5 HSA Benefits

Introduction to Health Savings Accounts (HSAs)

A Health Savings Account (HSA) is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan (HDHP). The funds contributed to an HSA are not subject to federal income tax at the time of deposit. HSAs were created to help individuals with high-deductible health plans save for medical expenses on a tax-free basis.

Key Benefits of HSAs

There are several benefits associated with Health Savings Accounts. Some of the key benefits include: * Tax Benefits: Contributions to an HSA are tax-deductible, and the funds grow tax-free. Withdrawals for qualified medical expenses are also tax-free. * Portability: HSAs are portable, meaning that the account stays with the individual even if they change jobs or retire. * Investment Opportunities: Many HSA providers offer investment options, such as stocks, bonds, and mutual funds, allowing individuals to grow their HSA funds over time. * No “Use It or Lose It” Rule: Unlike Flexible Spending Accounts (FSAs), HSAs do not have a “use it or lose it” rule, which means that any unused funds at the end of the year can be carried over to the next year. * Qualified Medical Expenses: HSA funds can be used to pay for a wide range of qualified medical expenses, including doctor visits, hospital stays, prescription medications, and more.

Eligibility and Contribution Limits

To be eligible for an HSA, an individual must be enrolled in a high-deductible health plan (HDHP) and not be covered by any other health insurance plan. The contribution limits for HSAs vary from year to year and are subject to cost-of-living adjustments. For the current year, the contribution limits are 3,850 for individual coverage and 7,750 for family coverage.

Using HSA Funds

HSA funds can be used to pay for a wide range of qualified medical expenses, including: * Doctor visits and hospital stays * Prescription medications and medical equipment * Dental and vision care * Mental health and substance abuse treatment * Long-term care expenses It’s essential to keep receipts and records of qualified medical expenses, as these may be required to support HSA withdrawals.

💡 Note: HSA funds can also be used to pay for certain non-medical expenses, such as health insurance premiums during retirement or for COBRA coverage, but these may be subject to income tax and penalties.

Investing HSA Funds

Many HSA providers offer investment options, such as stocks, bonds, and mutual funds, allowing individuals to grow their HSA funds over time. Investing HSA funds can be a great way to build wealth for future medical expenses, but it’s essential to carefully consider investment options and risk tolerance before investing.

| Investment Option | Description |

|---|---|

| Stocks | Individual stocks or stock mutual funds |

| Bonds | Government or corporate bonds |

| Mutual Funds | Diversified portfolios of stocks, bonds, or other securities |

As individuals navigate the complexities of healthcare and personal finance, understanding the benefits and uses of Health Savings Accounts can be invaluable. By leveraging the tax advantages, investment opportunities, and flexibility of HSAs, individuals can take control of their medical expenses and build a more secure financial future.

In summary, Health Savings Accounts offer a range of benefits, from tax advantages and portability to investment opportunities and flexibility. By understanding how HSAs work and how to use them effectively, individuals can make the most of these powerful savings tools and achieve greater financial stability and security.

What is a Health Savings Account (HSA)?

+

A Health Savings Account (HSA) is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan (HDHP).

What are the benefits of an HSA?

+

The benefits of an HSA include tax advantages, portability, investment opportunities, and flexibility. Contributions to an HSA are tax-deductible, and the funds grow tax-free. Withdrawals for qualified medical expenses are also tax-free.

How do I contribute to an HSA?

+

To contribute to an HSA, you must be enrolled in a high-deductible health plan (HDHP) and not be covered by any other health insurance plan. The contribution limits for HSAs vary from year to year and are subject to cost-of-living adjustments.

Related Terms:

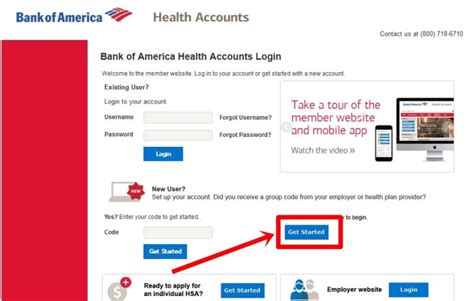

- HSA Bank

- Bank of America login

- My HSA account

- Mybenefits Bank of America

- Optum Bank HSA login

- My HSA account login