5 City Tech HSA Tips

Introduction to City Tech HSA

In today’s fast-paced world, managing healthcare expenses can be overwhelming, especially with the ever-rising costs of medical services. To help alleviate some of this financial burden, Health Savings Accounts (HSAs) have become increasingly popular. For those affiliated with City Tech, understanding how to maximize the benefits of a City Tech HSA is crucial. This article will delve into the world of City Tech HSAs, providing valuable tips on how to get the most out of this healthcare savings vehicle.

Understanding City Tech HSA

Before diving into the tips, it’s essential to have a solid understanding of what a City Tech HSA entails. A Health Savings Account is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside pre-tax dollars for medical expenses. The funds contributed to an HSA are not subject to federal income tax, and the account earnings grow tax-free. Moreover, withdrawals from an HSA for qualified medical expenses are tax-free, making it a highly beneficial tool for managing healthcare costs.

Tip 1: Contribution Limits

One of the critical aspects of maximizing a City Tech HSA is understanding the contribution limits. The IRS sets these limits annually, and for the current year, individuals can contribute up to 3,650</b> for self-only coverage, while families can contribute up to <b>7,300. It’s also worth noting that individuals aged 55 or older can make an additional catch-up contribution of $1,000. Making the maximum allowable contribution is key to building a substantial fund for future medical expenses.

Tip 2: Investing Your HSA Funds

Many HSA holders are unaware that they can invest their HSA funds, potentially growing their savings over time. By investing in a variety of assets such as stocks, bonds, or mutual funds, individuals can make their HSA work harder for them. However, it’s crucial to understand the investment options available through your City Tech HSA provider and to consider your risk tolerance and investment goals before making any investment decisions.

Tip 3: Tracking and Managing Expenses

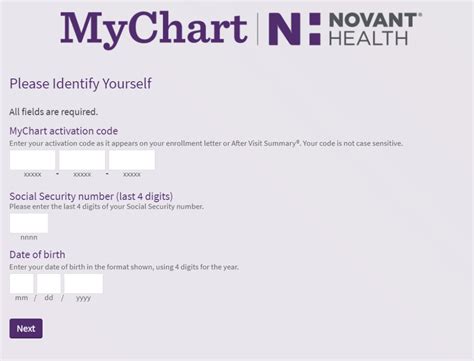

Effective management of a City Tech HSA involves keeping track of medical expenses and ensuring that reimbursements are properly handled. It’s essential to maintain detailed records of all medical expenses, including receipts and invoices, to facilitate easy reimbursement from the HSA. Many HSA providers offer online platforms or mobile apps that make it easier to manage accounts, track expenses, and submit claims for reimbursement.

Tip 4: Understanding Qualified Medical Expenses

To make the most out of a City Tech HSA, it’s vital to understand what constitutes qualified medical expenses. These expenses include a wide range of medical services and products, from doctor visits and hospital stays to prescription medications and certain medical equipment. The IRS provides a detailed list of qualified medical expenses, and individuals should familiarize themselves with this list to ensure they are maximizing their HSA benefits.

Tip 5: Long-Term Savings Strategy

Perhaps one of the most overlooked benefits of a City Tech HSA is its potential as a long-term savings vehicle. Unlike Flexible Spending Accounts (FSAs), HSAs do not have a “use it or lose it” rule, meaning that unused funds roll over from year to year. By contributing consistently and allowing the funds to grow over time, individuals can build a significant nest egg for future medical expenses or even use it as a supplemental retirement fund.

💡 Note: It's essential to review and understand the specific terms and conditions of your City Tech HSA, as certain rules and contribution limits may apply.

Additional Considerations

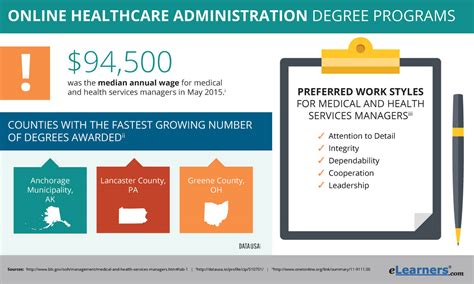

In addition to the tips outlined above, there are several other factors to consider when maximizing the benefits of a City Tech HSA. These include understanding the rules regarding HSA eligibility, the process for opening and managing an HSA, and the potential impact of HSA funds on Medicare and Social Security benefits. By taking a comprehensive approach to HSA management, individuals can ensure they are making the most of this valuable financial tool.

Comparison of HSA Providers

When selecting an HSA provider for your City Tech HSA, it’s crucial to compare the features and benefits offered by different providers. This includes looking at factors such as investment options, fees, customer service, and mobile accessibility. The following table provides a comparison of some key features among popular HSA providers:

| Provider | Investment Options | Fees | Customer Service |

|---|---|---|---|

| Provider A | Stocks, Bonds, Mutual Funds | No monthly maintenance fee | 24/7 phone support |

| Provider B | Stocks, ETFs, Index Funds | $3 monthly maintenance fee | Live chat support |

| Provider C | Bonds, Mutual Funds, CDs | No fees for accounts over $1,000 | Email support |

In summary, maximizing the benefits of a City Tech HSA requires a thorough understanding of its features, careful management of contributions and expenses, and a long-term savings strategy. By following these tips and considering additional factors such as HSA provider selection, individuals can make the most of their City Tech HSA and better prepare for future healthcare expenses.

What are the main benefits of a City Tech HSA?

+

The main benefits of a City Tech HSA include tax-free contributions, tax-free earnings, and tax-free withdrawals for qualified medical expenses, making it a highly beneficial tool for managing healthcare costs.

Can I use my City Tech HSA for non-medical expenses?

+

Withdrawals from an HSA for non-qualified medical expenses are subject to income tax and may be subject to a 20% penalty, except for individuals aged 65 or older or those who are disabled.

How do I open a City Tech HSA?

+

To open a City Tech HSA, you typically need to have a high-deductible health plan (HDHP) and meet certain eligibility criteria. You can then apply through your employer or directly through an HSA provider.

Related Terms:

- Monroe University The Bronx

- York College

- Lehman College

- Brooklyn College

- LaGuardia Community College

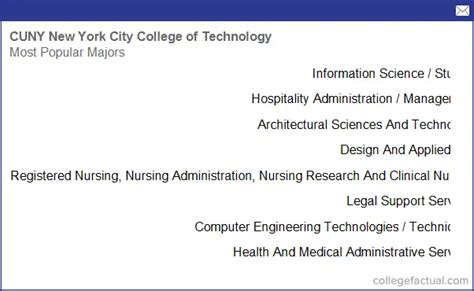

- City Tech Health Services Administration