Health and Life Insurance Broker Services

Introduction to Health and Life Insurance Broker Services

In today’s complex and often confusing world of health and life insurance, navigating the myriad of options and plans can be overwhelming for individuals and businesses alike. This is where health and life insurance broker services come into play, offering expert guidance and support to help clients make informed decisions about their insurance needs. Insurance brokers specialize in providing personalized service, helping clients understand the nuances of different insurance policies, and finding the best coverage to suit their specific requirements.

Role of a Health and Life Insurance Broker

A health and life insurance broker acts as an intermediary between the client and the insurance company. Their primary role is to assess the client’s insurance needs, provide professional advice, and facilitate the purchase of insurance policies. Unlike insurance agents who represent specific insurance companies, brokers are independent, allowing them to offer a broader range of options from various providers. This independence enables brokers to focus on the client’s best interests, ensuring they receive the most suitable coverage at competitive rates.

Benefits of Using Health and Life Insurance Broker Services

There are several benefits to using health and life insurance broker services: - Expert Knowledge: Brokers have extensive knowledge of the insurance market and can explain complex policy details in an understandable manner. - Personalized Service: They offer tailored advice and solutions based on the client’s unique circumstances and needs. - Time-Saving: By leveraging the broker’s expertise, clients can save time that would be spent researching and comparing different insurance policies. - Access to Multiple Providers: Brokers can provide quotes and plans from a variety of insurance companies, increasing the likelihood of finding the perfect policy. - Cost-Effective: Often, working with a broker can result in more affordable premiums due to their ability to negotiate with insurance providers.

How Health and Life Insurance Broker Services Work

The process of working with a health and life insurance broker typically begins with an initial consultation, where the broker will discuss the client’s insurance goals, budget, and current situation. Based on this information, the broker will research and compare various insurance policies from different providers, considering factors such as coverage, premiums, and policy limitations. Once the broker has identified suitable options, they will present these to the client, explaining the pros and cons of each policy in a clear and concise manner. After the client selects a policy, the broker will assist with the application process and ensure that the client understands all the terms and conditions of their new insurance policy.

Types of Insurance Offered by Brokers

Health and life insurance brokers offer a wide range of insurance products, including: - Individual and Family Health Insurance: Plans designed for individuals and families not covered by employer-sponsored health insurance. - Group Health Insurance: Policies for businesses looking to provide health insurance benefits to their employees. - Term Life Insurance: Temporary life insurance coverage for a specified period. - Whole Life Insurance: Permanent life insurance that covers the insured for their entire lifetime. - Disability Income Insurance: Insurance that provides income replacement if the insured becomes unable to work due to illness or injury.

💡 Note: It's essential to carefully review and understand the terms of any insurance policy before purchasing, as policies can vary significantly in what they cover and how they operate.

Choosing the Right Health and Life Insurance Broker

When selecting a health and life insurance broker, consider the following factors: - Experience and Expertise: Look for brokers with extensive experience in the health and life insurance sector. - Licenses and Certifications: Ensure the broker is properly licensed and certified to operate in your state or region. - Reputation: Research the broker’s reputation online, reading reviews and testimonials from past clients. - Service Offerings: Consider the range of services the broker provides, from policy selection to claims assistance. - Fees and Compensation: Understand how the broker is compensated and whether they charge any additional fees for their services.

| Broker Service | Description |

|---|---|

| Policy Selection | Assistance in choosing the most appropriate insurance policy. |

| Claims Assistance | Help with filing insurance claims and ensuring timely payouts. |

| Premium Negotiation | Efforts to secure the best possible premiums for the client's insurance policy. |

In the end, health and life insurance broker services play a vital role in helping individuals and businesses navigate the complex world of insurance, ensuring they are adequately protected against life’s uncertainties. By providing expert guidance, personalized service, and access to a wide range of insurance products, brokers can offer peace of mind and financial security to their clients.

What is the primary role of a health and life insurance broker?

+

The primary role of a health and life insurance broker is to assess the client’s insurance needs, provide professional advice, and facilitate the purchase of insurance policies that best suit their requirements.

How do health and life insurance brokers get compensated?

+

Health and life insurance brokers typically receive compensation in the form of commissions paid by the insurance companies for the policies they sell. Some brokers may also charge additional fees for their services.

What are the benefits of using health and life insurance broker services?

+

The benefits include expert knowledge, personalized service, time-saving, access to multiple providers, and potentially more cost-effective insurance solutions tailored to the client’s needs.

Related Terms:

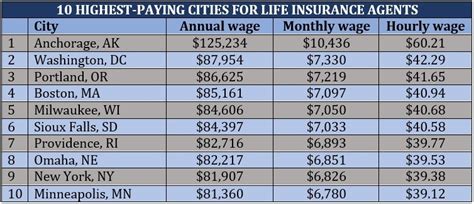

- Life Insurance Broker salary

- Business health insurance broker

- Life insurance broker vs agent

- Private car insurance brokers

- Life insurance brokers near me

- EMG Insurance Brokerage