5 Cigna Ratings

Introduction to Cigna Ratings

Cigna is a global health services company that offers a wide range of insurance products and services to individuals, families, and businesses. With a presence in over 200 countries and jurisdictions, Cigna has established itself as a leading player in the health insurance industry. One of the key indicators of a company’s performance and reputation is its ratings, which are assigned by independent rating agencies. In this article, we will delve into the world of Cigna ratings, exploring what they mean, how they are determined, and what they signify for customers and investors alike.

Understanding Cigna Ratings

Ratings are a way to measure a company’s financial strength, creditworthiness, and overall performance. For insurance companies like Cigna, ratings are crucial as they reflect the company’s ability to pay claims, meet financial obligations, and maintain a stable financial position. The most well-known rating agencies include A.M. Best, Moody’s, Standard & Poor’s, and Fitch Ratings. Each agency uses its own methodology to assign ratings, which are usually expressed as a combination of letters and symbols. For example, A.M. Best uses a scale of A++ (Superior) to F (Failed), while Moody’s uses a scale of Aaa (Exceptional) to C (Caution).

Cigna’s Current Ratings

As of the latest available data, Cigna’s ratings are as follows: - A.M. Best: A (Excellent) - Moody’s: A3 (Lower Medium Grade) - Standard & Poor’s: A- (Strong) - Fitch Ratings: A (Strong) These ratings indicate that Cigna has a strong financial position, a stable outlook, and a good credit profile. However, it’s essential to note that ratings can change over time due to various factors, such as changes in the company’s financial performance, regulatory environment, or market conditions.

What Do Cigna Ratings Mean for Customers?

For customers, Cigna ratings can provide valuable insights into the company’s ability to pay claims and meet its financial obligations. A high rating can indicate that the company is financially stable and has a strong track record of paying claims. This can give customers peace of mind, knowing that their insurance provider is reliable and can meet its commitments. On the other hand, a low rating can raise concerns about the company’s financial health and its ability to pay claims.

Factors That Influence Cigna Ratings

Several factors can influence Cigna’s ratings, including: * Financial Performance: The company’s revenue, profitability, and cash flow can impact its ratings. * Regulatory Environment: Changes in regulations, laws, or regulatory requirements can affect the company’s operations and financial performance. * Market Conditions: Economic downturns, industry trends, and competitive pressures can influence the company’s ratings. * Management and Governance: The company’s leadership, corporate governance, and risk management practices can impact its ratings.

Importance of Cigna Ratings for Investors

For investors, Cigna ratings can provide valuable information about the company’s creditworthiness and financial stability. A high rating can indicate that the company is a relatively safe investment, with a low risk of default. This can make the company’s debt and equity securities more attractive to investors. On the other hand, a low rating can increase the perceived risk of investing in the company, which can impact its ability to raise capital and attract investors.

💡 Note: Ratings are just one factor to consider when evaluating an insurance company or investment opportunity. It's essential to conduct thorough research and consult with financial experts before making any decisions.

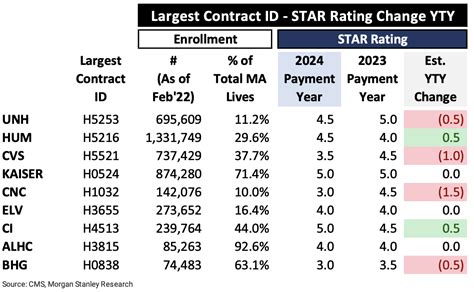

Comparison of Cigna Ratings with Industry Peers

To put Cigna’s ratings into perspective, it’s helpful to compare them with those of its industry peers. Some of Cigna’s main competitors include UnitedHealth Group, Anthem, and Aetna. A comparison of their ratings can provide insights into their relative financial strength and stability.

| Company | A.M. Best | Moody's | Standard & Poor's | Fitch Ratings |

|---|---|---|---|---|

| Cigna | A (Excellent) | A3 (Lower Medium Grade) | A- (Strong) | A (Strong) |

| UnitedHealth Group | A+ (Superior) | A1 (Upper Medium Grade) | AA- (Very Strong) | AA (Very Strong) |

| Anthem | A (Excellent) | Baa1 (Medium Grade) | A- (Strong) | A- (Strong) |

| Aetna | A (Excellent) | Baa1 (Medium Grade) | A- (Strong) | A- (Strong) |

In conclusion, Cigna’s ratings provide valuable insights into the company’s financial strength, creditworthiness, and overall performance. By understanding what these ratings mean and how they are determined, customers and investors can make more informed decisions about their insurance and investment options. Whether you’re a current or potential customer, or an investor looking to diversify your portfolio, Cigna’s ratings are an essential factor to consider.

What do Cigna ratings mean for policyholders?

+

Cigna ratings indicate the company’s financial strength and ability to pay claims. A high rating can provide peace of mind for policyholders, knowing that their insurance provider is reliable and can meet its commitments.

How often are Cigna ratings updated?

+

Cigna ratings are updated periodically by the rating agencies. The frequency of updates can vary depending on the agency and the company’s performance. Typically, ratings are reviewed and updated annually or whenever there are significant changes in the company’s financial position or market conditions.

Can Cigna ratings affect the cost of insurance premiums?

+

Yes, Cigna ratings can indirectly affect the cost of insurance premiums. A high rating can indicate that the company is financially strong and has a low risk of default, which can lead to lower premiums. On the other hand, a low rating can increase the perceived risk of investing in the company, which can result in higher premiums.

Related Terms:

- cigna insurance ratings and reviews

- cigna health insurance ranking

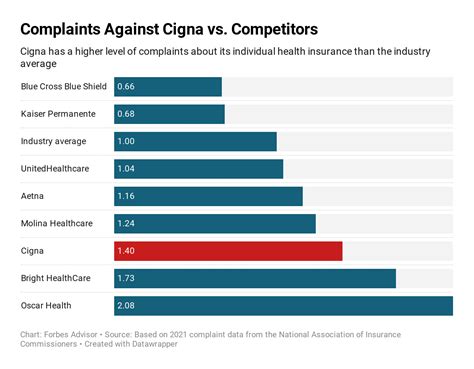

- cigna health care complaints

- pros and cons of cigna

- cigna medicare reviews complaints

- cigna health insurance reviews ratings