5 Core CT Health Insurance Tips

Understanding the Basics of CT Health Insurance

When it comes to health insurance in Connecticut (CT), there are several factors to consider to ensure you have the right coverage for your needs. With numerous plans and providers available, navigating the system can be overwhelming. However, by focusing on a few core tips, you can make informed decisions about your health insurance. Understanding your options and evaluating your needs are crucial steps in selecting the best health insurance plan in CT.

Evaluating Your Health Insurance Needs

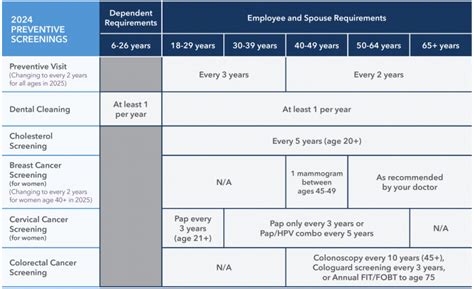

Before choosing a health insurance plan, it’s essential to assess your health care needs. Consider factors such as your age, health status, and the number of people in your household who need coverage. If you have a pre-existing condition or require regular medical care, you may need a plan with more comprehensive coverage. Preventive care services, such as annual check-ups and vaccinations, should also be considered when evaluating plans.

Comparing CT Health Insurance Plans

Comparing health insurance plans in CT involves looking at several key factors, including: * Premium costs: The monthly cost of your health insurance plan. * Deductible: The amount you must pay out-of-pocket before your insurance coverage kicks in. * Copays and coinsurance: The costs associated with doctor visits and medical procedures. * Network of providers: The list of healthcare providers who participate in your insurance plan’s network. * Maximum out-of-pocket expenses: The maximum amount you’ll pay for healthcare expenses in a given year.

Choosing the Right Health Insurance Plan

With so many options available, choosing the right health insurance plan in CT can be challenging. Consider the following tips to help you make an informed decision: * Research different plans and compare their features and costs. * Read reviews and ask for referrals from friends, family, or a licensed insurance agent. * Check the plan’s accreditation and ratings from independent organizations. * Review the plan’s policy documents carefully to understand the terms and conditions.

Managing Your CT Health Insurance Costs

Managing your health insurance costs in CT requires a combination of strategies, including: * Taking advantage of tax credits and subsidies, if eligible. * Utilizing health savings accounts (HSAs) or flexible spending accounts (FSAs) to set aside pre-tax dollars for medical expenses. * Shopping around for plans during open enrollment to find the best rates and coverage. * Practicing preventive care to reduce the need for costly medical interventions.

📝 Note: It's essential to review and update your health insurance plan regularly to ensure it continues to meet your changing needs and budget.

To further illustrate the key factors to consider when evaluating CT health insurance plans, the following table provides a summary:

| Plan Feature | Description |

|---|---|

| Premium Costs | The monthly cost of your health insurance plan. |

| Deductible | The amount you must pay out-of-pocket before your insurance coverage kicks in. |

| Copays and Coinsurance | The costs associated with doctor visits and medical procedures. |

| Network of Providers | The list of healthcare providers who participate in your insurance plan’s network. |

| Maximum Out-of-Pocket Expenses | The maximum amount you’ll pay for healthcare expenses in a given year. |

In summary, finding the right health insurance plan in CT involves understanding your needs, comparing plans, and managing your costs. By following these core tips and staying informed, you can make the best decisions for your health and financial well-being.

What is the difference between a copay and coinsurance?

+

A copay is a fixed amount you pay for a specific medical service, while coinsurance is a percentage of the cost of the service that you pay after meeting your deductible.

Can I change my health insurance plan outside of open enrollment?

+

In most cases, you can only change your health insurance plan during open enrollment, unless you experience a qualifying life event, such as a move or job change.

How do I know if I’m eligible for a tax credit or subsidy?

+

You can check your eligibility for a tax credit or subsidy by visiting the official healthcare website or consulting with a licensed insurance agent.

Related Terms:

- Care compass CT login

- Quantum Health ct

- Ct HEP portal login

- Care compass Quantum Health

- Ct HEP requirements 2024

- Core CT Login