5 BofA HSA Tips

Introduction to Bank of America Health Savings Accounts (HSAs)

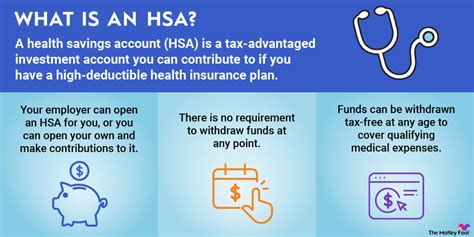

Bank of America offers Health Savings Accounts (HSAs) that can help individuals with high-deductible health plans (HDHPs) save money for medical expenses. An HSA is a tax-advantaged savings account that allows individuals to set aside pre-tax dollars to pay for qualified medical expenses. In this article, we will provide 5 tips for getting the most out of a Bank of America HSA.

Understanding How HSAs Work

Before we dive into the tips, it’s essential to understand how HSAs work. Contributions to an HSA are tax-deductible, and the funds grow tax-free. Withdrawals for qualified medical expenses are also tax-free. This triple tax benefit makes HSAs an attractive option for individuals with HDHPs. Additionally, HSAs are portable, meaning that the account belongs to the individual, not the employer, so it can be taken with them if they change jobs.

Tips for Using a Bank of America HSA

Here are 5 tips for getting the most out of a Bank of America HSA: * Contribute enough to cover out-of-pocket expenses: Try to contribute enough to your HSA to cover your annual out-of-pocket expenses, including deductibles, copays, and coinsurance. * Invest your HSA funds: Bank of America offers investment options for HSA funds, which can help your money grow over time. Consider investing your HSA funds to maximize your savings. * Keep receipts and records: Keep receipts and records of your medical expenses, as you’ll need to provide documentation to support your HSA withdrawals. * Use the Bank of America HSA debit card: Bank of America offers an HSA debit card that can be used to pay for qualified medical expenses. This can make it easier to keep track of your expenses and ensure that you’re using your HSA funds for eligible expenses. * Consider using your HSA for long-term care expenses: HSAs can be used to pay for long-term care expenses, such as nursing home care or home health care. Consider using your HSA to pay for these expenses, as they can be tax-free.

Additional Benefits of Bank of America HSAs

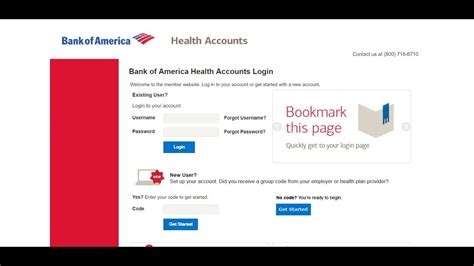

In addition to the tips above, Bank of America HSAs offer several other benefits, including: * Low fees: Bank of America HSAs have low fees, including no monthly maintenance fees for accounts with a balance of $1,000 or more. * Convenient online access: Bank of America offers convenient online access to HSA accounts, making it easy to manage your account and track your expenses. * Investment options: Bank of America offers a range of investment options for HSA funds, including mutual funds and exchange-traded funds (ETFs).

📝 Note: It's essential to review the terms and conditions of your Bank of America HSA to ensure that you understand the fees, investment options, and other features of your account.

Comparison of HSA Providers

The following table compares the features of Bank of America HSAs with those of other HSA providers:

| Provider | Fees | Investment Options | Debit Card |

|---|---|---|---|

| Bank of America | Low fees, no monthly maintenance fees for accounts with a balance of 1,000 or more</td> <td>Mutual funds, ETFs</td> <td>Yes</td> </tr> <tr> <td>Fidelity</td> <td>No fees, no minimums</td> <td>Mutual funds, ETFs, stocks, bonds</td> <td>Yes</td> </tr> <tr> <td>HealthEquity</td> <td>Low fees, no monthly maintenance fees for accounts with a balance of 1,000 or more | Mutual funds, ETFs | Yes |

As we summarize the key points, it’s clear that Bank of America HSAs offer a range of benefits, including low fees, convenient online access, and investment options. By following the tips outlined above and taking advantage of these benefits, individuals can maximize their savings and get the most out of their Bank of America HSA.

What is a Health Savings Account (HSA)?

+

A Health Savings Account (HSA) is a tax-advantaged savings account that allows individuals with high-deductible health plans (HDHPs) to set aside pre-tax dollars to pay for qualified medical expenses.

How do I contribute to a Bank of America HSA?

+

You can contribute to a Bank of America HSA by setting up automatic transfers from your paycheck or bank account, or by making one-time contributions online or by phone.

Can I use my HSA funds for non-medical expenses?

+

No, HSA funds can only be used for qualified medical expenses. If you use your HSA funds for non-medical expenses, you may be subject to penalties and taxes.

Related Terms:

- HSA Bank

- Health savings account debit card

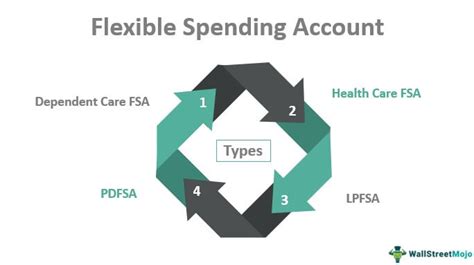

- bank of america flex spending

- boa hsa login

- merrill lynch hsa

- health accounts bank of america