5 Careers in Health Insurance

Introduction to Health Insurance Careers

A career in health insurance can be highly rewarding, offering a range of opportunities to make a positive impact on people’s lives. The health insurance industry is complex and multifaceted, involving various roles that require different skill sets and areas of expertise. From underwriting and claims processing to sales and customer service, there are numerous career paths to explore. In this article, we will delve into five careers in health insurance, highlighting their responsibilities, required skills, and growth prospects.

Career 1: Health Insurance Underwriter

Health insurance underwriters play a critical role in assessing and managing risk for insurance companies. Their primary responsibility is to evaluate applications for health insurance coverage, determining the likelihood of an individual or group making a claim. Underwriters must analyze various factors, including medical history, age, and lifestyle, to decide whether to approve or reject an application. They must also determine the premium amount and any applicable exclusions or limitations. Key skills required for this role include analytical thinking, attention to detail, and strong communication skills.

Career 2: Claims Adjuster

Claims adjusters are responsible for processing and settling claims made by policyholders. Their duties involve investigating claims, gathering information, and determining the validity and extent of coverage. Adjusters must also negotiate with healthcare providers and policyholders to reach a fair settlement. This role requires strong analytical and problem-solving skills, as well as excellent communication and interpersonal skills. Claims adjusters must be able to work in a fast-paced environment, handling multiple claims simultaneously and meeting deadlines.

Career 3: Health Insurance Sales Agent

Health insurance sales agents work with clients to determine their insurance needs and provide tailored solutions. They must stay up-to-date with industry developments and changes in healthcare legislation, as well as understand the various types of health insurance products available. Sales agents must be able to build strong relationships with clients, providing excellent customer service and support. This role requires strong communication and interpersonal skills, as well as the ability to work in a competitive sales environment.

Career 4: Customer Service Representative

Customer service representatives are the primary point of contact for policyholders and potential customers. They must answer questions, address concerns, and provide information on health insurance products and services. This role requires excellent communication and interpersonal skills, as well as the ability to work in a fast-paced environment. Customer service representatives must be able to resolve issues efficiently and effectively, ensuring high levels of customer satisfaction.

Career 5: Health Insurance Actuary

Health insurance actuaries use statistical models and data analysis to assess and manage risk for insurance companies. They must analyze large datasets to identify trends and patterns, predicting future claims and determining premium rates. Actuaries must also develop and implement pricing strategies, ensuring that insurance products are competitive and profitable. Key skills required for this role include strong analytical and mathematical skills, as well as the ability to communicate complex data insights to non-technical stakeholders.

📝 Note: Many of these careers require specialized education and training, such as a degree in a related field (e.g., business, healthcare, or mathematics) and professional certifications (e.g., Chartered Life Underwriter or Associate in Health Insurance).

Key Skills and Qualifications

While the specific skills and qualifications required may vary depending on the role, there are some common characteristics that are essential for success in the health insurance industry. These include: * Strong analytical and problem-solving skills * Excellent communication and interpersonal skills * Ability to work in a fast-paced environment * Strong attention to detail and organizational skills * Ability to stay up-to-date with industry developments and changes in healthcare legislation * Professional certifications and specialized education or training

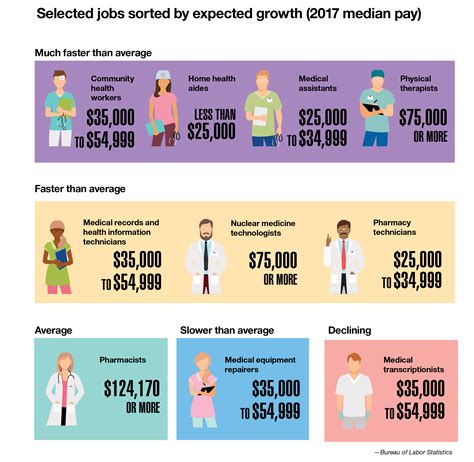

Growth Prospects and Salary Ranges

The health insurance industry is expected to experience steady growth in the coming years, driven by an aging population and an increasing demand for healthcare services. According to the Bureau of Labor Statistics, employment of insurance underwriters, claims adjusters, and sales agents is projected to grow 10% from 2020 to 2030, faster than the average for all occupations. Salary ranges for these careers vary depending on factors such as location, experience, and industry segment. However, here are some approximate salary ranges for each of the careers mentioned:

| Career | Entry-Level Salary Range | Mid-Career Salary Range | Senior-Level Salary Range |

|---|---|---|---|

| Health Insurance Underwriter | 50,000 - 70,000 | 70,000 - 100,000 | 100,000 - 140,000 |

| Claims Adjuster | 40,000 - 60,000 | 60,000 - 90,000 | 90,000 - 120,000 |

| Health Insurance Sales Agent | 40,000 - 70,000 | 70,000 - 100,000 | 100,000 - 150,000 |

| Customer Service Representative | 30,000 - 50,000 | 50,000 - 70,000 | 70,000 - 90,000 |

| Health Insurance Actuary | 60,000 - 90,000 | 90,000 - 120,000 | 120,000 - 160,000 |

In summary, careers in health insurance offer a range of opportunities for individuals with different skill sets and areas of expertise. From underwriting and claims processing to sales and customer service, these roles require strong analytical and communication skills, as well as the ability to work in a fast-paced environment. With steady growth prospects and competitive salary ranges, a career in health insurance can be a rewarding and challenging choice for those passionate about making a positive impact on people’s lives.

What are the most in-demand careers in health insurance?

+

The most in-demand careers in health insurance include health insurance underwriter, claims adjuster, health insurance sales agent, customer service representative, and health insurance actuary.

What skills are required for a career in health insurance?

+

Key skills required for a career in health insurance include strong analytical and problem-solving skills, excellent communication and interpersonal skills, ability to work in a fast-paced environment, and strong attention to detail and organizational skills.

What is the average salary range for health insurance careers?

+

The average salary range for health insurance careers varies depending on the role, location, and experience. However, approximate salary ranges for entry-level, mid-career, and senior-level positions are provided in the table above.

How do I get started in a health insurance career?

+

To get started in a health insurance career, research the different roles and required skills, pursue relevant education and training, and gain industry experience through internships or entry-level positions.

What are the growth prospects for health insurance careers?

+

The health insurance industry is expected to experience steady growth in the coming years, driven by an aging population and an increasing demand for healthcare services. Employment of insurance underwriters, claims adjusters, and sales agents is projected to grow 10% from 2020 to 2030, faster than the average for all occupations.

Related Terms:

- Health insurance job description Resume

- Working in health insurance Reddit

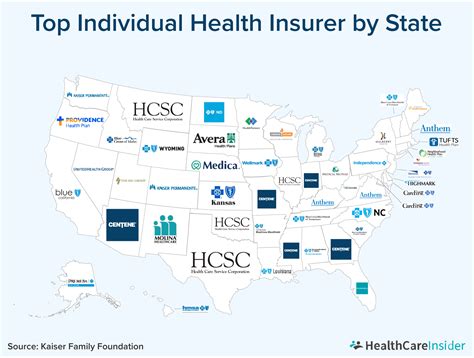

- Health Insurance job salary

- Health insurance companies

- Health insurance Specialist

- Career insurance