Best PEO for Health Insurance

Introduction to PEOs and Health Insurance

When it comes to managing the complexities of health insurance for employees, many businesses turn to Professional Employer Organizations (PEOs). A PEO can provide a range of benefits, including access to better health insurance options, simplified administrative tasks, and compliance assistance with regulatory requirements. In this article, we will delve into the world of PEOs, their role in health insurance, and how to choose the best PEO for your business’s health insurance needs.

What is a PEO?

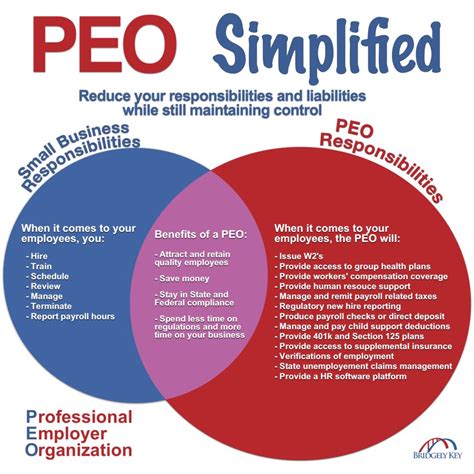

A Professional Employer Organization (PEO) is a company that provides a range of services to small and medium-sized businesses, including payroll processing, benefits administration, and human resources support. By partnering with a PEO, businesses can outsource many of their HR tasks, freeing up time and resources to focus on core operations. One of the key benefits of working with a PEO is access to better health insurance options. PEOs often have established relationships with major insurance carriers, allowing them to offer more competitive rates and a wider range of plan options to their clients.

How PEOs Work with Health Insurance

PEOs work by establishing a co-employment relationship with their client businesses. This means that the PEO becomes the employer of record for tax and insurance purposes, while the client business retains control over the day-to-day management of their employees. By pooling the employees of multiple client businesses together, PEOs can negotiate better rates with insurance carriers and offer more comprehensive benefits packages. This can be especially beneficial for small businesses, which may not have the negotiating power to secure competitive rates on their own.

Benefits of Using a PEO for Health Insurance

There are several benefits to using a PEO for health insurance, including: * Access to better rates: PEOs can negotiate more competitive rates with insurance carriers due to their larger pool of employees. * Simplified administration: PEOs handle all aspects of benefits administration, including enrollment, premium payments, and claims processing. * Compliance assistance: PEOs can help businesses navigate the complex regulatory landscape surrounding health insurance, including the Affordable Care Act (ACA). * Increased benefits options: PEOs often offer a range of benefits options, including dental, vision, and life insurance, in addition to health insurance.

Choosing the Best PEO for Health Insurance

With so many PEOs to choose from, it can be difficult to determine which one is the best fit for your business’s health insurance needs. Here are a few factors to consider: * Size and scope: Look for a PEO that has a large enough pool of employees to negotiate competitive rates with insurance carriers. * Carrier relationships: Consider a PEO that has established relationships with major insurance carriers, such as UnitedHealthcare or Blue Cross Blue Shield. * Benefits options: Think about the types of benefits you want to offer your employees, and choose a PEO that can provide them. * Customer service: Look for a PEO with a reputation for excellent customer service and support.

Top PEOs for Health Insurance

Here are a few of the top PEOs for health insurance: * ADP TotalSource: ADP is a well-established PEO with a large pool of employees and a range of benefits options. * Insperity: Insperity is a PEO that offers a range of benefits options, including health, dental, and vision insurance. * Paychex: Paychex is a PEO that provides a range of HR services, including benefits administration and payroll processing. * TriNet: TriNet is a PEO that specializes in serving small and medium-sized businesses, with a range of benefits options and competitive rates.

| PEO | Benefits Options | Carrier Relationships |

|---|---|---|

| ADP TotalSource | Health, dental, vision, life insurance | UnitedHealthcare, Blue Cross Blue Shield |

| Insperity | Health, dental, vision, life insurance | Aetna, Cigna, Humana |

| Paychex | Health, dental, vision, life insurance | UnitedHealthcare, Blue Cross Blue Shield |

| TriNet | Health, dental, vision, life insurance | Aetna, Cigna, Humana |

💡 Note: When choosing a PEO, it's essential to consider your business's specific needs and goals. Be sure to research and compares the different options carefully before making a decision.

In summary, a PEO can be a valuable partner for businesses looking to provide high-quality health insurance to their employees. By understanding how PEOs work with health insurance, the benefits of using a PEO, and how to choose the best PEO for your business’s needs, you can make an informed decision and find the right PEO to meet your goals.

What is a PEO and how does it work with health insurance?

+

A PEO, or Professional Employer Organization, is a company that provides a range of services to small and medium-sized businesses, including payroll processing, benefits administration, and human resources support. By partnering with a PEO, businesses can outsource many of their HR tasks, including health insurance, and gain access to better rates and more comprehensive benefits packages.

What are the benefits of using a PEO for health insurance?

+

The benefits of using a PEO for health insurance include access to better rates, simplified administration, compliance assistance, and increased benefits options. PEOs can negotiate more competitive rates with insurance carriers due to their larger pool of employees, and they can handle all aspects of benefits administration, including enrollment, premium payments, and claims processing.

How do I choose the best PEO for my business’s health insurance needs?

+

To choose the best PEO for your business’s health insurance needs, consider factors such as the PEO’s size and scope, carrier relationships, benefits options, and customer service. Look for a PEO that has a large enough pool of employees to negotiate competitive rates, established relationships with major insurance carriers, and a range of benefits options that meet your business’s needs.

Related Terms:

- largest peo companies

- top 10 peo providers

- top best global peo services

- peo options for small companies

- small business peo service providers

- best peos small companies