5 Ways Chase HSA Works

Introduction to Chase HSA

Chase Health Savings Account (HSA) is a type of savings account that allows individuals with high-deductible health plans to set aside pre-tax dollars for medical expenses. In this article, we will explore the ins and outs of Chase HSA, including its benefits, eligibility, and how it works. Whether you’re an individual or an employer looking to offer HSAs to your employees, understanding how Chase HSA works is crucial in making informed decisions about your health care and financial planning.

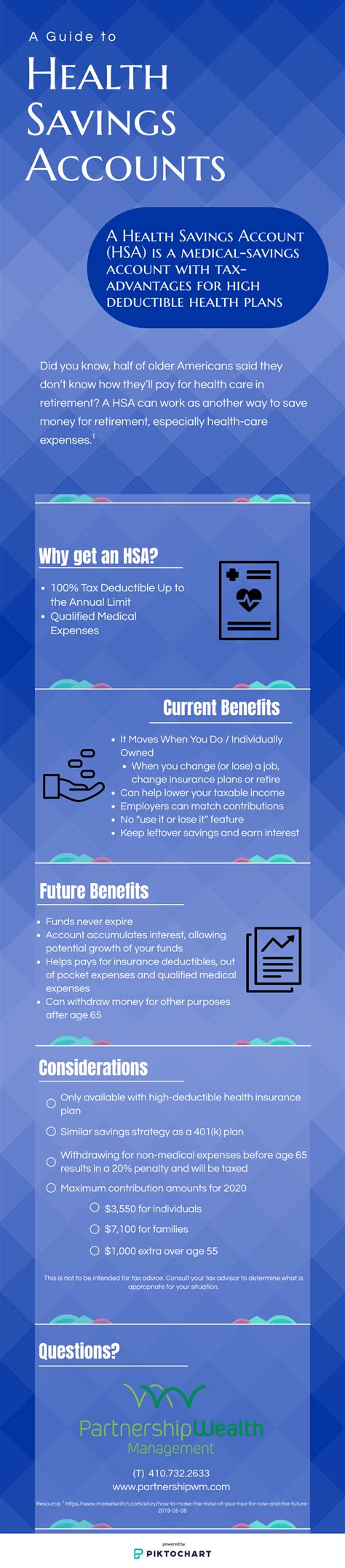

Benefits of Chase HSA

Chase HSA offers numerous benefits, including: * Tax advantages: Contributions to a Chase HSA are tax-deductible, and the funds grow tax-free. * Portability: HSAs are portable, meaning you can take them with you if you change jobs or retire. * Flexibility: You can use your HSA funds to pay for a wide range of medical expenses, including doctor visits, prescriptions, and hospital stays. * Investment opportunities: You can invest your HSA funds in a variety of assets, such as stocks, bonds, and mutual funds. * No “use it or lose it” rule: Unlike flexible spending accounts (FSAs), HSAs do not have a “use it or lose it” rule, so you can carry over unused funds from year to year.

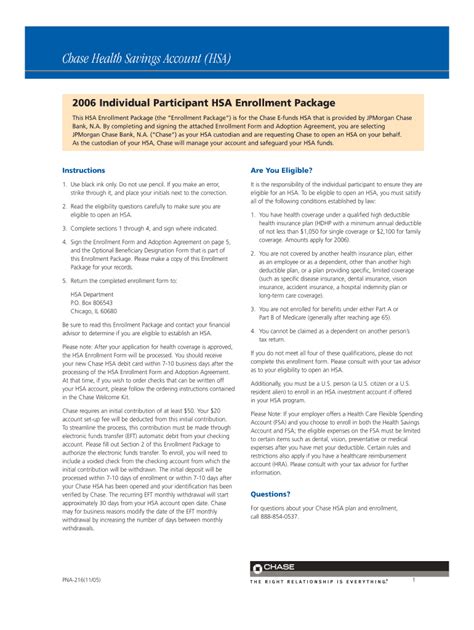

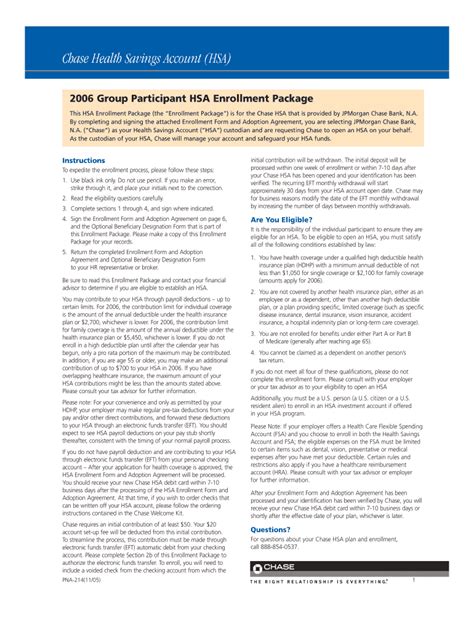

Eligibility and Enrollment

To be eligible for a Chase HSA, you must: * Be covered under a high-deductible health plan (HDHP) * Not be enrolled in Medicare * Not be claimed as a dependent on someone else’s tax return * Not have any other health coverage, except for certain exceptions, such as dental or vision insurance The enrollment process for Chase HSA typically involves: * Opening an HSA account with Chase * Setting up contributions to your HSA account * Receiving an HSA debit card to use for medical expenses

5 Ways Chase HSA Works

Here are five ways Chase HSA works: * Contributions: You can contribute to your Chase HSA through payroll deductions or individual contributions. The contribution limits vary from year to year, and you can find the current limits on the IRS website. * Investments: You can invest your HSA funds in a variety of assets, such as stocks, bonds, and mutual funds. This allows your HSA funds to grow over time, providing a source of funds for future medical expenses. * Medical expense reimbursement: You can use your HSA funds to pay for qualified medical expenses, such as doctor visits, prescriptions, and hospital stays. You can reimburse yourself for these expenses using your HSA debit card or by submitting a claim to Chase. * Carryover: You can carry over unused HSA funds from year to year, allowing you to build up a nest egg for future medical expenses. * Portability: Your HSA is portable, meaning you can take it with you if you change jobs or retire. This provides peace of mind, knowing that you can keep your HSA funds even if your employment situation changes.

Managing Your Chase HSA

Managing your Chase HSA involves: * Monitoring your account balance and transaction history * Keeping track of your contributions and investment earnings * Ensuring that you have sufficient funds to cover medical expenses * Reviewing and updating your investment portfolio as needed You can manage your Chase HSA online or through the Chase mobile app, making it easy to stay on top of your account activity and make informed decisions about your health care and financial planning.

💡 Note: It's essential to review and understand the terms and conditions of your Chase HSA, including any fees associated with the account, to ensure that you're getting the most out of your HSA.

To summarize, Chase HSA is a valuable tool for individuals with high-deductible health plans, offering tax advantages, portability, flexibility, and investment opportunities. By understanding how Chase HSA works and managing your account effectively, you can make the most of your HSA and achieve your health care and financial goals.

What is the contribution limit for Chase HSA?

+

The contribution limit for Chase HSA varies from year to year. You can find the current limits on the IRS website.

Can I use my Chase HSA for non-medical expenses?

+

No, you can only use your Chase HSA for qualified medical expenses. Using your HSA for non-medical expenses may result in penalties and taxes.

How do I invest my Chase HSA funds?

+

You can invest your Chase HSA funds in a variety of assets, such as stocks, bonds, and mutual funds. You can review and update your investment portfolio online or through the Chase mobile app.

Related Terms:

- Chase Bank HSA fees

- Open Chase HSA account

- Chase HSA account reddit

- Chase HSA online enrollment

- Best health savings account

- Health savings account California