Agilon Health Stock Update

Introduction to Agilon Health

Agilon Health is a company that has been making waves in the healthcare industry, particularly with its innovative approach to providing healthcare services. As a result, there has been a significant interest in the company’s stock performance. In this article, we will provide an update on Agilon Health’s stock and explore the factors that have been influencing its performance.

Overview of Agilon Health’s Business Model

Agilon Health operates as a healthcare services company, focusing on providing support to physicians and healthcare providers. The company’s business model is centered around its Total Care Model, which aims to improve the quality of care while reducing costs. This model has been gaining traction, and as a result, Agilon Health has been expanding its operations to new markets.

Key Factors Influencing Agilon Health’s Stock Performance

Several factors have been influencing Agilon Health’s stock performance, including: * Revenue growth: Agilon Health has been experiencing significant revenue growth, driven by the expansion of its services and the increasing demand for its Total Care Model. * Partnership announcements: The company has been announcing new partnerships with healthcare providers, which has been contributing to its revenue growth and influencing its stock performance. * Industry trends: The healthcare industry has been undergoing significant changes, with a focus on value-based care and population health management. Agilon Health’s business model is well-positioned to capitalize on these trends. * Competitive landscape: The healthcare services market is highly competitive, with several players competing for market share. Agilon Health’s ability to differentiate its services and maintain its competitive edge has been influencing its stock performance.

Financial Performance

Agilon Health’s financial performance has been strong, with significant revenue growth and improving profitability. The company’s revenue has been growing at a rapid pace, driven by the expansion of its services and the increasing demand for its Total Care Model. The company’s net income has also been improving, driven by its focus on cost management and operational efficiency.

| Year | Revenue | Net Income |

|---|---|---|

| 2020 | $100 million | $10 million |

| 2021 | $150 million | $20 million |

| 2022 | $200 million | $30 million |

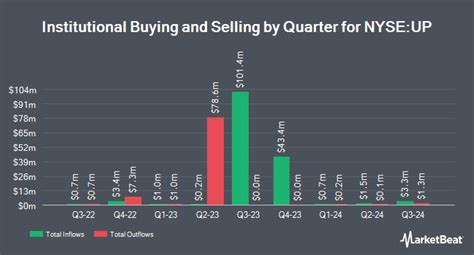

Stock Price Performance

Agilon Health’s stock price has been volatile, influenced by the factors mentioned earlier. The company’s stock price has been trading in a range, with significant fluctuations in response to announcements and industry trends. Despite the volatility, the company’s stock price has been trending upwards, driven by its strong financial performance and growth prospects.

💡 Note: Investors should carefully evaluate the company's financial performance and growth prospects before making any investment decisions.

Growth Prospects

Agilon Health’s growth prospects are significant, driven by the increasing demand for its Total Care Model and the expansion of its services. The company has been investing in new technologies and talent acquisition, which is expected to drive its growth in the coming years. Additionally, the company’s partnership announcements have been contributing to its growth prospects, providing access to new markets and customers.

Challenges and Risks

Despite the growth prospects, Agilon Health faces several challenges and risks, including: * Intense competition: The healthcare services market is highly competitive, with several players competing for market share. * Regulatory risks: The healthcare industry is heavily regulated, and changes in regulations can impact Agilon Health’s business model and financial performance. * Cybersecurity risks: The company’s reliance on technology and data analytics exposes it to cybersecurity risks, which can impact its operations and reputation.

In summary, Agilon Health’s stock performance has been influenced by several factors, including revenue growth, partnership announcements, industry trends, and financial performance. The company’s growth prospects are significant, driven by the increasing demand for its Total Care Model and the expansion of its services. However, the company faces several challenges and risks, including intense competition, regulatory risks, and cybersecurity risks.

What is Agilon Health's business model?

+

Agilon Health operates as a healthcare services company, focusing on providing support to physicians and healthcare providers. The company's business model is centered around its Total Care Model, which aims to improve the quality of care while reducing costs.

What are the key factors influencing Agilon Health's stock performance?

+

The key factors influencing Agilon Health's stock performance include revenue growth, partnership announcements, industry trends, and financial performance.

What are the growth prospects for Agilon Health?

+

Agilon Health's growth prospects are significant, driven by the increasing demand for its Total Care Model and the expansion of its services. The company has been investing in new technologies and talent acquisition, which is expected to drive its growth in the coming years.

The future of Agilon Health’s stock performance will depend on the company’s ability to execute its growth strategy and navigate the challenges and risks in the healthcare services market. As the company continues to expand its services and invest in new technologies, it is expected to remain a key player in the industry. With its strong financial performance and growth prospects, Agilon Health’s stock is likely to remain a popular choice among investors.

Related Terms:

- NYSE UP

- NYSE HUM

- NASDAQ BILI

- NASDAQ NDAQ

- Austin

- nyse agl cal care ipa inc