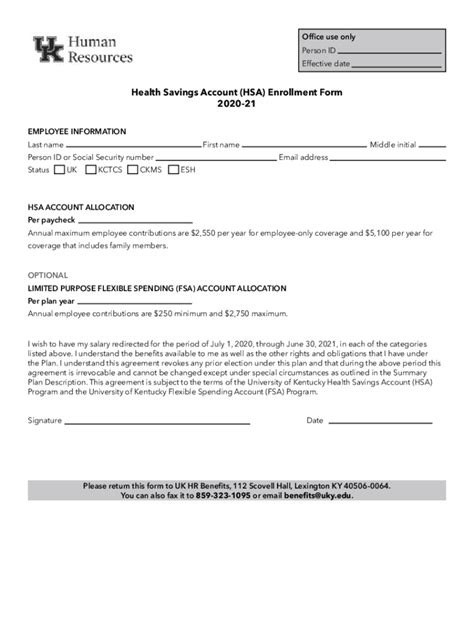

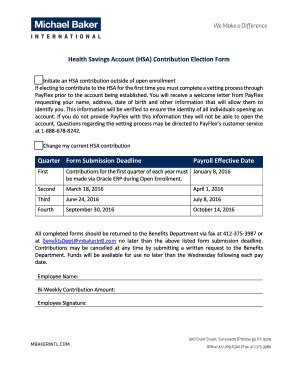

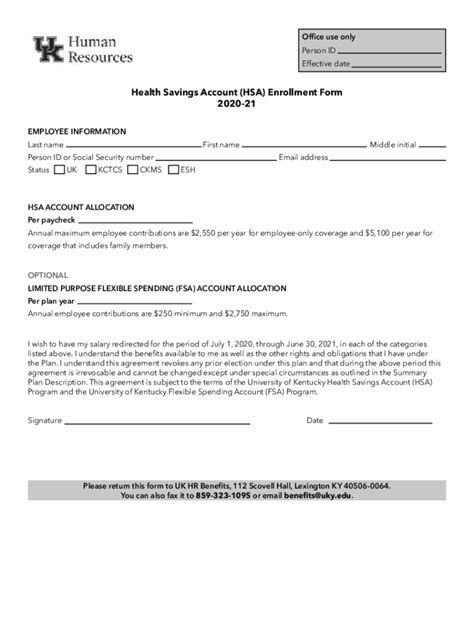

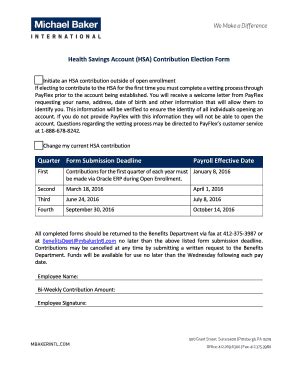

Using your Aetna HSA is relatively straightforward. Here are the steps: * Open an HSA account: You can open an HSA account through Aetna or another HSA provider. * Contribute to your account: You can contribute to your HSA through payroll deductions or by making direct contributions. * Use your HSA card: You can use your HSA card to pay for qualified medical expenses, such as doctor visits and prescriptions. * Submit claims: If you need to submit a claim for reimbursement, you can do so through the Aetna website or by mail.

💡 Note: It's essential to keep receipts and records of your medical expenses, as you may need to provide documentation to support your HSA claims.

Aetna HSA Investment Options

Some Aetna HSAs offer investment options, which can help your money grow over time. These options may include: * Stocks: You can invest in individual stocks or stock mutual funds. * Bonds: You can invest in individual bonds or bond mutual funds. * Mutual funds: You can invest in a variety of mutual funds, including index funds and actively managed funds. * Exchange-traded funds (ETFs): You can invest in ETFs, which are similar to mutual funds but trade on an exchange like stocks.

| Investment Option | Description |

|---|---|

| Stocks | Invest in individual stocks or stock mutual funds |

| Bonds | Invest in individual bonds or bond mutual funds |

| Mutual funds | Invest in a variety of mutual funds, including index funds and actively managed funds |

| Exchange-traded funds (ETFs) | Invest in ETFs, which are similar to mutual funds but trade on an exchange like stocks |

Conclusion and Final Thoughts

In conclusion, an Aetna Health Savings Account can be a valuable tool for managing your healthcare expenses while also saving for the future. With its tax advantages, flexibility, and investment options, an HSA can help you take control of your healthcare costs and build a safety net for retirement. By understanding how an HSA works and how to use it effectively, you can make the most of this powerful savings tool.

What is an Aetna Health Savings Account?

+

An Aetna Health Savings Account is a type of savings account that allows you to set aside pre-tax dollars to pay for qualified medical expenses.

How do I contribute to my Aetna HSA?

+

You can contribute to your Aetna HSA through payroll deductions or by making direct contributions.

Can I use my Aetna HSA to pay for non-medical expenses?

+

No, you can only use your Aetna HSA to pay for qualified medical expenses. If you use your HSA for non-medical expenses, you may be subject to penalties and taxes.

How do I invest my Aetna HSA funds?

+

You can invest your Aetna HSA funds in a variety of options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

Can I take my Aetna HSA with me if I change jobs?

+

Yes, your Aetna HSA is portable, which means you can take it with you if you change jobs or retire.

Related Terms:

- Aetna HSA PayFlex login

- Aetna HSA eligible expenses

- How does Aetna HSA work

- Aetna health savings account PayFlex

- Aetna HSA debit card

- Aetna HSA balance