Health

Clear Springs Health Part D Plans

Introduction to Clear Springs Health Part D Plans

Clear Springs Health is a company that offers various health insurance plans, including Part D plans, which are designed to help Medicare beneficiaries cover the cost of prescription medications. These plans are an essential part of health care for many seniors and individuals with disabilities, as they can help make prescription drugs more affordable. In this article, we will delve into the details of Clear Springs Health Part D plans, including what they cover, how they work, and what benefits they offer.

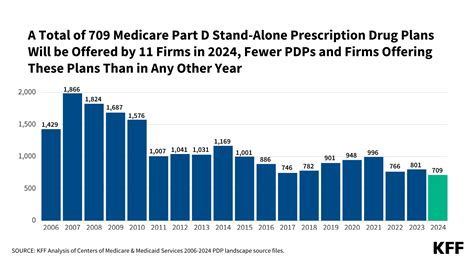

Understanding Medicare Part D

Before we dive into the specifics of Clear Springs Health Part D plans, it’s essential to understand what Medicare Part D is. Medicare Part D is a federal program that helps Medicare beneficiaries pay for prescription medications. It was introduced in 2006 as part of the Medicare Modernization Act and has since become an integral part of the Medicare program. Part D plans are offered by private insurance companies, such as Clear Springs Health, which contract with Medicare to provide coverage.

How Clear Springs Health Part D Plans Work

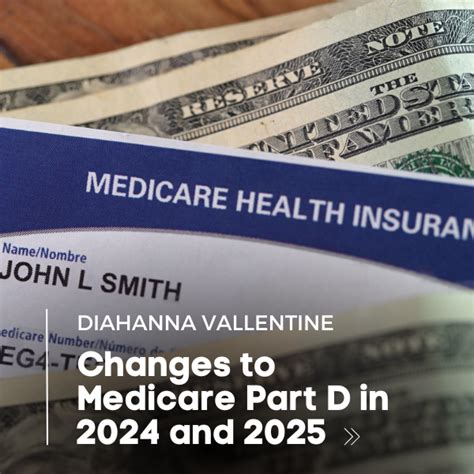

Clear Springs Health Part D plans work similarly to other Part D plans. Here’s a general overview of how they work: * Enrollment: To enroll in a Clear Springs Health Part D plan, you must be a Medicare beneficiary and live in the plan’s service area. * Premiums: You will pay a monthly premium for your Part D plan, which can vary depending on the plan you choose and your income level. * Deductible: Most Part D plans, including those offered by Clear Springs Health, have a deductible, which is the amount you must pay out-of-pocket for your prescriptions before your plan starts covering costs. * Copays/Coinsurance: After you meet your deductible, you will pay a copay or coinsurance for your prescriptions, which can range from 1 to 10 or more per prescription, depending on the plan and the type of medication. * Coverage Gap: Many Part D plans, including those offered by Clear Springs Health, have a coverage gap, also known as the “donut hole.” This means that after you and your plan have spent a certain amount on prescriptions, you will be responsible for paying a larger share of the costs until you reach the catastrophic coverage level.

Benefits of Clear Springs Health Part D Plans

Clear Springs Health Part D plans offer several benefits, including: * Affordable premiums: Clear Springs Health offers competitive premiums for its Part D plans, making it more affordable for Medicare beneficiaries to get the prescription coverage they need. * Comprehensive coverage: Clear Springs Health Part D plans cover a wide range of prescription medications, including brand-name and generic drugs. * Convenient pharmacy network: Clear Springs Health has a large network of pharmacies, making it easy for beneficiaries to fill their prescriptions. * Dedicated customer service: Clear Springs Health offers dedicated customer service to help beneficiaries with questions and concerns about their Part D plan.

Clear Springs Health Part D Plan Options

Clear Springs Health offers several Part D plan options, each with its own unique features and benefits. Here are some of the plan options available: * Basic Plan: This plan offers basic coverage for prescription medications, with a low premium and a moderate deductible. * Enhanced Plan: This plan offers more comprehensive coverage, with a higher premium and a lower deductible. * Premium Plan: This plan offers the most comprehensive coverage, with a higher premium and a low deductible.

| Plan Option | Premium | Deductible | Copay/Coinsurance |

|---|---|---|---|

| Basic Plan | $20-$30 per month | $200-$300 per year | $10-$20 per prescription |

| Enhanced Plan | $30-$40 per month | $100-$200 per year | $5-$10 per prescription |

| Premium Plan | $40-$50 per month | $50-$100 per year | $0-$5 per prescription |

💡 Note: The premium, deductible, and copay/coinsurance amounts listed in the table are examples and may vary depending on the plan and the beneficiary's location.

Eligibility and Enrollment

To be eligible for a Clear Springs Health Part D plan, you must be a Medicare beneficiary and live in the plan’s service area. You can enroll in a Clear Springs Health Part D plan during the following periods: * Initial Enrollment Period (IEP): This is the 7-month period that starts 3 months before your 65th birthday and ends 3 months after your 65th birthday. * Annual Election Period (AEP): This is the period from October 15 to December 7 each year, during which you can change your Part D plan or enroll in a new one. * Special Enrollment Period (SEP): This is a special period during which you can enroll in a Part D plan or change your plan outside of the AEP, such as if you move to a new area or lose your current coverage.

Conclusion and Final Thoughts

In conclusion, Clear Springs Health Part D plans offer a range of benefits and options for Medicare beneficiaries who need prescription coverage. With competitive premiums, comprehensive coverage, and a convenient pharmacy network, Clear Springs Health is a great option for those looking for a reliable and affordable Part D plan. Whether you’re new to Medicare or looking to change your current plan, Clear Springs Health is definitely worth considering. By understanding how Part D plans work and what benefits they offer, you can make an informed decision about your prescription coverage and ensure that you get the medications you need at a price you can afford.

What is Medicare Part D?

+

Medicare Part D is a federal program that helps Medicare beneficiaries pay for prescription medications.

How do I enroll in a Clear Springs Health Part D plan?

+

You can enroll in a Clear Springs Health Part D plan during the Initial Enrollment Period, Annual Election Period, or Special Enrollment Period.

What are the benefits of Clear Springs Health Part D plans?

+

Clear Springs Health Part D plans offer affordable premiums, comprehensive coverage, and a convenient pharmacy network.

Related Terms:

- clear springs health part d

- Clear Spring Health complaints

- Clear Spring Health member login

- Clear Spring Health Phone number

- Clear Spring health NationsBenefits

- Clear Spring Health Provider Portal