Health

Curative Health Insurance Plans

Introduction to Curative Health Insurance Plans

Curative health insurance plans are designed to provide financial protection against medical expenses arising from various health conditions, injuries, or diseases. These plans are essential for individuals, families, and groups to ensure they receive quality healthcare without incurring significant out-of-pocket costs. In this article, we will delve into the world of curative health insurance plans, exploring their benefits, types, and features.

Benefits of Curative Health Insurance Plans

The benefits of curative health insurance plans are numerous and can be summarized as follows: * Financial Protection: Curative health insurance plans provide financial protection against medical expenses, ensuring that individuals and families do not face financial ruin due to unexpected medical bills. * Access to Quality Healthcare: These plans enable policyholders to access quality healthcare services from a network of participating healthcare providers. * Preventive Care: Many curative health insurance plans cover preventive care services, such as routine check-ups, screenings, and vaccinations, to help policyholders maintain good health and prevent illnesses. * Tax Benefits: In some countries, premiums paid for curative health insurance plans are tax-deductible, providing policyholders with additional savings.

Types of Curative Health Insurance Plans

There are several types of curative health insurance plans available, including: * Individual Plans: Designed for individuals and families, these plans provide coverage for medical expenses arising from various health conditions. * Group Plans: Offered to groups, such as employees of a company, these plans provide coverage for medical expenses and often offer additional benefits, such as dental and vision coverage. * Medicare Supplement Plans: Designed for individuals who are eligible for Medicare, these plans provide additional coverage for medical expenses not covered by Medicare. * Short-Term Plans: Temporary plans that provide coverage for a limited period, often used to bridge the gap between jobs or during times of transition.

Features of Curative Health Insurance Plans

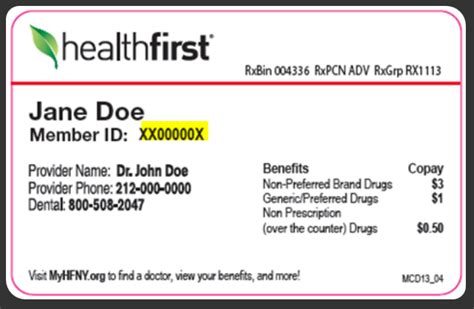

Curative health insurance plans often come with various features, including: * Deductible: The amount policyholders must pay out-of-pocket before the insurance plan begins to cover medical expenses. * Co-pay: A fixed amount policyholders pay for each medical service, such as doctor visits or prescription medications. * Co-insurance: A percentage of medical expenses that policyholders pay after meeting the deductible. * Out-of-Pocket Maximum: The maximum amount policyholders pay for medical expenses during a policy period. * Network: A list of participating healthcare providers who have agreed to provide medical services to policyholders at a discounted rate.

| Plan Type | Deductible | Co-pay | Co-insurance | Out-of-Pocket Maximum |

|---|---|---|---|---|

| Individual Plan | $1,000 | $20 | 20% | $5,000 |

| Group Plan | $500 | $10 | 10% | $3,000 |

| Medicare Supplement Plan | $0 | $0 | 0% | $0 |

📝 Note: The features and benefits of curative health insurance plans may vary depending on the insurance provider and policy type.

Choosing the Right Curative Health Insurance Plan

When selecting a curative health insurance plan, it is essential to consider several factors, including: * Premium Costs: The monthly or annual cost of the plan. * Coverage: The types of medical services and expenses covered by the plan. * Network: The list of participating healthcare providers. * Deductible and Out-of-Pocket Maximum: The amount policyholders must pay out-of-pocket before the plan begins to cover medical expenses. * Pre-existing Conditions: Whether the plan covers pre-existing medical conditions.

Conclusion

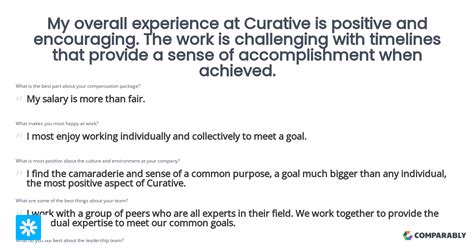

In summary, curative health insurance plans are designed to provide financial protection against medical expenses arising from various health conditions, injuries, or diseases. With various types of plans available, including individual, group, Medicare supplement, and short-term plans, individuals and families can choose the plan that best suits their needs. By considering factors such as premium costs, coverage, network, deductible, and out-of-pockets maximum, policyholders can ensure they receive quality healthcare without incurring significant out-of-pocket costs.

What is the purpose of curative health insurance plans?

+

The purpose of curative health insurance plans is to provide financial protection against medical expenses arising from various health conditions, injuries, or diseases.

What are the benefits of curative health insurance plans?

+

The benefits of curative health insurance plans include financial protection, access to quality healthcare, preventive care, and tax benefits.

How do I choose the right curative health insurance plan?

+

When choosing a curative health insurance plan, consider factors such as premium costs, coverage, network, deductible, and out-of-pocket maximum.

Related Terms:

- Curative health insurance cost

- Curative health insurance reviews

- Rehabilitative

- Curative health insurance claims Address

- Curative first health insurance

- Curative Customer Service