5 Tips Allied Health Insurance

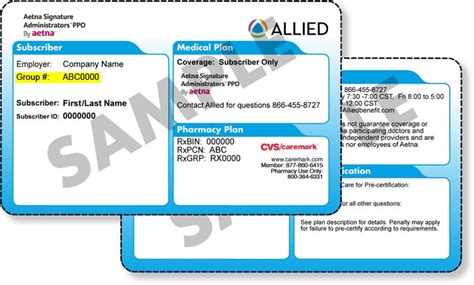

Introduction to Allied Health Insurance

Allied health insurance is a type of coverage that provides financial protection against the high costs of medical care for allied health professionals, such as physical therapists, occupational therapists, and speech-language pathologists. Having adequate insurance coverage is crucial for these professionals to ensure they can continue providing quality care to their patients without financial burdens. In this article, we will explore five essential tips for allied health insurance, highlighting key considerations and benefits.

Understanding Allied Health Insurance Needs

Before selecting an insurance plan, it’s essential to understand the specific needs of allied health professionals. Liability coverage is a critical component, as it protects against claims of negligence or malpractice. Additionally, business interruption insurance can help mitigate losses in the event of unexpected disruptions to the practice. Allied health professionals should also consider equipment insurance to protect against damage or loss of essential equipment.

Tips for Allied Health Insurance

Here are five tips to consider when selecting an allied health insurance plan: * Assess your risk exposure: Consider the type of care you provide, the location of your practice, and the number of patients you see. This will help you determine the level of liability coverage you need. * Choose a reputable insurer: Research the insurance company’s reputation, financial stability, and claims handling process. Look for an insurer that specializes in allied health insurance and has experience working with professionals in your field. * Customize your policy: Ensure your policy is tailored to your specific needs. This may include adding endorsements or riders to cover unique aspects of your practice, such as cyber liability or data breach coverage. * Review and update your policy regularly: As your practice evolves, your insurance needs may change. Regularly review your policy to ensure it continues to provide adequate coverage and make updates as necessary. * Consider bundling policies: If you have multiple insurance needs, such as liability, business interruption, and equipment insurance, consider bundling them with a single insurer. This can often result in cost savings and streamlined administration.

Benefits of Allied Health Insurance

Allied health insurance provides numerous benefits, including: * Financial protection: Liability coverage can help protect your assets and reputation in the event of a claim. * Business stability: Business interruption insurance can help ensure your practice remains operational during unexpected disruptions. * Peace of mind: Knowing you have adequate insurance coverage can reduce stress and allow you to focus on providing quality care to your patients. * Compliance: Many states require allied health professionals to carry liability insurance. Having adequate coverage can help ensure compliance with regulatory requirements. * Professional credibility: Carrying adequate insurance coverage can enhance your professional reputation and demonstrate your commitment to providing quality care.

Key Considerations

When selecting an allied health insurance plan, consider the following key factors: * Policy limits: Ensure the policy limits are sufficient to cover potential claims. * Deductible and premium: Balance the deductible and premium to ensure you can afford the coverage. * Coverage exclusions: Understand what is excluded from coverage, such as certain types of claims or damages. * Claims handling process: Research the insurer’s claims handling process to ensure it is efficient and responsive.

📝 Note: It's essential to carefully review and understand the policy terms, conditions, and exclusions before purchasing an allied health insurance plan.

Conclusion and Final Thoughts

In conclusion, allied health insurance is a critical component of a successful practice. By understanding your insurance needs, assessing your risk exposure, and selecting a reputable insurer, you can ensure you have adequate coverage to protect your assets and reputation. Remember to regularly review and update your policy to ensure it continues to meet your evolving needs. With the right insurance coverage, you can focus on providing quality care to your patients and maintaining a thriving practice.

What is allied health insurance?

+

Allied health insurance is a type of coverage that provides financial protection against the high costs of medical care for allied health professionals, such as physical therapists, occupational therapists, and speech-language pathologists.

What types of insurance do allied health professionals need?

+

Allied health professionals typically need liability coverage, business interruption insurance, and equipment insurance to protect against various risks and financial losses.

How do I choose a reputable insurer for allied health insurance?

+

Research the insurance company’s reputation, financial stability, and claims handling process. Look for an insurer that specializes in allied health insurance and has experience working with professionals in your field.

Related Terms:

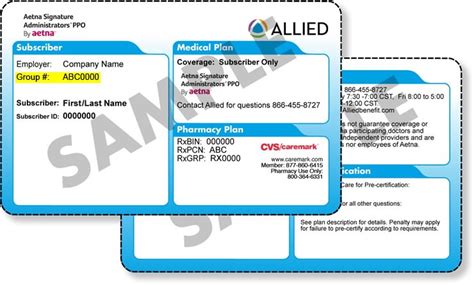

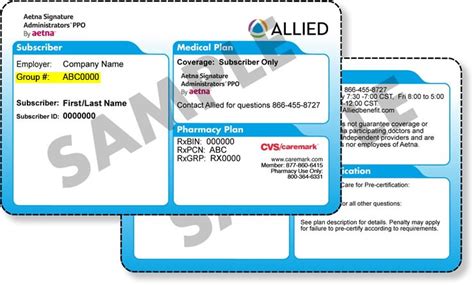

- Allied Insurance

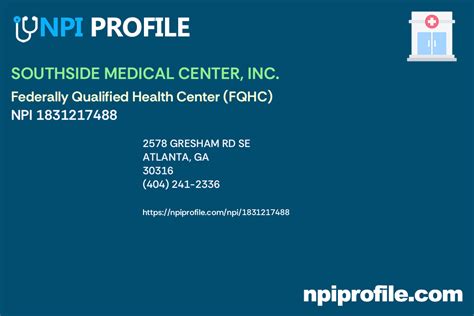

- Who accepts Allied health insurance

- Allied medical insurance

- Allied Benefits Provider portal

- Allied health insurance reviews

- Allied Benefits login