Health

Allegiance Health Insurance Plans

Introduction to Allegiance Health Insurance Plans

Allegiance Health Insurance Plans are designed to provide individuals and families with comprehensive coverage for their medical needs. With a wide range of plans to choose from, Allegiance Health Insurance offers flexibility and affordability, making it easier for people to access quality healthcare. In this blog post, we will delve into the details of Allegiance Health Insurance Plans, exploring their features, benefits, and how they can cater to different healthcare requirements.

Key Features of Allegiance Health Insurance Plans

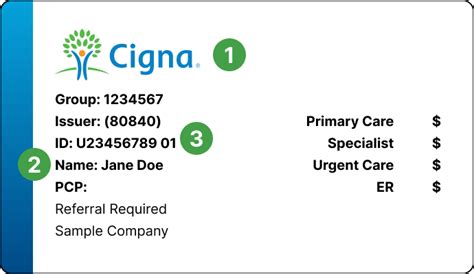

Allegiance Health Insurance Plans come with several key features that make them attractive to those seeking health insurance. Some of the notable features include: * Comprehensive Coverage: Allegiance Health Insurance Plans offer comprehensive coverage for medical expenses, including doctor visits, hospital stays, surgeries, and prescription medications. * Network of Providers: Allegiance has a vast network of healthcare providers, ensuring that policyholders have access to quality care when they need it. * Flexible Plan Options: With a variety of plans to choose from, individuals and families can select the one that best suits their needs and budget. * Preventive Care Services: Many Allegiance Health Insurance Plans cover preventive care services, such as routine check-ups, vaccinations, and screenings, to help policyholders maintain their health and prevent illnesses.

Benefits of Allegiance Health Insurance Plans

The benefits of Allegiance Health Insurance Plans are numerous. Some of the most significant advantages include: * Financial Protection: Allegiance Health Insurance Plans provide financial protection against unexpected medical expenses, ensuring that policyholders do not have to bear the burden of high healthcare costs. * Access to Quality Care: With a comprehensive network of healthcare providers, Allegiance policyholders can access quality care when they need it. * Preventive Care: By covering preventive care services, Allegiance Health Insurance Plans encourage policyholders to maintain their health and prevent illnesses. * Peace of Mind: Having an Allegiance Health Insurance Plan can provide policyholders with peace of mind, knowing that they are protected against unexpected medical expenses.

Types of Allegiance Health Insurance Plans

Allegiance offers a range of health insurance plans to cater to different needs and budgets. Some of the most common types of plans include: * Individual and Family Plans: These plans are designed for individuals and families who are not covered by an employer-sponsored plan. * Group Plans: These plans are designed for businesses and organizations that want to provide health insurance coverage to their employees. * Medicare Supplement Plans: These plans are designed for individuals who are eligible for Medicare and want to supplement their coverage. * Short-Term Plans: These plans are designed for individuals who need temporary health insurance coverage.

How to Choose the Right Allegiance Health Insurance Plan

Choosing the right Allegiance Health Insurance Plan can be overwhelming, especially with the numerous options available. Here are some tips to help you make an informed decision: * Assess Your Needs: Consider your medical needs, budget, and lifestyle when selecting a plan. * Compare Plans: Compare different plans, including their features, benefits, and costs. * Check the Network: Ensure that your healthcare providers are part of the plan’s network. * Read Reviews: Read reviews from other policyholders to get an idea of the plan’s quality and service.

📝 Note: It's essential to carefully review the plan's terms and conditions, including any exclusions or limitations, before making a decision.

Enrolling in an Allegiance Health Insurance Plan

Enrolling in an Allegiance Health Insurance Plan is a straightforward process. Here are the steps to follow: * Visit the Website: Visit the Allegiance website to explore the different plans and options. * Contact a Representative: Contact an Allegiance representative to discuss your needs and get personalized advice. * Apply Online: Apply online or over the phone, depending on your preference. * Review and Sign: Review your application, sign the contract, and pay your premium to complete the enrollment process.

Conclusion

In summary, Allegiance Health Insurance Plans offer comprehensive coverage, flexibility, and affordability, making them an attractive option for individuals and families seeking health insurance. By understanding the key features, benefits, and types of plans available, policyholders can make informed decisions about their healthcare needs. Whether you’re looking for individual, group, or Medicare supplement coverage, Allegiance has a plan that can cater to your requirements. With its vast network of providers and preventive care services, Allegiance Health Insurance Plans provide financial protection, access to quality care, and peace of mind.

What is the difference between an individual and group health insurance plan?

+

An individual health insurance plan is designed for individuals and families, while a group plan is designed for businesses and organizations that want to provide health insurance coverage to their employees.

How do I enroll in an Allegiance Health Insurance Plan?

+

You can enroll in an Allegiance Health Insurance Plan by visiting the website, contacting a representative, applying online or over the phone, and reviewing and signing the contract.

What is the network of providers for Allegiance Health Insurance Plans?

+

Allegiance has a vast network of healthcare providers, ensuring that policyholders have access to quality care when they need it.

Related Terms:

- allegiance website

- allegiance insurance website

- allegiance health insurance providers

- allegiance health insurance customer service

- allegiance com login

- allegiance insurance login