Boost Your Health Insurance Coverage

Introduction to Health Insurance

Health insurance is a type of insurance that covers the cost of medical and surgical expenses incurred by the insured. It is an essential aspect of financial planning, as it helps to protect individuals and families from the risk of incurring large medical bills. With the rising cost of healthcare, having adequate health insurance coverage is more important than ever. In this article, we will discuss the importance of health insurance, the different types of health insurance plans, and provide tips on how to boost your health insurance coverage.

Why Health Insurance is Important

Having health insurance is crucial for several reasons. Firstly, it provides financial protection against unexpected medical expenses. Without health insurance, a single illness or injury can lead to financial ruin. Secondly, health insurance encourages individuals to seek medical attention when needed, rather than delaying treatment due to cost concerns. This can lead to better health outcomes and improved quality of life. Finally, health insurance provides access to preventive care, such as routine check-ups and screenings, which can help to prevent illnesses and detect health problems early.

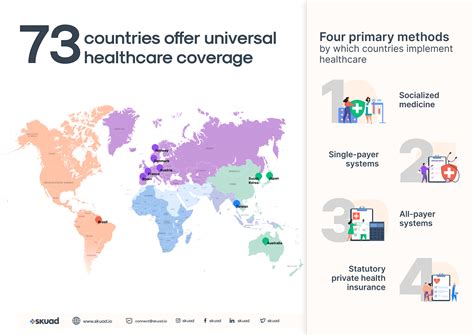

Types of Health Insurance Plans

There are several types of health insurance plans available, including: * Individual and Family Plans: These plans are designed for individuals and families who are not covered by an employer-sponsored plan. * Group Plans: These plans are offered by employers to their employees and are often more affordable than individual plans. * Medicare and Medicaid: These plans are government-sponsored and provide coverage to seniors, low-income individuals, and people with disabilities. * Short-Term Plans: These plans provide temporary coverage for individuals who are between jobs or waiting for other coverage to start.

Boosting Your Health Insurance Coverage

If you already have health insurance, there are several ways to boost your coverage. Here are a few tips: * Increase Your Premium: While it may seem counterintuitive, increasing your premium can provide more comprehensive coverage and lower out-of-pocket costs. * Add Supplemental Coverage: Supplemental coverage, such as dental or vision insurance, can provide additional protection against unexpected expenses. * Take Advantage of Preventive Care: Many health insurance plans cover preventive care, such as routine check-ups and screenings, at no additional cost. * Keep Your Plan Up-to-Date: Make sure to review and update your health insurance plan regularly to ensure that it continues to meet your needs.

📝 Note: It's essential to carefully review your health insurance plan and understand what is covered and what is not, to avoid unexpected expenses.

Maximizing Your Health Insurance Benefits

To get the most out of your health insurance plan, it’s essential to understand how to maximize your benefits. Here are a few tips: * Know Your Network: Make sure to choose healthcare providers who are part of your plan’s network to avoid higher costs. * Understand Your Deductible: Your deductible is the amount you must pay out-of-pocket before your insurance plan kicks in. Make sure to understand how your deductible works and plan accordingly. * Take Advantage of Tax Benefits: Many health insurance plans offer tax benefits, such as health savings accounts (HSAs), which can help to reduce your taxable income. * Keep Track of Your Expenses: Keep track of your medical expenses to ensure that you are taking advantage of all the benefits available to you.

Common Health Insurance Mistakes to Avoid

When it comes to health insurance, there are several common mistakes to avoid. Here are a few: * Not Reading the Fine Print: Make sure to carefully read and understand your health insurance plan before signing up. * Not Asking Questions: Don’t be afraid to ask questions if you’re unsure about something. * Not Keeping Your Plan Up-to-Date: Make sure to review and update your health insurance plan regularly to ensure that it continues to meet your needs. * Not Taking Advantage of Preventive Care: Many health insurance plans cover preventive care, such as routine check-ups and screenings, at no additional cost.

| Plan Type | Premium | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| Individual Plan | $300 | $1,000 | $5,000 |

| Group Plan | $200 | $500 | $3,000 |

| Medicare Plan | $150 | $0 | $2,000 |

In summary, having adequate health insurance coverage is essential for protecting your financial well-being and ensuring access to quality healthcare. By understanding the different types of health insurance plans, boosting your coverage, maximizing your benefits, and avoiding common mistakes, you can get the most out of your health insurance plan.

What is health insurance?

+

Health insurance is a type of insurance that covers the cost of medical and surgical expenses incurred by the insured.

How do I choose the right health insurance plan?

+

When choosing a health insurance plan, consider factors such as premium cost, deductible, out-of-pocket maximum, and network of providers.

What is the difference between a deductible and an out-of-pocket maximum?

+

A deductible is the amount you must pay out-of-pocket before your insurance plan kicks in, while an out-of-pocket maximum is the maximum amount you will pay for healthcare expenses in a given year.

Related Terms:

- Boost health insurance ACA

- Boost insurance claim

- Free health insurance

- Boost dental insurance

- Boost Mobile insurance

- Boost Insurance LinkedIn