Change Healthcare Enrollment Made Easy

Understanding the Basics of Healthcare Enrollment

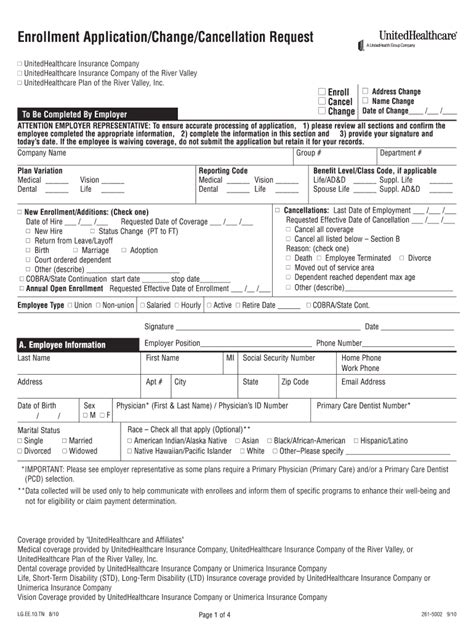

With the ever-changing landscape of healthcare, understanding the basics of healthcare enrollment is crucial for individuals, families, and businesses alike. The process can be overwhelming, especially for those who are new to the system or have limited experience with health insurance. In this article, we will break down the key components of healthcare enrollment, making it easier for you to navigate the process.

The first step in healthcare enrollment is to determine your eligibility. This involves understanding the different types of health insurance plans available, including individual and family plans, group plans, and Medicaid and CHIP plans. Each type of plan has its own set of eligibility requirements, which may include factors such as income level, family size, and employment status.

Types of Health Insurance Plans

There are several types of health insurance plans to choose from, each with its own unique features and benefits. Some of the most common types of plans include:

- Health Maintenance Organization (HMO) plans: These plans require you to receive medical care from a specific network of providers, with the exception of emergency situations.

- Preferred Provider Organization (PPO) plans: These plans offer a network of providers, but also allow you to see providers outside of the network at a higher cost.

- Exclusive Provider Organization (EPO) plans: These plans offer a network of providers, but do not cover care received from providers outside of the network, except in emergency situations.

- Point of Service (POS) plans: These plans combine elements of HMO and PPO plans, allowing you to choose between receiving care from a primary care physician or a specialist.

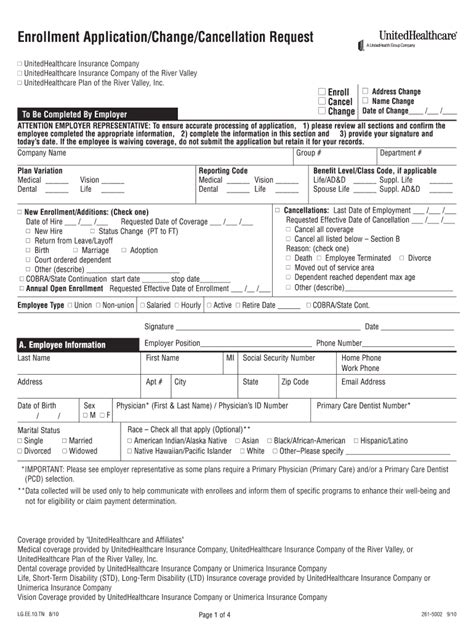

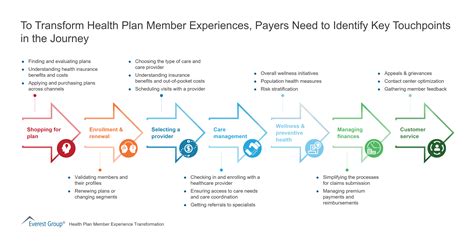

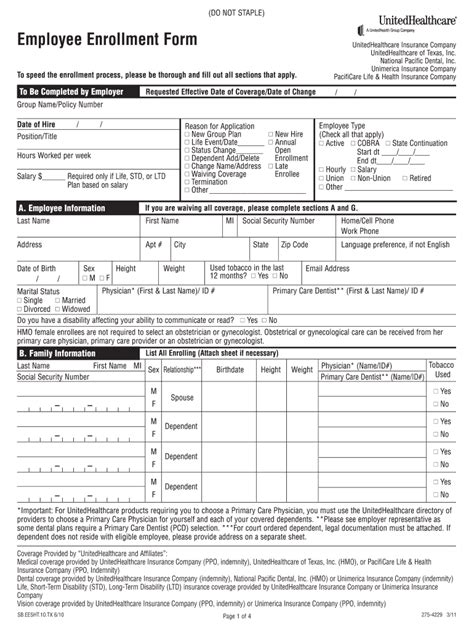

How to Enroll in a Health Insurance Plan

Once you have determined your eligibility and chosen a health insurance plan, the next step is to enroll. The enrollment process typically involves the following steps:

- Application: You will need to submit an application for the health insurance plan you have chosen. This can usually be done online, by phone, or in person.

- Verification: The insurance company will verify the information you provided on your application, including your identity, income, and employment status.

- Approval: If your application is approved, you will receive a confirmation notice and information about your new health insurance plan.

- Payment: You will need to make your first premium payment to activate your coverage.

It is essential to note that the enrollment process may vary depending on the type of plan you are applying for and the insurance company you are working with. Be sure to review the plan’s terms and conditions carefully before enrolling.

Special Enrollment Periods

In addition to the regular enrollment period, there are also special enrollment periods (SEPs) available for individuals who experience certain life events. These events may include:

- Loss of job-based coverage

- Divorce or separation

- Birth or adoption of a child

- Death of a spouse or dependent

- Other qualifying life events

If you experience one of these life events, you may be eligible for a special enrollment period, which allows you to enroll in a health insurance plan outside of the regular enrollment period.

Common Challenges and Solutions

Despite the efforts to simplify the healthcare enrollment process, individuals and families may still encounter challenges. Some common issues include:

- Difficulty navigating the application process

- Confusion about plan options and benefits

- Trouble understanding eligibility requirements

- Difficulty making premium payments

To overcome these challenges, it is essential to:

- Seek guidance from a licensed insurance agent or broker

- Thoroughly review plan documents and terms

- Ask questions and clarify any concerns

- Explore financial assistance options, such as subsidies or tax credits

📝 Note: It is crucial to carefully review and understand the terms and conditions of your health insurance plan before enrolling. This includes understanding the plan's network, benefits, and any limitations or exclusions.

Comparison of Health Insurance Plans

| Plan Type | Network | Out-of-Network Coverage | Premium |

|---|---|---|---|

| HMO | Specific network of providers | Emergency situations only | Lower premiums |

| PPO | Network of providers, with out-of-network options | Coverage at a higher cost | Higher premiums |

| EPO | Network of providers, with no out-of-network coverage | No coverage, except in emergency situations | Lower premiums |

| POS | Combination of HMO and PPO plans | Coverage at a higher cost | Higher premiums |

In summary, healthcare enrollment can be a complex and overwhelming process, but by understanding the basics of health insurance plans, eligibility requirements, and the enrollment process, individuals and families can make informed decisions about their healthcare coverage. It is essential to carefully review plan documents, ask questions, and seek guidance from licensed insurance agents or brokers to ensure that you find the right plan for your needs and budget.

What is the difference between an HMO and a PPO plan?

+

An HMO plan requires you to receive medical care from a specific network of providers, while a PPO plan offers a network of providers, but also allows you to see providers outside of the network at a higher cost.

How do I know if I am eligible for a special enrollment period?

+

You may be eligible for a special enrollment period if you experience a qualifying life event, such as loss of job-based coverage, divorce or separation, birth or adoption of a child, or death of a spouse or dependent.

What is the best way to compare health insurance plans?

+

The best way to compare health insurance plans is to carefully review the plan’s terms and conditions, including the network, benefits, and any limitations or exclusions. You can also seek guidance from a licensed insurance agent or broker to help you make an informed decision.

Related Terms:

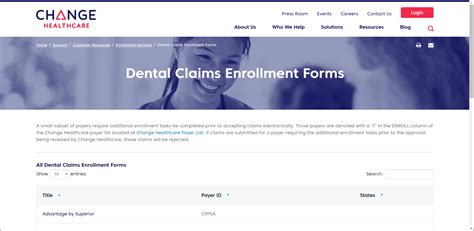

- change healthcare enrollment pes

- Change Healthcare Payer Enrollment

- Change Healthcare EFT Enrollment login

- Change Healthcare Provider login

- Change Healthcare Enrollment Forms

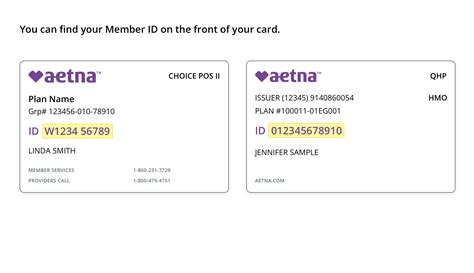

- Payer enroll services Aetna