5 Deployment Pay Tips

Understanding Deployment Pay

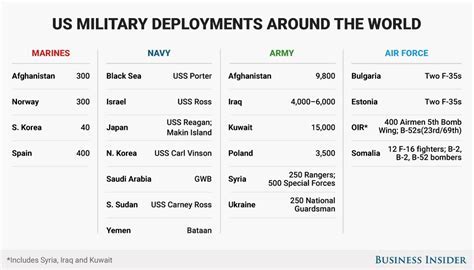

When it comes to military deployment, one of the most critical aspects to consider is the financial implications. Deployment pay, also known as hazardous duty pay, is a type of compensation provided to military personnel who are deployed to hazardous or high-risk areas. This pay is intended to offset the risks and challenges associated with serving in these regions. In this article, we will explore five essential deployment pay tips to help military personnel navigate the complexities of deployment compensation.

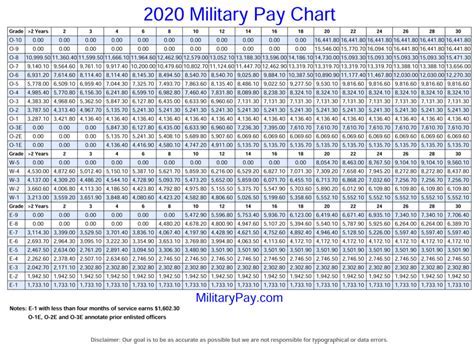

Tip 1: Calculate Your Deployment Pay

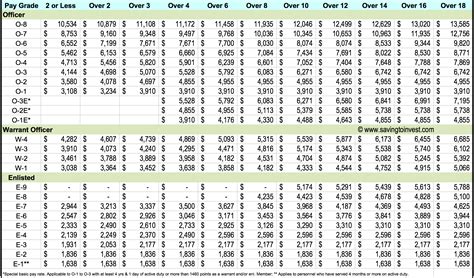

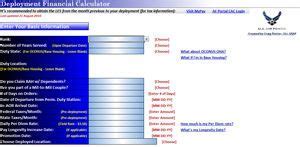

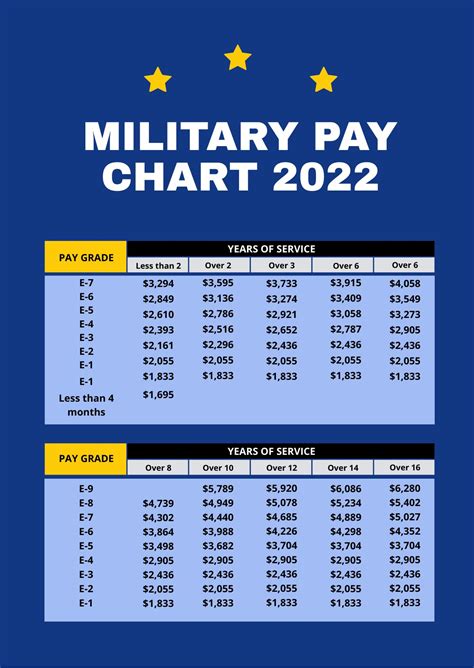

To understand your deployment pay, it’s essential to calculate your basic pay, allowances, and special pays. Basic pay is your standard salary, while allowances include housing, food, and other benefits. Special pays, such as hazardous duty pay, are added to your basic pay to compensate for the risks associated with deployment. You can use online calculators or consult with a military finance expert to determine your deployment pay.

Tip 2: Understand the Types of Deployment Pay

There are several types of deployment pay, including: * Imminent Danger Pay (IDP): Paid to personnel serving in areas where they are exposed to hostile fire or other hazardous conditions. * Hardship Duty Pay (HDP): Paid to personnel serving in areas with extreme climate conditions, inadequate housing, or other hardships. * Hazardous Duty Pay: Paid to personnel serving in areas with high risks of injury or death. It’s crucial to understand which type of deployment pay you are eligible for and how it will be calculated.

Tip 3: Manage Your Finances During Deployment

During deployment, it’s essential to manage your finances carefully. Consider the following tips: * Create a budget: Plan your expenses, including savings, investments, and debt repayment. * Automate your payments: Set up automatic payments for bills, loans, and other expenses. * Take advantage of tax benefits: Military personnel may be eligible for tax benefits, such as the Military Tax Relief Act. By managing your finances effectively, you can reduce stress and ensure a smooth transition during deployment.

Tip 4: Understand the Tax Implications of Deployment Pay

Deployment pay is subject to taxation, but there are some exceptions. For example, combat zone pay is tax-free, while hazardous duty pay may be taxable. It’s essential to understand the tax implications of your deployment pay to avoid any surprises when filing your tax return. Consult with a tax professional or military finance expert to ensure you are taking advantage of all eligible tax benefits.

Tip 5: Plan for Your Future

Deployment pay can provide a significant boost to your income, but it’s essential to plan for your future. Consider the following tips: * Save for retirement: Take advantage of military retirement savings plans, such as the Thrift Savings Plan. * Invest in education: Use your deployment pay to invest in education or training to enhance your career prospects. * Pay off debt: Use your deployment pay to pay off high-interest debt, such as credit cards or personal loans. By planning for your future, you can ensure a secure financial foundation and make the most of your deployment pay.

💡 Note: It's essential to consult with a military finance expert or tax professional to ensure you are taking advantage of all eligible benefits and tax implications.

In summary, deployment pay is a critical aspect of military compensation, and understanding the complexities of deployment pay can help military personnel navigate the challenges of serving in hazardous or high-risk areas. By calculating your deployment pay, understanding the types of deployment pay, managing your finances, understanding the tax implications, and planning for your future, you can make the most of your deployment pay and ensure a secure financial foundation.

What is deployment pay?

+

Deployment pay, also known as hazardous duty pay, is a type of compensation provided to military personnel who are deployed to hazardous or high-risk areas.

How is deployment pay calculated?

+

Deployment pay is calculated based on your basic pay, allowances, and special pays, such as hazardous duty pay.

Is deployment pay taxable?

+

Deployment pay is subject to taxation, but there are some exceptions, such as combat zone pay, which is tax-free.

Related Terms:

- Operational deployment pay Army

- Army deployment Calculator

- Air Force deployment pay calculator

- Deployment pay Air Force

- Deployment pay chart

- Hardship pay Army