5 Ways Financial Manager

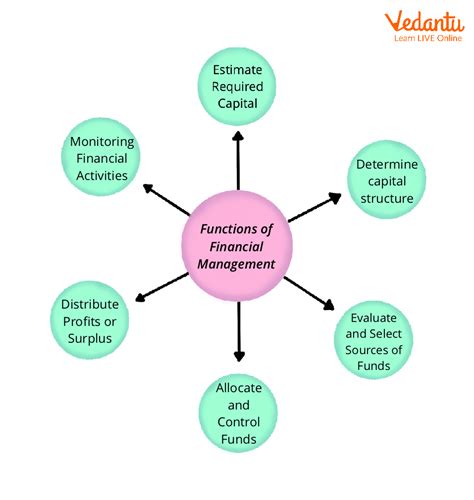

Introduction to Financial Management

Financial management is a crucial aspect of any organization, as it involves the planning, direction, and control of financial resources to achieve the company’s objectives. A financial manager plays a key role in this process, as they are responsible for making financial decisions that impact the company’s growth and profitability. In this article, we will discuss the 5 ways a financial manager can contribute to the success of an organization.

Strategic Planning

A financial manager is involved in the strategic planning process, which involves identifying the company’s goals and objectives and developing a plan to achieve them. This includes analyzing market trends, assessing the company’s financial position, and identifying opportunities for growth. The financial manager must also consider the company’s risk tolerance and develop strategies to mitigate potential risks.

Some of the key responsibilities of a financial manager in strategic planning include: * Developing financial models to forecast revenue and expenses * Conducting market research to identify new business opportunities * Analyzing the company’s financial performance and identifying areas for improvement * Developing and implementing financial strategies to achieve the company’s objectives

Financial Statement Analysis

A financial manager is responsible for analyzing the company’s financial statements, including the balance sheet, income statement, and cash flow statement. This involves identifying trends and analyzing ratios to assess the company’s financial performance. The financial manager must also identify areas for improvement and develop strategies to address any financial weaknesses.

Some of the key ratios that a financial manager may use to analyze the company’s financial performance include: * Current ratio: current assets / current liabilities * Debt-to-equity ratio: total debt / total equity * Return on equity (ROE): net income / total equity * Return on assets (ROA): net income / total assets

Investment Decisions

A financial manager is responsible for making investment decisions, including capital budgeting and portfolio management. This involves evaluating investment opportunities and selecting the best options based on the company’s objectives and risk tolerance. The financial manager must also monitor and adjust the company’s investment portfolio to ensure that it remains aligned with the company’s objectives.

Some of the key factors that a financial manager may consider when making investment decisions include: * Expected return: the potential return on investment * Risk: the potential risk of loss * Liquidity: the ability to convert the investment to cash * Diversification: the potential to reduce risk by spreading investments across different asset classes

Risk Management

A financial manager is responsible for identifying and managing financial risks, including market risk, credit risk, and operational risk. This involves developing risk management strategies and implementing controls to mitigate potential risks. The financial manager must also monitor and adjust the company’s risk management strategies to ensure that they remain effective.

Some of the key risk management strategies that a financial manager may use include: * Diversification: spreading investments across different asset classes to reduce risk * Hedging: using financial instruments to reduce potential losses * Insurance: transferring risk to a third party * Contingency planning: developing plans to respond to potential risks

Financial Reporting

A financial manager is responsible for preparing financial reports, including financial statements and management reports. This involves analyzing financial data and presenting the results in a clear and concise manner. The financial manager must also ensure that the financial reports are accurate and comply with relevant regulations.

Some of the key financial reports that a financial manager may prepare include: * Balance sheet: a statement of the company’s financial position at a particular point in time * Income statement: a statement of the company’s revenues and expenses over a particular period * Cash flow statement: a statement of the company’s inflows and outflows of cash over a particular period * Management report: a report that provides an overview of the company’s financial performance and highlights any areas for improvement

💡 Note: Financial management is a critical aspect of any organization, and a financial manager plays a key role in ensuring the company's financial success.

In summary, a financial manager contributes to the success of an organization by providing strategic planning, financial statement analysis, investment decisions, risk management, and financial reporting. These functions are critical to the company’s financial health and growth, and a financial manager must have a deep understanding of financial concepts and principles to perform these functions effectively.

What is the role of a financial manager in an organization?

+

A financial manager is responsible for making financial decisions that impact the company’s growth and profitability. This includes strategic planning, financial statement analysis, investment decisions, risk management, and financial reporting.

What are the key financial statements that a financial manager must prepare?

+

The key financial statements that a financial manager must prepare include the balance sheet, income statement, and cash flow statement. These statements provide an overview of the company’s financial position and performance.

What is the importance of risk management in financial management?

+

Risk management is critical in financial management as it helps to identify and mitigate potential risks that could impact the company’s financial performance. This includes market risk, credit risk, and operational risk.

Related Terms:

- finance manager qualifications and skills

- best degree for financial manager

- finance manager degree requirements

- degree needed for financial manager

- certified financial manager requirements