Army Loan Repayment Plan Options

Introduction to Army Loan Repayment Plan Options

The Army Loan Repayment Program (LRP) is a valuable incentive for individuals considering a career in the military. It’s designed to help enlisted soldiers repay their college loans, making it an attractive option for those with significant student debt. Understanding the various repayment plan options available can help individuals make informed decisions about their financial future. In this article, we will delve into the details of the Army Loan Repayment Plan, its benefits, and the steps to apply.

Benefits of the Army Loan Repayment Program

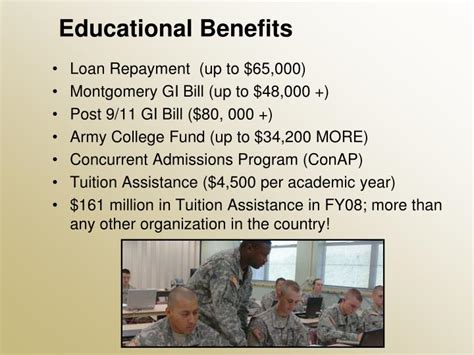

The Army Loan Repayment Program offers several benefits, including: * Up to $65,000 in loan repayment assistance for eligible soldiers * Eligibility for certain Military Occupational Specialties (MOS) * Ability to combine with other education incentives, such as the GI Bill * Tax-free payments, as the repayment benefits are not considered taxable income * Opportunity to have a significant portion of college loans paid off, reducing financial burden

Eligibility Requirements

To be eligible for the Army Loan Repayment Program, individuals must meet the following requirements: * Be a new enlistee in the Army * Have a high school diploma or equivalent * Score a minimum of 50 on the Armed Services Vocational Aptitude Battery (ASVAB) test * Enlist for a minimum of three years * Choose a qualifying Military Occupational Specialty (MOS) * Have a qualifying student loan, such as a federal Stafford Loan or a Supplemental Loan for Students (SLS)

Repayment Plan Options

The Army Loan Repayment Program offers several repayment plan options: * Annual Payments: The Army will make annual payments of up to 1,500 for each year of service, up to a maximum of 65,000. * Lump Sum Payments: In some cases, the Army may make a lump sum payment to pay off a significant portion of the loan balance. * Loan Forgiveness: The Army may forgive a portion of the loan balance after a certain number of years of service.

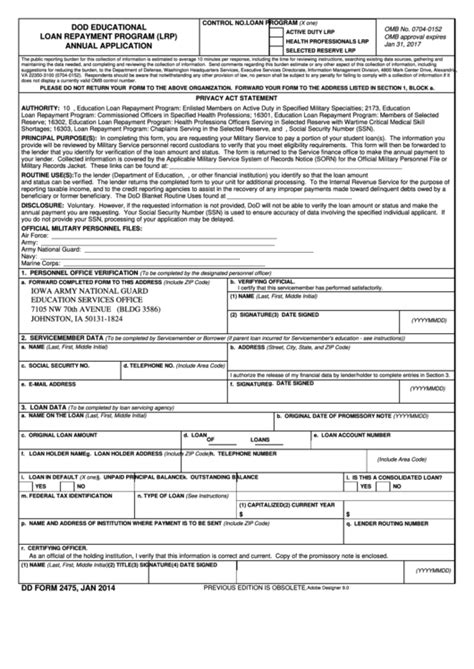

Steps to Apply

To apply for the Army Loan Repayment Program, follow these steps: * Meet with an Army recruiter to discuss eligibility and qualifying Military Occupational Specialties (MOS) * Complete the enlistment process and attend Basic Combat Training (BCT) * Submit an application for the Loan Repayment Program, including required documentation, such as loan statements and proof of enrollment * Receive approval and begin receiving loan repayment benefits

💡 Note: It's essential to carefully review the terms and conditions of the Loan Repayment Program and to understand the repayment plan options before enlisting.

Managing Debt with the Army Loan Repayment Program

The Army Loan Repayment Program can be an effective way to manage debt and reduce financial burden. By combining the program with other education incentives, such as the GI Bill, individuals can make significant progress in paying off their college loans. It’s essential to create a budget and stick to it, making timely payments and avoiding additional debt.

Comparison of Repayment Plan Options

The following table compares the repayment plan options available under the Army Loan Repayment Program:

| Repayment Plan Option | Annual Payment | Lump Sum Payment | Loan Forgiveness |

|---|---|---|---|

| Annual Payments | Up to 1,500 per year</td> <td>No</td> <td>No</td> </tr> <tr> <td>Lump Sum Payments</td> <td>No</td> <td>Up to 65,000 | No | |

| Loan Forgiveness | No | No | Up to $65,000 |

In summary, the Army Loan Repayment Program offers a valuable incentive for individuals considering a career in the military. By understanding the repayment plan options and eligibility requirements, individuals can make informed decisions about their financial future. With careful planning and management, the program can help reduce debt and achieve long-term financial stability.

What is the maximum amount of loan repayment assistance available under the Army Loan Repayment Program?

+

The maximum amount of loan repayment assistance available under the Army Loan Repayment Program is $65,000.

Can I combine the Army Loan Repayment Program with other education incentives, such as the GI Bill?

+

Yes, you can combine the Army Loan Repayment Program with other education incentives, such as the GI Bill, to maximize your benefits.

What are the eligibility requirements for the Army Loan Repayment Program?

+

To be eligible for the Army Loan Repayment Program, you must be a new enlistee in the Army, have a high school diploma or equivalent, score a minimum of 50 on the ASVAB test, enlist for a minimum of three years, choose a qualifying MOS, and have a qualifying student loan.

Related Terms:

- Military student loan forgiveness

- Navy Loan Repayment Program

- LRP Army logistics

- SLRP Army National Guard

- army tuition repayment program

- army loan repayment portal