Bank of America Health Savings Account

Introduction to Health Savings Accounts

A Health Savings Account (HSA) is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside pre-tax dollars for medical expenses. The Bank of America Health Savings Account is one such option, designed to help individuals and families save for healthcare costs while also providing a potential long-term investment vehicle. In this article, we will delve into the details of the Bank of America HSA, its benefits, and how it works.

Benefits of a Bank of America Health Savings Account

The Bank of America Health Savings Account offers several benefits, including: * Tax advantages: Contributions to an HSA are tax-deductible, and the funds grow tax-free. Withdrawals for qualified medical expenses are also tax-free. * Flexibility: HSAs can be used to pay for a wide range of medical expenses, including doctor visits, prescription medications, and hospital stays. * Portability: HSAs are portable, meaning that the account stays with the individual even if they change jobs or retire. * Investment opportunities: Bank of America offers a range of investment options for HSA funds, allowing account holders to potentially grow their savings over time.

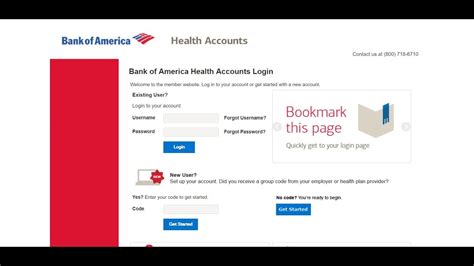

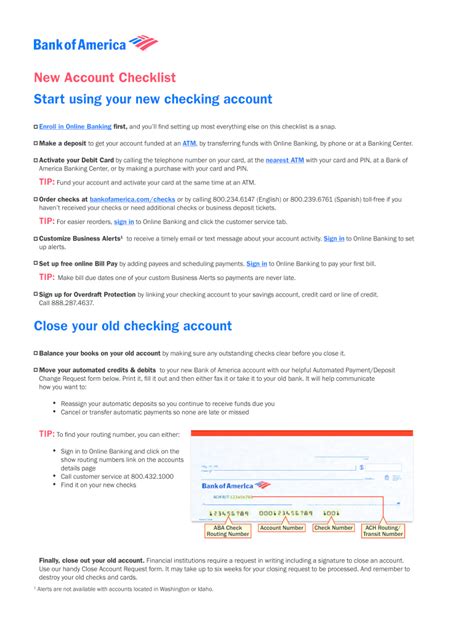

How the Bank of America Health Savings Account Works

To be eligible for a Bank of America HSA, individuals must have a high-deductible health plan (HDHP) and cannot be enrolled in any other type of health coverage, such as a flexible spending account (FSA) or a health reimbursement arrangement (HRA). The following steps outline how to open and use a Bank of America HSA: * Open an HSA account with Bank of America by applying online or by phone. * Fund the account with contributions, which can be made by the individual or their employer. * Use the HSA debit card or checks to pay for qualified medical expenses. * Invest HSA funds in a range of investment options, such as mutual funds or stocks.

Eligible Medical Expenses

HSAs can be used to pay for a wide range of medical expenses, including: * Doctor visits and copays * Prescription medications * Hospital stays and surgery * Dental and vision care * Medical equipment and supplies The following table provides examples of eligible and ineligible medical expenses:

| Eligible Expenses | Ineligible Expenses |

|---|---|

| Doctor visits and copays | Gym memberships |

| Prescription medications | Cosmetic surgery |

| Hospital stays and surgery | Non-prescription medications |

📝 Note: It's essential to keep receipts and records of medical expenses, as these may be required to support HSA withdrawals.

Contributions and Limits

The annual contribution limit for HSAs varies depending on the type of HDHP coverage. For 2023, the limits are: * 3,850 for individual coverage * 7,750 for family coverage Contributions can be made by the individual or their employer, and catch-up contributions are allowed for individuals aged 55 or older.

Investment Options

Bank of America offers a range of investment options for HSA funds, including: * Mutual funds * Stocks * Bonds * Exchange-traded funds (ETFs) It’s essential to carefully consider investment options and to seek professional advice if needed, as investment gains can be subject to market fluctuations.

Account Management

Bank of America provides online and mobile banking services to manage HSA accounts, including: * Account balance and transaction history * Investment tracking and management * Bill pay and transfer services * Customer support and education resources

In summary, the Bank of America Health Savings Account is a valuable tool for individuals and families with high-deductible health plans, offering tax advantages, flexibility, and investment opportunities. By understanding how the account works, eligible medical expenses, and investment options, individuals can make the most of their HSA and save for healthcare costs.

What is a Health Savings Account (HSA)?

+

A Health Savings Account (HSA) is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside pre-tax dollars for medical expenses.

What are the benefits of a Bank of America Health Savings Account?

+

The benefits of a Bank of America Health Savings Account include tax advantages, flexibility, portability, and investment opportunities.

How do I open a Bank of America Health Savings Account?

+

To open a Bank of America Health Savings Account, apply online or by phone, and fund the account with contributions.

Related Terms:

- Bank of America HSA login

- HSA Bank

- Bank of America login

- My HSA account login

- Mybenefits Bank of America

- Optum HSA