5 Cigna Insurance Tips

Understanding Cigna Insurance: A Comprehensive Guide

Cigna is a global health service company that offers a wide range of insurance products and services to individuals, families, and businesses. With a long history of providing innovative and customer-centric solutions, Cigna has become a trusted name in the insurance industry. In this article, we will provide you with 5 Cigna insurance tips to help you navigate the complex world of insurance and make informed decisions about your coverage.

Tip 1: Choose the Right Plan

Choosing the right insurance plan is crucial to ensuring that you have adequate coverage for your medical needs. Cigna offers a variety of plans, including individual and family plans, group plans, and Medicare plans. When selecting a plan, consider factors such as your age, health status, and budget. It’s also essential to review the plan’s network of providers, deductibles, copays, and coinsurance to ensure that it meets your needs.

Tip 2: Understand Your Network

Cigna has a large network of healthcare providers, including doctors, hospitals, and specialists. Understanding your network is vital to ensuring that you receive covered care at discounted rates. In-network providers have contracted with Cigna to provide services at a lower cost, while out-of-network providers may charge higher rates. Make sure to check if your preferred providers are part of Cigna’s network before selecting a plan.

Tip 3: Take Advantage of Preventive Care

Preventive care is an essential aspect of maintaining good health, and Cigna offers a range of preventive care services, including annual physicals, vaccinations, and screenings. These services are often covered at no additional cost to you, and they can help identify potential health issues early on. Take advantage of these services to stay healthy and avoid costly medical bills down the line.

Tip 4: Manage Your Claims Effectively

Filing a claim with Cigna can seem daunting, but it’s a relatively straightforward process. To manage your claims effectively, make sure to: * Keep accurate records of your medical expenses * Submit claims promptly to avoid delays * Follow up with Cigna to ensure that your claims are being processed correctly * Review your Explanation of Benefits (EOB) statements carefully to understand how your claims are being paid

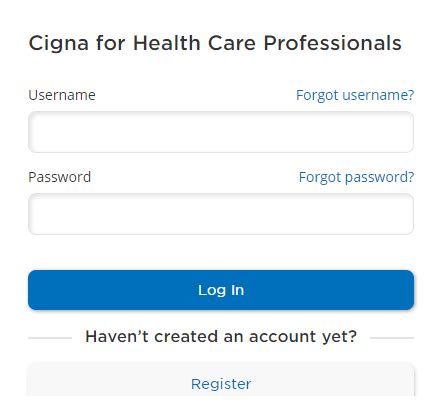

Tip 5: Utilize Cigna’s Online Resources

Cigna offers a range of online resources to help you manage your insurance and stay informed about your coverage. These resources include: * MyCigna, a secure online portal where you can view your claims, track your expenses, and access your insurance documents * Cigna’s mobile app, which allows you to access your insurance information on-the-go * Cigna’s website, which provides a wealth of information on insurance plans, providers, and health topics

💡 Note: Always review your insurance documents carefully and ask questions if you're unsure about any aspect of your coverage.

In summary, navigating the world of Cigna insurance can be complex, but with the right knowledge and resources, you can make informed decisions about your coverage and ensure that you have adequate protection for your medical needs. By choosing the right plan, understanding your network, taking advantage of preventive care, managing your claims effectively, and utilizing Cigna’s online resources, you can get the most out of your insurance and stay healthy and happy.

What types of insurance plans does Cigna offer?

+

Cigna offers a range of insurance plans, including individual and family plans, group plans, and Medicare plans.

How do I find a provider in Cigna’s network?

+

You can find a provider in Cigna’s network by visiting Cigna’s website or using their mobile app. You can also call Cigna’s customer service number for assistance.

What is the difference between in-network and out-of-network providers?

+

In-network providers have contracted with Cigna to provide services at a lower cost, while out-of-network providers may charge higher rates. It’s generally more cost-effective to receive care from in-network providers.

Related Terms:

- cigna life insurance login

- cigna life insurance website

- cigna provider portal sign in

- cigna life insurance customer service

- cigna life insurance death claim

- Related searches cigna official website