E3 Visa Annual Income

Understanding the E3 Visa Annual Income Requirement

The E3 visa is a highly sought-after visa category for Australian nationals who wish to work in the United States. One of the key requirements for eligibility is meeting the annual income threshold. In this article, we will delve into the details of the E3 visa annual income requirement, its implications, and what it means for Australian professionals looking to work in the US.

What is the E3 Visa Annual Income Requirement?

The E3 visa annual income requirement is not explicitly stated in the visa regulations. However, the US Department of Labor requires that the employer pay the prevailing wage for the specific occupation in the specific area of employment. The prevailing wage is the average wage paid to similarly employed workers in the same occupation and geographic area. The purpose of this requirement is to ensure that foreign workers are not paid less than their American counterparts, thereby protecting the wages and working conditions of US workers.

How is the Prevailing Wage Determined?

The prevailing wage is determined by the US Department of Labor’s Employment and Training Administration. Employers can use online resources, such as the Foreign Labor Certification Data Center, to determine the prevailing wage for a specific occupation and location. The prevailing wage is typically based on data from the Bureau of Labor Statistics and other sources.

Factors Affecting the E3 Visa Annual Income Requirement

Several factors can affect the E3 visa annual income requirement, including: * Occupation: Different occupations have different prevailing wages. For example, a software engineer may have a higher prevailing wage than a teacher. * Location: The cost of living and prevailing wages vary significantly across different regions in the US. For example, the prevailing wage for a software engineer in San Francisco may be higher than in other parts of the country. * Level of experience: Employers may be required to pay a higher prevailing wage for more experienced workers. * Industry: Prevailing wages can also vary depending on the industry. For example, a worker in the finance industry may have a higher prevailing wage than a worker in the non-profit sector.

Consequences of Not Meeting the E3 Visa Annual Income Requirement

If an employer does not meet the prevailing wage requirement, the E3 visa application may be denied. Additionally, if the employer is found to have paid the foreign worker less than the prevailing wage, the employer may be subject to fines and penalties. It is essential for employers to ensure that they are paying the prevailing wage to avoid any potential consequences.

Example of Prevailing Wages for Common Occupations

The following table provides examples of prevailing wages for common occupations in the US:

| Occupation | Prevailing Wage (per year) |

|---|---|

| Software Engineer | 124,000</td> </tr> <tr> <td>Registered Nurse</td> <td>83,000 |

| Financial Analyst | 95,000</td> </tr> <tr> <td>Marketing Manager</td> <td>142,000 |

Please note that these figures are examples and may vary depending on the location and industry.

📝 Note: The prevailing wage is subject to change, and employers should always check the latest data to ensure compliance with the regulations.

In summary, the E3 visa annual income requirement is an essential aspect of the visa application process. Employers must ensure that they are paying the prevailing wage to avoid any potential consequences. By understanding the factors that affect the prevailing wage and using online resources to determine the prevailing wage, employers can ensure compliance with the regulations and support Australian professionals in their pursuit of working in the US.

To further support Australian professionals, it is crucial to consider the following key points: * Research the prevailing wage: Employers should research the prevailing wage for the specific occupation and location to ensure compliance with the regulations. * Consult with experts: Employers may want to consult with experts, such as immigration lawyers or human resources specialists, to ensure that they are meeting the prevailing wage requirement. * Review and update: Employers should regularly review and update their wage structures to ensure that they are paying the prevailing wage.

What is the purpose of the prevailing wage requirement?

+

The purpose of the prevailing wage requirement is to ensure that foreign workers are not paid less than their American counterparts, thereby protecting the wages and working conditions of US workers.

How do I determine the prevailing wage for a specific occupation and location?

+

Employers can use online resources, such as the Foreign Labor Certification Data Center, to determine the prevailing wage for a specific occupation and location.

What are the consequences of not meeting the E3 visa annual income requirement?

+

If an employer does not meet the prevailing wage requirement, the E3 visa application may be denied. Additionally, if the employer is found to have paid the foreign worker less than the prevailing wage, the employer may be subject to fines and penalties.

In final consideration, understanding the E3 visa annual income requirement is crucial for Australian professionals and employers alike. By recognizing the importance of the prevailing wage and taking steps to ensure compliance, employers can support the growth and development of their organizations while also protecting the rights and interests of their employees. Ultimately, this knowledge will facilitate a smoother and more successful E3 visa application process, enabling Australian professionals to pursue their career goals in the US with confidence and clarity.

Related Terms:

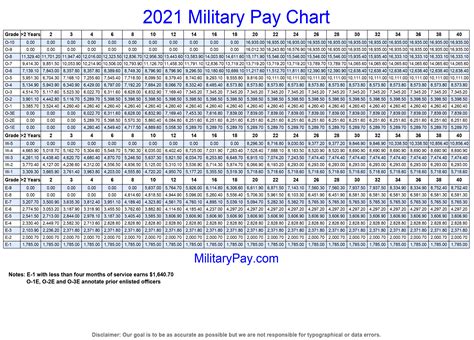

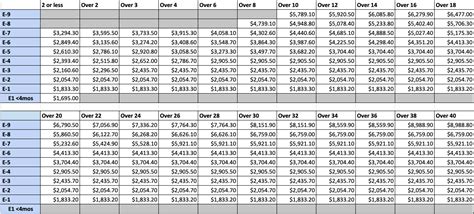

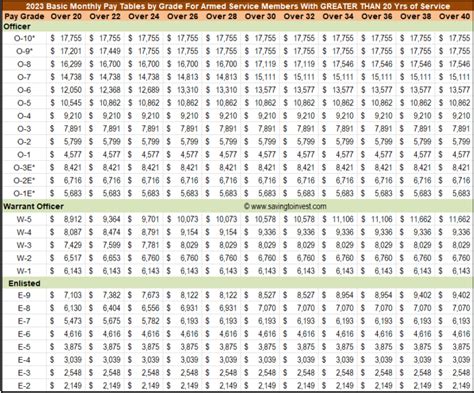

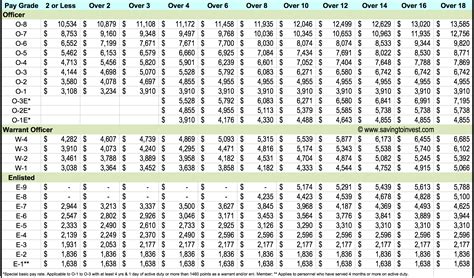

- e 3 annual income usmc

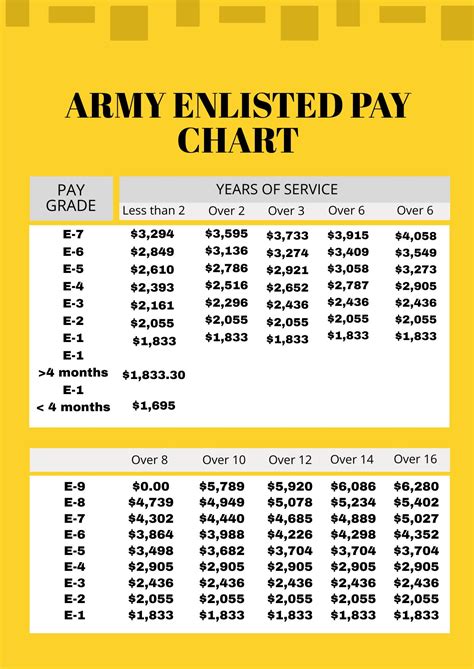

- E 3 salary Army

- e 3 annual income air force

- e 3 pay army monthly

- E2 pay

- E 4 pay