Health

Clever Care Health Plan Options

Introduction to Clever Care Health Plan Options

The world of health insurance can be overwhelming, with numerous options available to individuals, families, and businesses. One such option is the Clever Care Health Plan, which offers a range of benefits and features designed to provide comprehensive coverage and peace of mind. In this article, we will delve into the details of Clever Care Health Plan options, exploring the various features, benefits, and considerations that come with choosing a health insurance plan.

Understanding Clever Care Health Plan Options

Clever Care Health Plan options are designed to cater to diverse needs and budgets. The plans are typically categorized into different tiers, each offering varying levels of coverage and premium costs. The key to selecting the right plan is to understand the specific needs of the individual or family, including their health status, lifestyle, and financial situation. Some of the factors to consider when evaluating Clever Care Health Plan options include: * Deductible: The amount that must be paid out-of-pocket before the insurance coverage kicks in. * Co-pay: The fixed amount paid for doctor visits, prescriptions, and other healthcare services. * Co-insurance: The percentage of healthcare costs paid by the insurance plan after the deductible is met. * Out-of-pocket maximum: The maximum amount that must be paid for healthcare expenses in a given year.

Clever Care Health Plan Features and Benefits

Clever Care Health Plan options often come with a range of features and benefits, including: * Preventive care services: Routine check-ups, vaccinations, and screenings are typically covered at no additional cost. * Prescription medication coverage: Many plans offer coverage for prescription medications, including generic and brand-name options. * Mental health and substance abuse services: Coverage for therapy sessions, counseling, and treatment programs. * Network of healthcare providers: Access to a network of participating healthcare providers, including primary care physicians, specialists, and hospitals. * Telehealth services: Virtual consultations and remote monitoring options for added convenience and flexibility.

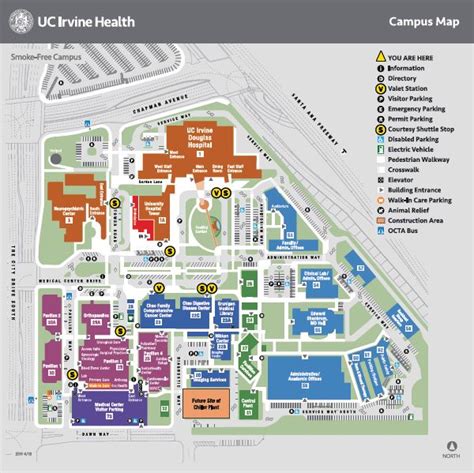

💡 Note: It is essential to review the plan's network of healthcare providers to ensure that the preferred doctors and hospitals are included.

Types of Clever Care Health Plan Options

Clever Care Health Plan options may include: * Individual plans: Designed for single individuals or families, these plans offer flexible coverage options and premium costs. * Group plans: Suitable for businesses and organizations, these plans provide coverage for employees and their dependents. * Short-term plans: Temporary coverage options for individuals who are between jobs, waiting for other coverage to start, or need immediate coverage. * Medicare and Medicaid plans: Specialized plans for seniors, people with disabilities, and low-income individuals.

How to Choose the Right Clever Care Health Plan Option

Selecting the right Clever Care Health Plan option requires careful consideration of several factors, including: * Health status: Individuals with pre-existing conditions or ongoing health issues may require more comprehensive coverage. * Budget: Premium costs, deductibles, and out-of-pocket expenses must be balanced against the need for adequate coverage. * Lifestyle: Families with young children, individuals with chronic conditions, or those who require frequent medical care may need more extensive coverage. * Provider network: Ensuring that the preferred healthcare providers are included in the plan’s network is crucial.

Additional Considerations

When evaluating Clever Care Health Plan options, it is essential to consider the following: * Maximum out-of-pocket costs: The total amount that must be paid for healthcare expenses in a given year. * Pharmacy coverage: The types of prescription medications covered, including generic and brand-name options. * Vision and dental coverage: Optional coverage for vision and dental care services. * Customer support: The availability and quality of customer support services, including phone, email, and online resources.

| Plan Type | Premium Cost | Deductible | Co-pay | Co-insurance |

|---|---|---|---|---|

| Individual Plan | $300-$500 per month | $1,000-$2,000 per year | $20-$50 per visit | 20%-30% of costs |

| Group Plan | $500-$1,000 per month | $2,000-$5,000 per year | $20-$50 per visit | 20%-30% of costs |

| Short-term Plan | $100-$300 per month | $1,000-$2,000 per year | $20-$50 per visit | 20%-30% of costs |

Final Thoughts

In conclusion, Clever Care Health Plan options offer a range of benefits and features designed to provide comprehensive coverage and peace of mind. By carefully evaluating the various plan options, considering factors such as health status, budget, lifestyle, and provider network, individuals and families can make informed decisions about their healthcare coverage. It is essential to review the plan’s features, benefits, and limitations to ensure that the chosen plan meets the specific needs and requirements.

What is the difference between a deductible and a co-pay?

+

A deductible is the amount that must be paid out-of-pocket before the insurance coverage kicks in, while a co-pay is the fixed amount paid for doctor visits, prescriptions, and other healthcare services.

Can I customize my Clever Care Health Plan option to meet my specific needs?

+

Yes, many Clever Care Health Plan options allow for customization to meet specific needs, including adding or removing coverage for certain services or increasing the deductible to lower premium costs.

How do I know if a particular healthcare provider is included in the plan’s network?

+

It is essential to review the plan’s provider directory or contact the insurance company directly to confirm that the preferred healthcare providers are included in the plan’s network.

Related Terms:

- One Pacific Plaza

- Clever Care Health Plan stock

- Clever Care eoc

- Clever Care NationsBenefits

- Clever Care grocery store

- Care evolve login