5 Tips Assurance Health

Introduction to Health Assurance

When it comes to ensuring the well-being of ourselves and our loved ones, health assurance plays a crucial role. It provides a financial safety net against unexpected medical expenses, allowing individuals to focus on recovery rather than worrying about the cost of healthcare. In this blog post, we will explore the importance of health assurance and provide 5 tips to help you choose the right plan for your needs.

Understanding Health Assurance

Health assurance, often used interchangeably with health insurance, refers to a type of coverage that pays for medical expenses, including doctor visits, hospital stays, and other healthcare services. It can be provided by an employer, purchased individually, or obtained through government programs. Having health assurance is essential in today’s world, where medical costs can quickly escalate and become a significant burden on individuals and families.

Benefits of Health Assurance

The benefits of health assurance are numerous. Some of the key advantages include: * Financial Protection: Health assurance protects you from the financial impact of unexpected medical expenses, ensuring that you do not have to deplete your savings or go into debt to pay for healthcare services. * Access to Quality Care: With health assurance, you have access to a network of healthcare providers, including specialists and hospitals, which can provide high-quality care when you need it. * Preventive Care: Many health assurance plans cover preventive care services, such as routine check-ups, vaccinations, and screenings, which can help prevent illnesses and detect health problems early. * Peace of Mind: Knowing that you have health assurance can give you peace of mind, reducing stress and anxiety about medical expenses.

5 Tips for Choosing the Right Health Assurance Plan

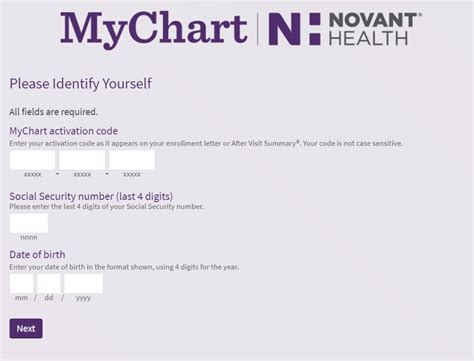

With so many health assurance plans available, choosing the right one can be overwhelming. Here are 5 tips to help you make an informed decision: * Tip 1: Assess Your Needs: Consider your health status, lifestyle, and budget when selecting a health assurance plan. If you have a pre-existing condition, you may want to choose a plan that offers more comprehensive coverage. * Tip 2: Compare Plans: Research and compare different health assurance plans, including their coverage, deductibles, copays, and coinsurance. Look for plans that offer a balance of affordability and comprehensive coverage. * Tip 3: Check the Network: Make sure the health assurance plan you choose has a network of healthcare providers that includes your primary care physician and any specialists you may need to see. * Tip 4: Review the Fine Print: Carefully review the terms and conditions of the health assurance plan, including any exclusions, limitations, or waiting periods. * Tip 5: Seek Professional Advice: If you are unsure about which health assurance plan to choose, consider seeking advice from a licensed insurance agent or broker who can help you navigate the options and choose the best plan for your needs.

Additional Considerations

In addition to the 5 tips above, there are several other factors to consider when choosing a health assurance plan. These include: * Maximum Out-of-Pocket Costs: Make sure you understand the maximum out-of-pocket costs associated with the plan, including deductibles, copays, and coinsurance. * Pre-Authorization Requirements: Some health assurance plans require pre-authorization for certain medical procedures or services. Understand what is required and how it may impact your care. * Appeals Process: If a claim is denied, understand the appeals process and how to dispute the decision.

📝 Note: Always carefully review the terms and conditions of a health assurance plan before enrolling, and ask questions if you are unsure about any aspect of the plan.

Conclusion and Final Thoughts

In conclusion, health assurance is a critical component of overall well-being, providing financial protection and access to quality healthcare services. By following the 5 tips outlined above and carefully considering your needs and options, you can choose a health assurance plan that provides peace of mind and protection against unexpected medical expenses. Remember to review the fine print, ask questions, and seek professional advice if needed.

What is health assurance, and how does it work?

+

Health assurance is a type of coverage that pays for medical expenses, including doctor visits, hospital stays, and other healthcare services. It can be provided by an employer, purchased individually, or obtained through government programs.

How do I choose the right health assurance plan for my needs?

+

Consider your health status, lifestyle, and budget when selecting a health assurance plan. Compare different plans, including their coverage, deductibles, copays, and coinsurance. Review the fine print, and seek professional advice if needed.

What are some common mistakes to avoid when choosing a health assurance plan?

+

Common mistakes to avoid include not carefully reviewing the terms and conditions of the plan, not considering the network of healthcare providers, and not seeking professional advice if needed.

Related Terms:

- Assurance health insurance

- Assurance Health locations

- Assurance Health Ohio

- Assurance Health Indianapolis reviews

- Assurance Health Sylvania reviews

- Assurance Health psychiatric Hospital