5 Berklee Insurance Options

Introduction to Berklee Insurance Options

Berklee College of Music offers various insurance options to its students, designed to provide financial protection against unforeseen medical and other expenses. These options are crucial for students to ensure they can focus on their studies without worrying about unexpected costs. In this post, we will delve into five Berklee insurance options, exploring their benefits, coverage, and how they can support students during their time at Berklee.

Understanding the Importance of Insurance for Students

Before we dive into the specifics of each insurance option, it’s essential to understand why insurance is crucial for students. Medical emergencies, injuries, and other unforeseen events can occur at any time, and without proper insurance coverage, these events can lead to significant financial burdens. Insurance helps mitigate these risks, providing students with the peace of mind they need to excel in their academic pursuits.

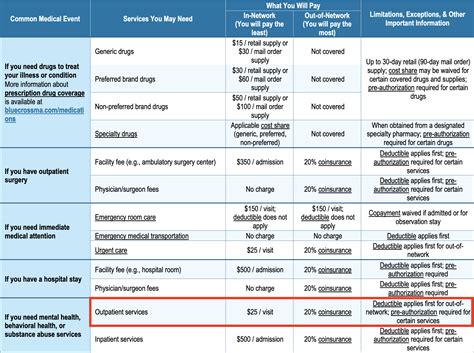

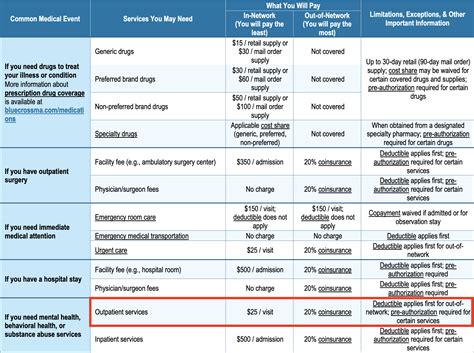

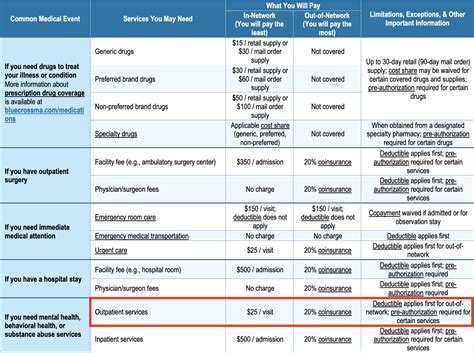

Berklee Insurance Option 1: Student Health Insurance Plan (SHIP)

The Student Health Insurance Plan (SHIP) is a comprehensive health insurance plan designed specifically for Berklee students. This plan offers extensive coverage for medical expenses, including doctor visits, hospital stays, prescription medications, and more. SHIP is mandatory for all students unless they can demonstrate comparable coverage through another insurance provider.

Berklee Insurance Option 2: Dental Insurance

Berklee’s dental insurance option provides coverage for dental care, including routine check-ups, fillings, crowns, and other dental procedures. This insurance helps students maintain good oral health without incurring significant out-of-pocket expenses. Dental health is an essential aspect of overall well-being, and this insurance option ensures that students can access necessary dental care.

Berklee Insurance Option 3: Vision Insurance

The vision insurance option at Berklee covers expenses related to eye care, including eye exams, glasses, and contact lenses. This insurance is particularly beneficial for students who require corrective eyewear or have other vision needs. By covering these expenses, Berklee’s vision insurance helps students see clearly, both literally and figuratively, as they navigate their academic and personal lives.

Berklee Insurance Option 4: Disability Insurance

Disability insurance is designed to provide financial support to students who become unable to attend classes due to illness or injury. This insurance option helps ensure that students can continue to meet their financial obligations, such as tuition and living expenses, even if they are temporarily unable to study. Disability insurance offers a safety net, helping students avoid financial hardship during challenging times.

Berklee Insurance Option 5: Travel Insurance

For students who plan to travel, whether for study abroad programs, internships, or personal trips, Berklee’s travel insurance option is highly recommended. This insurance covers unexpected medical and travel-related expenses that may arise during trips, providing students with global protection. Whether dealing with medical emergencies, trip cancellations, or lost luggage, travel insurance gives students the confidence to explore the world without undue worry about financial risks.

📝 Note: It's essential for students to carefully review the terms, coverage, and costs of each insurance option to choose the plans that best fit their needs and budgets.

To summarize, Berklee College of Music offers a range of insurance options designed to protect students from various risks and uncertainties. By understanding and leveraging these options, students can better manage potential financial burdens, ensuring they can focus on their academic and personal growth without unnecessary stress. Whether it’s health, dental, vision, disability, or travel insurance, each option plays a vital role in supporting students throughout their journey at Berklee.

What is the purpose of the Student Health Insurance Plan (SHIP)?

+

The purpose of SHIP is to provide comprehensive health insurance coverage to Berklee students, ensuring they have access to necessary medical care without incurring significant financial burdens.

Is dental insurance mandatory for all Berklee students?

+

No, dental insurance is not mandatory, but it is highly recommended to ensure students can maintain good oral health without additional financial stress.

What does Berklee’s travel insurance cover?

+

Berklee’s travel insurance covers unexpected medical and travel-related expenses that may arise during trips, including medical emergencies, trip cancellations, and lost luggage.

Related Terms:

- berklee health insurance opt

- Berklee Health Insurance cost

- Berklee dental insurance

- Berklee case management

- Berklee therapy

- Berklee Health and Wellness