5 Ambetter Tips

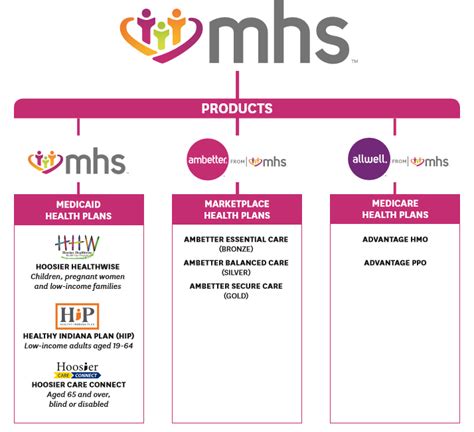

Introduction to Ambetter

Ambetter is a health insurance company that offers a range of plans to individuals and families. With its focus on providing affordable and comprehensive coverage, Ambetter has become a popular choice for those seeking healthcare solutions. In this article, we will explore five essential tips for getting the most out of your Ambetter plan.

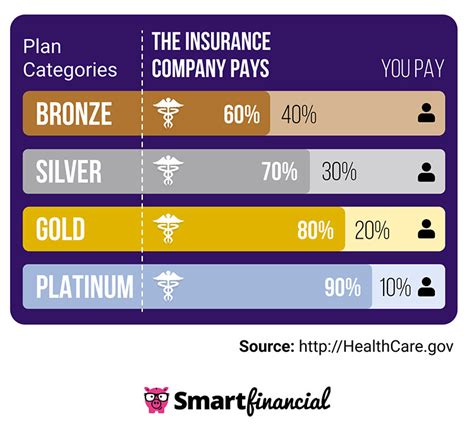

Tip 1: Understanding Your Plan Options

When selecting an Ambetter plan, it’s crucial to understand the different options available. Ambetter offers various plans, including bronze, silver, gold, and catastrophic plans. Each plan has its unique features, such as deductible amounts, copays, and coinsurance. Taking the time to research and compare these plans will help you choose the one that best fits your needs and budget. Consider factors like your health status, prescription medication requirements, and the number of doctor visits you expect to make in a year.

Tip 2: Maximizing Preventive Care

Ambetter plans often cover preventive care services without requiring a copay or coinsurance. These services include routine check-ups, vaccinations, and screenings for conditions like diabetes and certain types of cancer. By taking advantage of these services, you can stay on top of your health and catch potential issues early, reducing the risk of more severe and costly problems down the line. Be sure to review your plan documents to understand what preventive services are covered and how often you can access them.

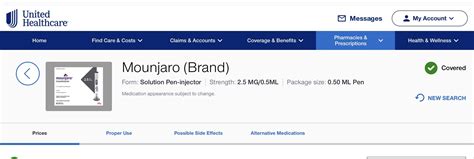

Tip 3: Managing Your Prescription Medications

If you take prescription medications regularly, it’s essential to understand how your Ambetter plan handles pharmacy benefits. Check your plan’s formulary to see which medications are covered and at what cost. Some plans may have tiered copays or require prior authorization for certain medications. Staying informed about your medication coverage can help you plan and budget accordingly. Additionally, look into any mail-order pharmacy options or discount programs that may be available to help reduce your medication costs.

Tip 4: Navigating the Ambetter Network

Ambetter has a network of participating providers that includes doctors, hospitals, and other healthcare professionals. Staying within this network can help keep your costs lower, as services provided by in-network providers are typically covered at a higher rate than those from out-of-network providers. Before seeking care, use Ambetter’s online tools or mobile app to find in-network providers in your area. This can help ensure that you receive the care you need while minimizing unexpected expenses.

Tip 5: Utilizing Ambetter’s Digital Tools

Ambetter offers a range of digital tools designed to make managing your health insurance easier and more convenient. These tools may include:

- Online portals for accessing your plan documents and claims information

- Mobile apps for finding in-network providers and estimating costs

- Telehealth services for remote consultations with healthcare professionals

- Personalized health and wellness resources, such as fitness trackers and nutrition advice

💡 Note: Always review your plan documents and contact Ambetter's customer service if you have any questions or concerns about your coverage or benefits.

To further illustrate the benefits of Ambetter’s plans, consider the following table, which summarizes the key features of each plan type:

| Plan Type | Deductible | Copay/Coinsurance | Max Out-of-Pocket |

|---|---|---|---|

| Bronze | Higher | Higher | Lower |

| Silver | Moderate | Moderate | Moderate |

| Gold | Lower | Lower | Higher |

| Catastrophic | Very High | Very High | Very High |

In summary, by understanding your plan options, maximizing preventive care, managing your prescription medications, navigating the Ambetter network, and utilizing digital tools, you can make the most of your Ambetter health insurance plan and ensure you receive the care you need while controlling costs.

What is the difference between Ambetter’s bronze, silver, gold, and catastrophic plans?

+

Ambetter’s plans differ in their deductible amounts, copays, and coinsurance rates. Bronze plans have higher deductibles and out-of-pocket costs, while gold plans have lower deductibles but higher premiums. Silver plans fall in between, offering a balance of cost and coverage. Catastrophic plans have very high deductibles and are designed for young adults or those who do not expect to need much medical care.

How do I find in-network providers with Ambetter?

+

You can find in-network providers using Ambetter’s online tools or mobile app. Simply enter your location and the type of provider you’re looking for, and you’ll be shown a list of nearby in-network options.

Can I use Ambetter’s digital tools to manage my prescription medications?

+

Yes, Ambetter’s digital tools can help you manage your prescription medications. You can use the online portal or mobile app to check your medication coverage, find pharmacies, and even order refills.

Related Terms:

- Ambetter Login

- Healthcare Marketplace

- Is Ambetter Medicaid

- United Healthcare reddit

- Oscar health insurance reviews

- Ambetter vs Cigna connect