Coors Retirement Health Care Coverage Options

Introduction to Coors Retirement Health Care Coverage Options

As employees approach retirement, one of the most significant concerns is how to manage healthcare costs. The Coors Company, known for its brewing business, offers its retirees various health care coverage options to ensure they can maintain their health and well-being without financial strain. Understanding these options is crucial for retirees to make informed decisions about their healthcare.

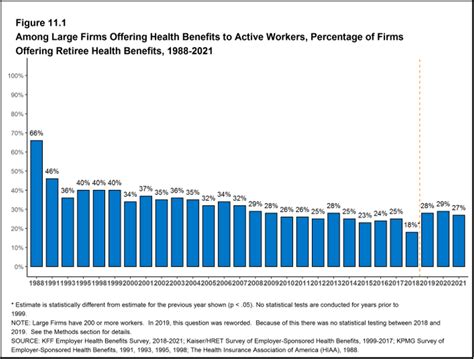

Overview of Coors Retirement Health Care Coverage

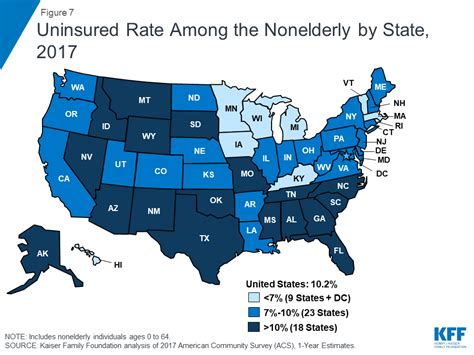

Coors retirement health care coverage is designed to provide retirees with comprehensive and affordable health care. The coverage includes medical, dental, and vision care, ensuring that retirees have access to a broad range of healthcare services. The specifics of the coverage can vary depending on the retiree’s location, age, and the plan they choose. It’s essential for retirees to review their options carefully to select the plan that best meets their needs.

Types of Health Care Coverage Options

Coors offers several health care coverage options for its retirees, including: - Medicare Supplement Insurance: Designed for retirees who are eligible for Medicare, this option helps cover out-of-pocket expenses not covered by Medicare, such as deductibles, copayments, and coinsurance. - Preferred Provider Organization (PPO) Plans: These plans offer a network of healthcare providers from which retirees can choose, allowing for more flexibility in healthcare decisions. - Health Maintenance Organization (HMO) Plans: HMO plans require retirees to receive medical care and services from specific healthcare providers, except in emergency situations. - Prescription Drug Coverage: This option helps cover the cost of prescription medications, which can be a significant expense for retirees.

Eligibility and Enrollment

To be eligible for Coors retirement health care coverage, retirees must meet specific criteria, such as having worked for the company for a certain number of years or being of a certain age. The enrollment process typically occurs during designated periods, and retirees must carefully review and select their coverage options during this time. It’s crucial for retirees to understand the eligibility criteria and enrollment process to ensure they secure the coverage they need.

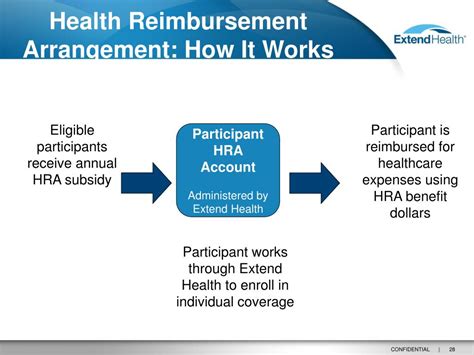

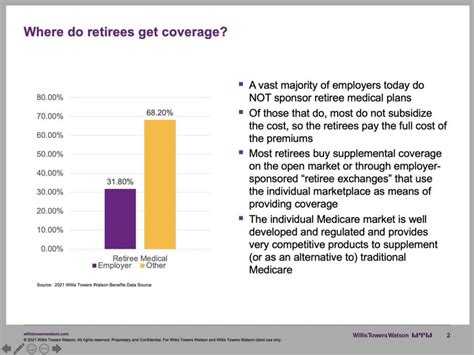

Cost and Contributions

The cost of Coors retirement health care coverage can vary based on the plan selected and the retiree’s circumstances. Some plans may require retirees to pay premiums, deductibles, or copayments, while others may be fully or partially subsidized by the company. Retirees should carefully consider the costs associated with each plan and factor these into their retirement budget.

Benefits and Advantages

Coors retirement health care coverage offers several benefits and advantages, including: - Comprehensive Coverage: Access to a wide range of healthcare services, ensuring retirees can address their health needs. - Financial Protection: Helps protect retirees from significant healthcare expenses, providing financial security. - Choice and Flexibility: Offers various plan options, allowing retirees to choose the coverage that best fits their needs and preferences. - Support and Resources: Often includes support and resources to help retirees navigate the healthcare system and make informed decisions about their care.

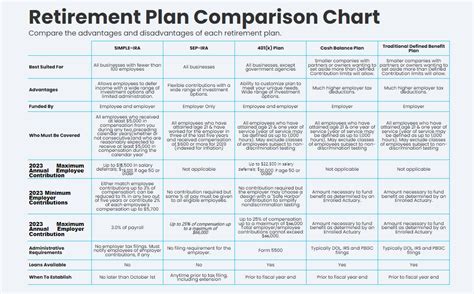

Comparison of Coverage Options

| Plan Type | Network | Cost | Coverage |

|---|---|---|---|

| Medicare Supplement | Nationwide | Varies | Out-of-pocket Medicare expenses |

| PPO | Preferred providers | Premiums, deductibles, copayments | Comprehensive medical care |

| HMO | Specific network | Lower premiums, higher deductibles | Managed care within the network |

📝 Note: The specifics of each plan, including network, cost, and coverage, can vary and should be reviewed carefully by retirees to ensure they understand the details of their selected plan.

Conclusion and Final Thoughts

In conclusion, Coors retirement health care coverage options are designed to support retirees in maintaining their health and managing healthcare expenses. By understanding the various plan options, eligibility criteria, and associated costs, retirees can make informed decisions about their healthcare coverage. It’s essential for retirees to carefully review and compare the different plans to select the one that best meets their needs and budget, ensuring they can enjoy their retirement with peace of mind regarding their healthcare.

What are the eligibility criteria for Coors retirement health care coverage?

+

Eligibility criteria include having worked for the company for a specified number of years and being of a certain age. Specific requirements may vary, so it’s essential to review the criteria carefully.

Can retirees change their health care coverage plan after enrollment?

+

Typically, changes to health care coverage can only be made during designated enrollment periods. However, certain life events may allow for plan changes outside of these periods. Retirees should review their plan’s rules regarding plan changes.

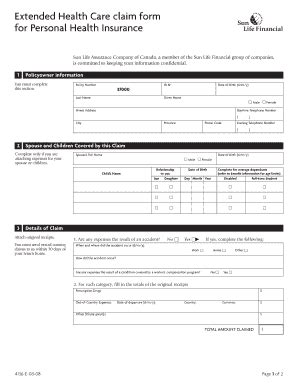

How do retirees enroll in Coors retirement health care coverage?

+

Enrollment typically occurs during specific periods, and retirees must carefully review and select their coverage options during this time. The enrollment process may be online, by phone, or through mail, depending on the company’s procedures.

Related Terms:

- coors retirement health care coverage