David Lavine Cost Basis Home Health Guide

Introduction to David Lavine Cost Basis Home Health Guide

The David Lavine Cost Basis Home Health Guide is a comprehensive resource designed to help individuals navigate the complexities of home health care, with a particular focus on understanding the cost basis of these services. As the healthcare landscape continues to evolve, it’s essential for patients and their families to be well-informed about the financial aspects of home health care. This guide aims to provide clarity on the cost basis, helping individuals make informed decisions about their care.

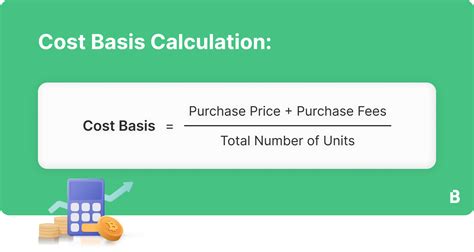

Understanding Cost Basis in Home Health Care

The cost basis in home health care refers to the original cost or value of the assets used to provide care. This concept is crucial in determining the tax implications and financial planning for individuals receiving home health care services. The cost basis includes not only the direct costs of care, such as medical equipment, therapies, and medications, but also indirect costs like travel expenses for medical appointments and home modifications necessary for care.

Factors Influencing Cost Basis

Several factors can influence the cost basis of home health care, including: - Location: Costs can vary significantly depending on the location, with urban areas typically being more expensive than rural ones. - Type of Care: The nature of the care required, such as skilled nursing, physical therapy, or occupational therapy, impacts the cost. - Degree of Care: The level of care needed, whether it’s full-time, part-time, or sporadic, affects the overall cost. - Equipment and Supplies: The need for specialized medical equipment and supplies can add to the cost basis.

Calculating Cost Basis

Calculating the cost basis involves considering all expenses related to home health care. This includes: - Direct medical costs - Indirect costs such as home modifications - Travel expenses for medical care - Costs of medical equipment and supplies

To accurately calculate the cost basis, it’s essential to keep detailed records of all expenses. This not only helps in financial planning but also in tax deductions and reimbursements from insurance providers.

Table of Estimated Costs

| Category | Estimated Monthly Cost |

|---|---|

| Skilled Nursing | 1,500 - 3,000 |

| Physical Therapy | 500 - 1,000 |

| Medical Equipment | 200 - 500 |

| Home Modifications | 1,000 - 5,000 |

Financial Planning and Tax Implications

Understanding the cost basis is crucial for financial planning and navigating tax implications. Individuals may be eligible for tax deductions on medical expenses, including home health care costs, which can significantly impact their financial situation. It’s advisable to consult with a financial advisor or tax professional to ensure all eligible expenses are accounted for and to plan for future care costs effectively.

💡 Note: Keeping accurate and detailed records of all expenses related to home health care is essential for tax purposes and financial planning.

Conclusion and Future Planning

In conclusion, the David Lavine Cost Basis Home Health Guide serves as a vital resource for individuals seeking to understand the financial aspects of home health care. By grasping the concept of cost basis and its influencing factors, individuals can better plan for their care, both financially and logistically. It’s essential to stay informed and adapt to changes in the healthcare system to ensure the best possible care while managing costs effectively.

What is the cost basis in home health care?

+

The cost basis refers to the original cost or value of the assets used to provide home health care, including direct and indirect costs.

How do I calculate the cost basis for home health care?

+

To calculate the cost basis, consider all expenses related to home health care, including direct medical costs, indirect costs like home modifications, and travel expenses for medical care.

Are home health care costs tax-deductible?

+

Yes, many home health care costs are eligible for tax deductions. It’s recommended to consult with a tax professional to ensure all eligible expenses are accounted for.