5 Health Insurance Benefits

Introduction to Health Insurance Benefits

Having health insurance is crucial in today’s world, where medical expenses can be overwhelming. Health insurance provides financial protection against medical costs, ensuring that individuals and families can receive necessary medical care without facing financial hardship. In this article, we will discuss five key benefits of health insurance, highlighting their importance and how they can impact an individual’s life.

Benefit 1: Financial Protection

One of the primary benefits of health insurance is financial protection. Medical expenses can be extremely high, and without insurance, individuals may struggle to pay for necessary treatments. Health insurance helps to cover these costs, ensuring that individuals do not have to deplete their savings or go into debt to receive medical care. This financial protection can be especially important for individuals with chronic conditions or those who require ongoing medical treatment.

Benefit 2: Access to Preventive Care

Another significant benefit of health insurance is access to preventive care. Preventive care includes routine check-ups, screenings, and vaccinations, which can help to prevent illnesses and detect health problems early. With health insurance, individuals are more likely to receive preventive care, which can help to reduce the risk of chronic diseases and improve overall health. Some examples of preventive care services that may be covered by health insurance include: * Routine physical exams * Cancer screenings * Vaccinations * Blood pressure and cholesterol screenings

Benefit 3: Reduced Out-of-Pocket Costs

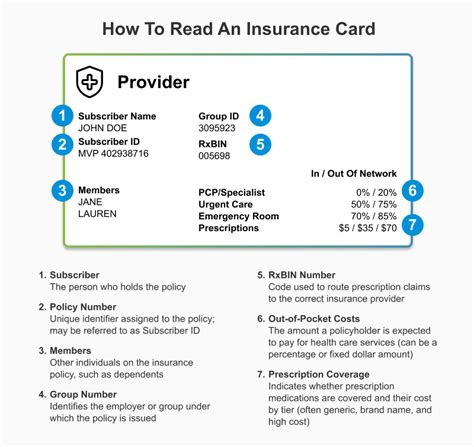

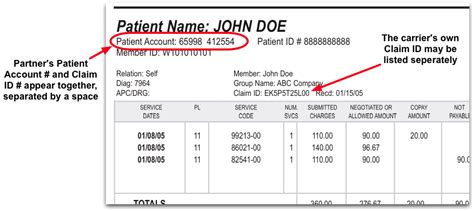

Health insurance can also help to reduce out-of-pocket costs for medical care. With insurance, individuals may only need to pay a copayment or coinsurance for medical services, rather than the full cost of care. This can help to make medical care more affordable and reduce the financial burden on individuals and families. Additionally, health insurance may also cover other expenses, such as: * Prescription medications * Laboratory tests and imaging services * Hospital stays and surgical procedures

Benefit 4: Increased Access to Specialist Care

Health insurance can also increase access to specialist care. Without insurance, individuals may not be able to afford to see a specialist, which can lead to delayed diagnosis and treatment. With health insurance, individuals are more likely to receive timely and specialized care, which can improve health outcomes and reduce the risk of complications. Some examples of specialist care services that may be covered by health insurance include: * Cardiology services * Oncology services * Orthopedic services * Neurology services

Benefit 5: Peace of Mind

Finally, health insurance can provide peace of mind for individuals and families. Knowing that they have financial protection against medical expenses can reduce stress and anxiety, allowing individuals to focus on their health and wellbeing. This peace of mind can be especially important for individuals with chronic conditions or those who are at risk for certain health problems.

| Benefit | Description |

|---|---|

| Financial Protection | Protection against high medical expenses |

| Access to Preventive Care | Access to routine check-ups, screenings, and vaccinations |

| Reduced Out-of-Pocket Costs | Reduced costs for medical services and expenses |

| Increased Access to Specialist Care | Access to specialized care and services |

| Peace of Mind | Reduced stress and anxiety related to medical expenses |

💡 Note: It's essential to review and understand the terms and conditions of your health insurance policy to ensure you're getting the most out of your benefits.

In summary, health insurance provides numerous benefits that can improve an individual’s life, including financial protection, access to preventive care, reduced out-of-pocket costs, increased access to specialist care, and peace of mind. By understanding these benefits, individuals can make informed decisions about their health insurance coverage and ensure they’re getting the care they need to maintain their health and wellbeing. Overall, health insurance is a vital component of any individual’s or family’s healthcare plan, providing a safety net against unexpected medical expenses and ensuring access to necessary medical care.

What is the primary benefit of health insurance?

+

The primary benefit of health insurance is financial protection against high medical expenses.

What types of services are typically covered by health insurance?

+

Health insurance typically covers a range of services, including routine check-ups, screenings, vaccinations, prescription medications, laboratory tests, and hospital stays.

How can health insurance provide peace of mind?

+

Health insurance can provide peace of mind by reducing stress and anxiety related to medical expenses, allowing individuals to focus on their health and wellbeing.

Related Terms:

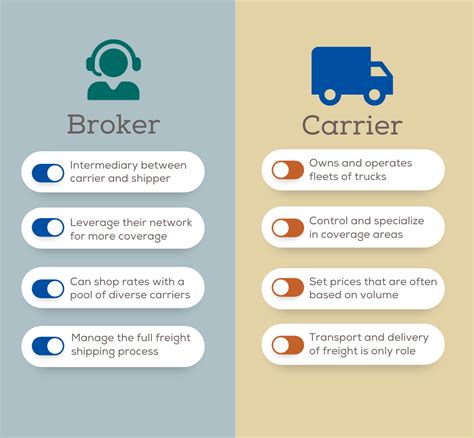

- an insured carriers health insurance

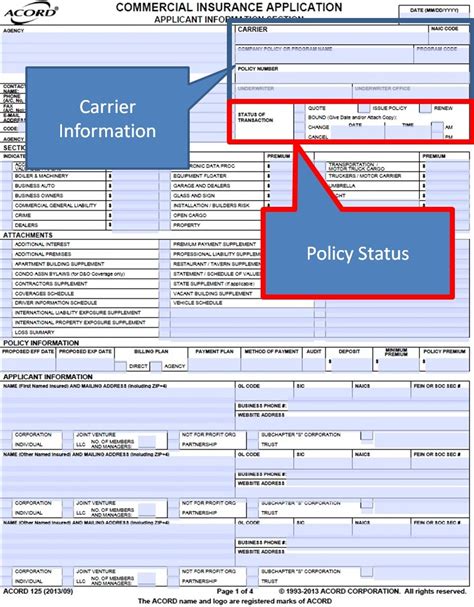

- Insurance carrier example

- Health insurance carrier example

- Insurance carrier examples

- Insurance carrier vs agency

- Insurance carrier name