Health

Allied Health Insurance Options

Introduction to Allied Health Insurance

Allied health insurance is a type of insurance coverage that provides financial protection to individuals who work in the allied health industry, such as nurses, therapists, and technicians. This type of insurance is designed to help professionals in the allied health field manage the risks associated with their job, including medical malpractice, accidents, and other unforeseen events. With the increasing demand for healthcare services, allied health insurance has become an essential component of a comprehensive benefits package for professionals in this field.

Types of Allied Health Insurance

There are several types of allied health insurance options available, including: * Professional Liability Insurance: This type of insurance provides coverage for professionals in the event of a medical malpractice lawsuit. * General Liability Insurance: This type of insurance provides coverage for accidents and other unforeseen events that may occur in the workplace. * Workers’ Compensation Insurance: This type of insurance provides coverage for work-related injuries and illnesses. * Business Insurance: This type of insurance provides coverage for businesses in the allied health industry, including coverage for equipment, property, and employees. * Personal Insurance: This type of insurance provides coverage for individuals in the allied health industry, including coverage for health, life, and disability.

Benefits of Allied Health Insurance

Allied health insurance provides several benefits to professionals in the allied health industry, including: * Financial Protection: Allied health insurance provides financial protection in the event of a medical malpractice lawsuit or other unforeseen events. * Peace of Mind: Allied health insurance provides peace of mind, knowing that you are protected in the event of an accident or other unforeseen event. * Compliance with Regulations: Allied health insurance helps professionals in the allied health industry comply with regulatory requirements. * Business Protection: Allied health insurance provides protection for businesses in the allied health industry, including coverage for equipment, property, and employees. * Personal Protection: Allied health insurance provides personal protection for individuals in the allied health industry, including coverage for health, life, and disability.

How to Choose the Right Allied Health Insurance

Choosing the right allied health insurance can be a daunting task, but there are several factors to consider, including: * Cost: The cost of the insurance premium is an important factor to consider. * Coverage: The type and amount of coverage is also an important factor to consider. * Provider Network: The provider network is also an important factor to consider, as it can impact the quality of care. * Customer Service: The customer service provided by the insurance company is also an important factor to consider. * Reputation: The reputation of the insurance company is also an important factor to consider.

📝 Note: It is essential to carefully review the policy terms and conditions before purchasing allied health insurance.

Common Allied Health Insurance Providers

There are several allied health insurance providers available, including: * MedMal Direct Insurance Company * ProAssurance Corporation * Medical Protective Corporation * CNA Financial Corporation * Liberty Mutual Insurance Company

| Insurance Provider | Coverage Options | Premium Costs |

|---|---|---|

| MedMal Direct Insurance Company | Professional Liability, General Liability, Workers' Compensation | Varying premium costs depending on the type and amount of coverage |

| ProAssurance Corporation | Professional Liability, General Liability, Business Insurance | Varying premium costs depending on the type and amount of coverage |

| Medical Protective Corporation | Professional Liability, General Liability, Personal Insurance | Varying premium costs depending on the type and amount of coverage |

Conclusion and Final Thoughts

In conclusion, allied health insurance is an essential component of a comprehensive benefits package for professionals in the allied health industry. With several types of allied health insurance options available, it is essential to carefully review the policy terms and conditions before purchasing. By considering factors such as cost, coverage, provider network, customer service, and reputation, professionals in the allied health industry can choose the right allied health insurance to meet their needs.

What is allied health insurance?

+

Allied health insurance is a type of insurance coverage that provides financial protection to individuals who work in the allied health industry, including nurses, therapists, and technicians.

What types of allied health insurance are available?

+

There are several types of allied health insurance available, including professional liability insurance, general liability insurance, workers’ compensation insurance, business insurance, and personal insurance.

How do I choose the right allied health insurance?

+

To choose the right allied health insurance, consider factors such as cost, coverage, provider network, customer service, and reputation.

Related Terms:

- Allied Health Insurance phone number

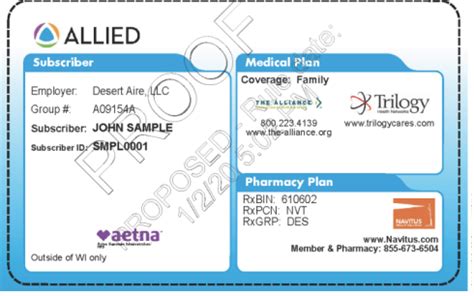

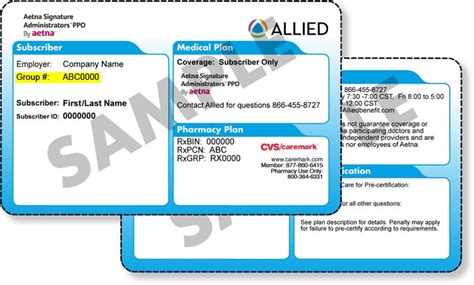

- Who accepts Allied health insurance

- Allied health insurance reviews

- Allied Benefits Provider phone number

- Allied Health insurance login

- Allied Universal benefits