Stock Financial Health Check

Introduction to Stock Financial Health Check

Conducting a stock financial health check is a crucial step for investors to evaluate the performance and potential of a company. This process involves analyzing various financial metrics and indicators to determine the company’s overall financial well-being. By doing so, investors can make informed decisions about their investments and avoid potential risks. In this article, we will delve into the world of stock financial health checks, exploring the key metrics, ratios, and indicators used to assess a company’s financial health.

Why is a Stock Financial Health Check Important?

A stock financial health check is essential for several reasons. Firstly, it helps investors to identify potential risks associated with a company, such as debt, poor management, or declining revenues. Secondly, it enables investors to evaluate a company’s growth potential, by analyzing its financial performance, management efficiency, and industry trends. Finally, a stock financial health check provides investors with a comprehensive understanding of a company’s financial situation, allowing them to make informed decisions about their investments.

Key Metrics and Ratios Used in Stock Financial Health Check

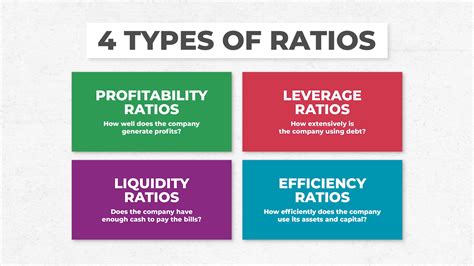

When conducting a stock financial health check, several key metrics and ratios are used to evaluate a company’s financial performance. These include: * Revenue Growth: The rate at which a company’s revenues are increasing or decreasing. * Net Income: A company’s total earnings, minus expenses, taxes, and dividends. * Return on Equity (ROE): A measure of a company’s profitability, calculated by dividing net income by shareholder equity. * Debt-to-Equity Ratio: A measure of a company’s leverage, calculated by dividing total debt by shareholder equity. * Current Ratio: A measure of a company’s liquidity, calculated by dividing current assets by current liabilities. * Interest Coverage Ratio: A measure of a company’s ability to meet its interest payments, calculated by dividing earnings before interest and taxes (EBIT) by interest expenses.

Steps to Conduct a Stock Financial Health Check

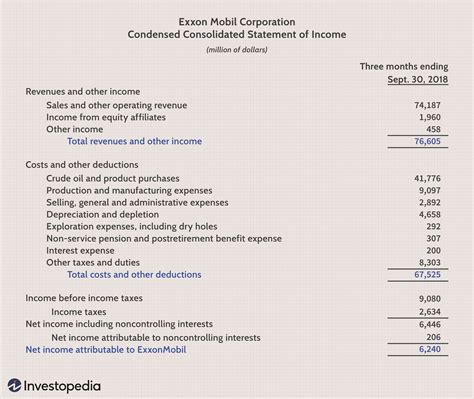

Conducting a stock financial health check involves several steps: * Gather financial data: Collect a company’s financial statements, including income statements, balance sheets, and cash flow statements. * Calculate key metrics and ratios: Use the financial data to calculate the key metrics and ratios mentioned earlier. * Analyze financial trends: Evaluate the company’s financial performance over time, identifying trends and patterns. * Compare to industry averages: Compare the company’s financial performance to industry averages, to determine its relative strength or weakness. * Evaluate management efficiency: Assess the company’s management team, evaluating their experience, track record, and leadership style.

💡 Note: It's essential to use reliable and up-to-date financial data when conducting a stock financial health check.

Common Indicators of Poor Financial Health

Several indicators can suggest that a company is experiencing poor financial health. These include: * Declining revenues: A consistent decline in revenues can indicate a company’s struggles to compete in its market. * Increasing debt: A significant increase in debt can indicate a company’s reliance on borrowing to finance its operations. * Poor management: Inexperienced or ineffective management can lead to poor financial decision-making and a decline in the company’s financial health. * Declining cash flows: A decline in cash flows can indicate a company’s struggles to generate sufficient funds to meet its obligations.

Benefits of Regular Stock Financial Health Checks

Regular stock financial health checks can provide several benefits to investors, including: * Improved investment decisions: By evaluating a company’s financial health, investors can make informed decisions about their investments. * Reduced risk: Identifying potential risks and weaknesses can help investors to avoid losses and reduce their risk exposure. * Increased confidence: A thorough understanding of a company’s financial health can provide investors with increased confidence in their investment decisions. * Better portfolio management: Regular stock financial health checks can help investors to optimize their portfolios, by identifying areas for improvement and potential opportunities for growth.

| Company | Revenue Growth | Net Income | Return on Equity (ROE) |

|---|---|---|---|

| Company A | 10% | $100 million | 20% |

| Company B | 5% | $50 million | 15% |

| Company C | 15% | $200 million | 25% |

As we can see from the table above, Company A has a strong revenue growth rate, high net income, and a impressive return on equity. On the other hand, Company B has a slower revenue growth rate, lower net income, and a lower return on equity. This suggests that Company A may be a more attractive investment opportunity than Company B.

In summary, conducting a stock financial health check is a crucial step for investors to evaluate the performance and potential of a company. By analyzing key metrics and ratios, investors can gain a comprehensive understanding of a company’s financial situation and make informed decisions about their investments. Regular stock financial health checks can provide several benefits, including improved investment decisions, reduced risk, increased confidence, and better portfolio management.

What is the purpose of a stock financial health check?

+

The purpose of a stock financial health check is to evaluate the performance and potential of a company, by analyzing its financial metrics and indicators.

What are the key metrics and ratios used in a stock financial health check?

+

The key metrics and ratios used in a stock financial health check include revenue growth, net income, return on equity, debt-to-equity ratio, current ratio, and interest coverage ratio.

How often should I conduct a stock financial health check?

+

It’s recommended to conduct a stock financial health check at least quarterly, or whenever there are significant changes in the company’s financial situation or market trends.

Related Terms:

- Financial key indicators

- Finance ratio

- Financial strength

- Financial statement