5 Ways NJ Health Insurance

New Jersey Health Insurance: A Comprehensive Guide

In the state of New Jersey, having health insurance is not just a wise decision, but it is also mandatory. The New Jersey individual mandate, which was enacted in 2019, requires all residents to have qualifying health coverage or face a penalty, unless they qualify for an exemption. This guide will walk you through the different ways to obtain health insurance in New Jersey, highlighting the options available and the factors to consider when selecting a plan.

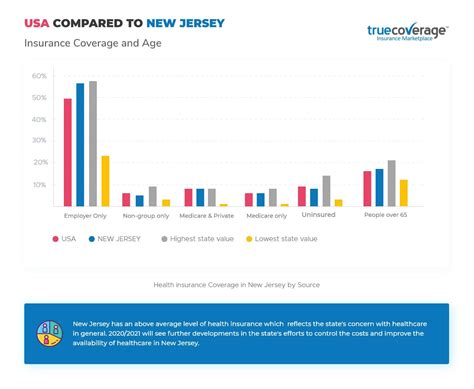

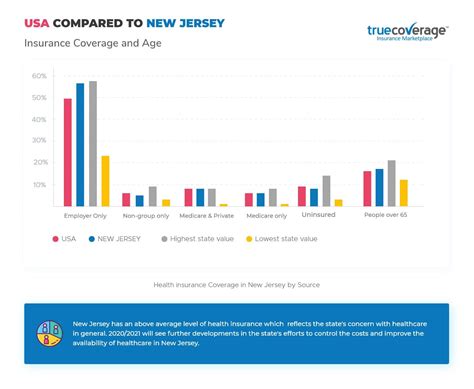

Understanding the NJ Health Insurance Market

The health insurance market in New Jersey offers a variety of plans from different carriers, each with its unique set of benefits, deductibles, and premiums. The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted the health insurance landscape, providing more people with access to health coverage. However, navigating the health insurance market can be overwhelming, especially with the numerous options available. Here are five ways to obtain health insurance in New Jersey:

- Employer-Sponsored Plans: Many employers in New Jersey offer health insurance as part of their employee benefits package. These plans are often more affordable than individual plans and may offer better coverage.

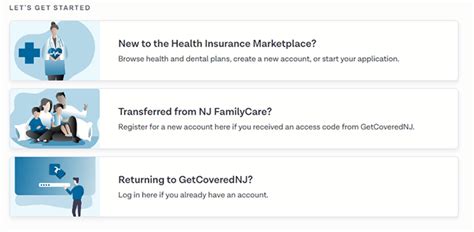

- Individual and Family Plans: For those who are not covered by their employer or are self-employed, individual and family plans are available through the health insurance marketplace or directly from insurance carriers.

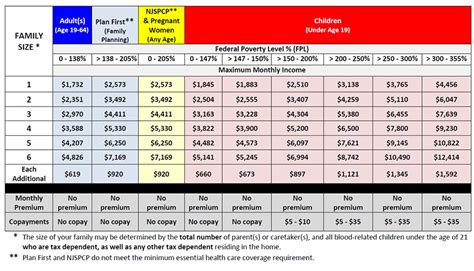

- Medicaid and NJ FamilyCare: New Jersey’s Medicaid program, known as NJ FamilyCare, provides health coverage to low-income individuals and families who meet specific eligibility requirements.

- Short-Term Limited-Duration Insurance (STLDI): STLDI plans offer temporary health coverage for individuals who are between jobs, waiting for other coverage to start, or need temporary coverage. These plans are not considered minimum essential coverage and do not provide the same level of benefits as major medical plans.

- Catastrophic Plans: Catastrophic plans are designed for young adults or those who are exempt from the individual mandate. These plans have lower premiums but higher deductibles and limited benefits.

Selecting the Right Health Insurance Plan

With so many options available, selecting the right health insurance plan can be a daunting task. When choosing a plan, consider the following factors: * Premiums: The monthly cost of the plan * Deductibles: The amount you must pay out-of-pocket before the insurance carrier starts paying * Copays and Coinsurance: The amount you pay for doctor visits, prescriptions, and other services * Network: The list of healthcare providers who participate in the plan’s network * Benefits: The services and treatments covered by the plan * Maximum Out-of-Pocket (MOOP): The maximum amount you pay for healthcare expenses in a calendar year

📝 Note: It's essential to review the plan's details, including the benefits, limitations, and exclusions, before making a decision.

NJ Health Insurance Carriers

New Jersey has several health insurance carriers that offer a range of plans, including:

| Carrier | Plan Types |

|---|---|

| AmeriHealth | Individual and Family, Group, Medicare |

| Horizon Blue Cross Blue Shield of New Jersey | Individual and Family, Group, Medicare, Medicaid |

| UnitedHealthcare | Individual and Family, Group, Medicare, Medicaid |

| Oxford Health Plans | Individual and Family, Group |

Enrollment and Eligibility

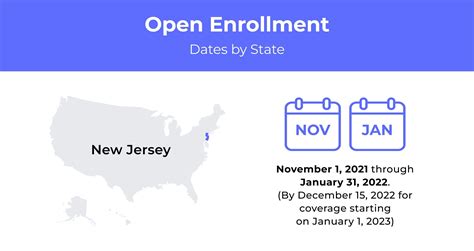

The enrollment period for health insurance in New Jersey typically runs from November to December, with some exceptions for special enrollment periods. To be eligible for health insurance, you must: * Be a resident of New Jersey * Be a U.S. citizen, national, or lawfully present immigrant * Not be incarcerated * Meet the specific eligibility requirements for the plan or program you are applying for

📝 Note: It's crucial to understand the enrollment periods and eligibility requirements to avoid gaps in coverage or penalties.

In final thoughts, navigating the New Jersey health insurance market requires careful consideration of the various options available. By understanding the different types of plans, selecting the right plan, and being aware of the enrollment and eligibility requirements, you can make an informed decision and ensure you have the necessary health coverage.

What is the individual mandate in New Jersey?

+

The individual mandate in New Jersey requires all residents to have qualifying health coverage or face a penalty, unless they qualify for an exemption.

What are the different types of health insurance plans available in New Jersey?

+

The different types of health insurance plans available in New Jersey include employer-sponsored plans, individual and family plans, Medicaid and NJ FamilyCare, short-term limited-duration insurance, and catastrophic plans.

How do I enroll in a health insurance plan in New Jersey?

+

To enroll in a health insurance plan in New Jersey, you can visit the health insurance marketplace website, contact a licensed insurance broker, or directly apply through an insurance carrier’s website.

Related Terms:

- Free health insurance New Jersey

- Best affordable health insurance NJ

- NJ health insurance Marketplace

- Get Covered NJ

- Best health insurance in NJ

- Aetna health insurance NJ