Alliant Health Plans Options

Introduction to Alliant Health Plans

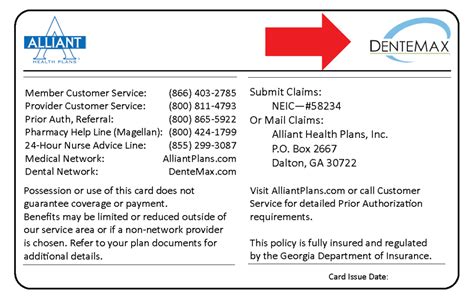

When it comes to choosing a health plan, there are numerous options available, each with its unique set of benefits and drawbacks. Alliant Health Plans is one such option that offers a range of health insurance plans to individuals, families, and businesses. In this article, we will delve into the world of Alliant Health Plans, exploring the various options available, their features, and what sets them apart from other health insurance providers.

Types of Alliant Health Plans

Alliant Health Plans offers a variety of health insurance plans, catering to different needs and budgets. Some of the most popular types of plans include: * Individual and Family Plans: These plans are designed for individuals and families who are not covered by their employer or are self-employed. They offer a range of benefits, including doctor visits, hospital stays, and prescription medication. * Group Plans: These plans are designed for businesses and organizations, providing coverage for employees and their families. * Medicare Plans: These plans are designed for seniors and individuals with disabilities, offering coverage for medical expenses, including doctor visits, hospital stays, and prescription medication. * Dental and Vision Plans: These plans provide coverage for dental and vision care, including routine check-ups, fillings, and eyeglasses.

Features of Alliant Health Plans

Alliant Health Plans offers a range of features that make them an attractive option for individuals and families. Some of the key features include: * Network of Providers: Alliant Health Plans has a large network of providers, including doctors, hospitals, and specialists. * Coverage Options: Alliant Health Plans offers a range of coverage options, including copays, deductibles, and coinsurance. * Preventive Care: Alliant Health Plans covers preventive care services, including routine check-ups, screenings, and vaccinations. * Prescription Medication: Alliant Health Plans covers prescription medication, including generic and brand-name drugs.

Benefits of Alliant Health Plans

There are several benefits to choosing Alliant Health Plans, including: * Affordability: Alliant Health Plans offers competitive pricing, making health insurance more affordable for individuals and families. * Flexibility: Alliant Health Plans offers a range of plan options, allowing individuals and families to choose the coverage that best meets their needs. * Quality of Care: Alliant Health Plans has a large network of providers, ensuring that individuals and families receive high-quality care. * Customer Service: Alliant Health Plans offers excellent customer service, including a 24⁄7 hotline and online support.

How to Choose the Right Alliant Health Plan

Choosing the right Alliant Health Plan can be overwhelming, especially with the numerous options available. Here are some tips to help you choose the right plan: * Assess Your Needs: Consider your health needs, including any pre-existing conditions or medications you take. * Compare Plans: Compare the different plans offered by Alliant Health Plans, including the coverage options, deductibles, and copays. * Check the Network: Check the network of providers to ensure that your doctor or hospital is included. * Read Reviews: Read reviews from other customers to get an idea of the quality of care and customer service.

| Plan Type | Coverage Options | Deductible | Copay |

|---|---|---|---|

| Individual and Family Plans | Doctor visits, hospital stays, prescription medication | $1,000 - $5,000 | $20 - $50 |

| Group Plans | Doctor visits, hospital stays, prescription medication | $500 - $2,000 | $10 - $30 |

| Medicare Plans | Medical expenses, including doctor visits, hospital stays, and prescription medication | $0 - $1,000 | $0 - $20 |

👍 Note: The deductible and copay amounts listed in the table are examples and may vary depending on the specific plan and provider.

In summary, Alliant Health Plans offers a range of health insurance options, each with its unique set of benefits and features. By assessing your needs, comparing plans, checking the network, and reading reviews, you can choose the right plan for you and your family. With competitive pricing, flexibility, and quality of care, Alliant Health Plans is an attractive option for individuals and families seeking health insurance.

The key points to consider when choosing an Alliant Health Plan include affordability, flexibility, quality of care, and customer service. By weighing these factors and considering your individual needs, you can make an informed decision and select a plan that provides the coverage and support you need.

The final decision to choose an Alliant Health Plan depends on your specific circumstances and priorities. It is essential to carefully evaluate the options and consider factors such as coverage, deductibles, copays, and network providers. By doing so, you can ensure that you select a plan that meets your needs and provides the necessary support for your health and well-being.

What types of health plans does Alliant Health Plans offer?

+

Alliant Health Plans offers individual and family plans, group plans, Medicare plans, and dental and vision plans.

How do I choose the right Alliant Health Plan for me?

+

To choose the right Alliant Health Plan, assess your needs, compare plans, check the network, and read reviews from other customers.

What is the deductible for Alliant Health Plans?

+

The deductible for Alliant Health Plans varies depending on the specific plan and provider, but can range from 1,000 to 5,000 for individual and family plans.

Related Terms:

- Truist

- alliant health plans dalton alamat

- alliant health plans dalton telepon

- Who owns Alliant Health Plans

- Alliant Health Plans Provider Portal

- Alliant Health Plans login