5 Tips Amex Travel Insurance

Introduction to Amex Travel Insurance

When planning a trip, whether for business or leisure, it’s essential to consider the unforeseen circumstances that could arise, such as trip cancellations, medical emergencies, or lost luggage. American Express (Amex) travel insurance offers a range of benefits designed to protect travelers from these risks, providing financial protection and assistance when needed. In this article, we will explore five key tips to consider when purchasing Amex travel insurance, helping you make an informed decision that suits your travel needs.

Understanding Your Coverage Needs

Before purchasing any travel insurance, it’s crucial to understand what you need to be covered for. Consider the type of trip you’re taking, the activities you plan to engage in, and the value of your trip. Trip cancellation and interruption insurance can reimburse you for prepaid, non-refundable trip costs if your trip is cancelled or interrupted due to unforeseen circumstances. Additionally, medical and evacuation insurance can provide coverage for emergency medical and dental expenses, as well as emergency evacuation, which can be particularly important when traveling to remote areas or engaging in high-risk activities.

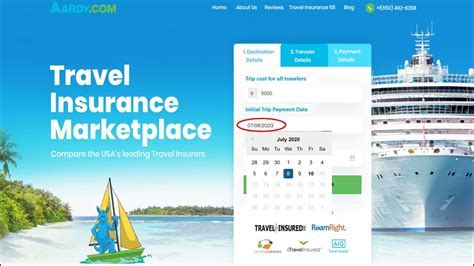

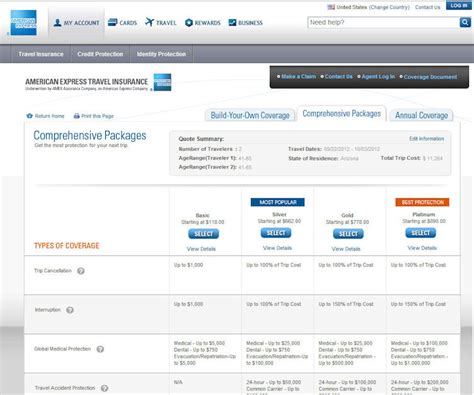

Comparing Policy Options

Amex offers various travel insurance policies, each designed to meet different traveler needs. When comparing policy options, consider the following factors: - Coverage limits: Ensure the policy provides sufficient coverage for your trip costs and potential medical expenses. - Deductibles: Understand the amount you’ll need to pay out-of-pocket for each claim. - Pre-existing condition coverage: If you have a pre-existing medical condition, look for policies that offer coverage for such conditions. - Activity-specific coverage: If you plan to engage in specific activities like skiing or scuba diving, ensure the policy covers these activities.

Reading Policy Documents Carefully

It’s essential to read the policy documents carefully before purchasing. Pay close attention to: - Policy exclusions: Understand what is not covered by the policy. - Claims process: Know how to file a claim and what documentation is required. - Customer support: Check if the insurer offers 24⁄7 customer support, which can be vital in emergency situations.

Considering Additional Benefits

Some Amex travel insurance policies come with additional benefits that can enhance your travel experience. These may include: - Travel assistance services: Providing help with travel arrangements, such as flight changes or hotel bookings. - Concierge services: Offering assistance with dining reservations, event tickets, and other travel-related needs. - Travel alerts and advisories: Keeping you informed about travel warnings and advisories for your destinations.

Reviewing Policy Reviews and Ratings

Finally, research the insurer’s reputation by reading policy reviews and ratings from other customers. This can give you an insight into the insurer’s customer service, claims handling, and overall satisfaction. Look for reviews on independent review platforms and consider the following: - Customer satisfaction ratings: High ratings can indicate good customer service and claims handling. - Complaints and issues: Be wary of insurers with a high number of complaints or unresolved issues.

📝 Note: Always review the policy terms and conditions carefully before purchasing to ensure you understand what is covered and what is not.

In the end, choosing the right Amex travel insurance policy involves careful consideration of your specific travel needs, understanding the policy details, and comparing different options. By following these tips, you can make an informed decision and enjoy your travels with peace of mind, knowing you’re protected against the unexpected.

What does Amex travel insurance typically cover?

+

Amex travel insurance typically covers trip cancellations, interruptions, medical emergencies, evacuations, and lost or stolen luggage, among other risks.

How do I choose the right Amex travel insurance policy for my needs?

+

Consider the type of trip, activities planned, and the value of your trip. Also, compare policy options based on coverage limits, deductibles, pre-existing condition coverage, and activity-specific coverage.

What should I look for when reading policy documents?

+

Pay attention to policy exclusions, the claims process, customer support, and any additional benefits that may be included, such as travel assistance services or concierge services.

Related Terms:

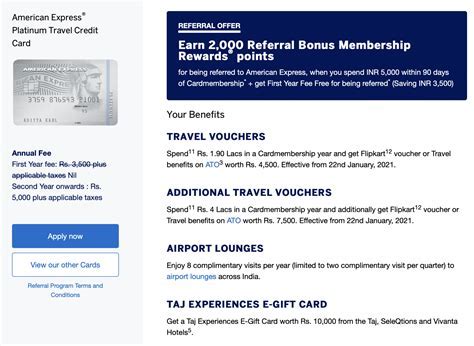

- American Express Travel Insurance

- American Express Platinum Travel Insurance

- American Express medical Insurance

- Amex Platinum travel medical insurance

- Amex Platinum travel insurance USA

- Allianz travel insurance