Delaware First Health Insurance Options

Introduction to Delaware First Health Insurance Options

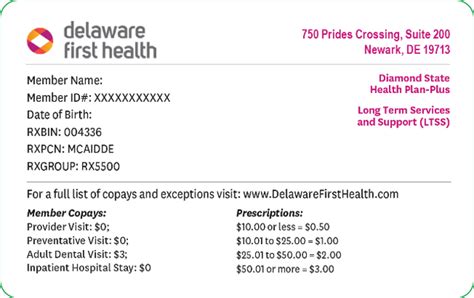

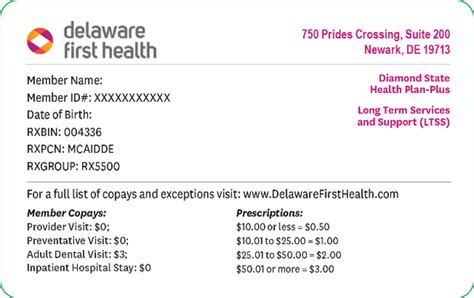

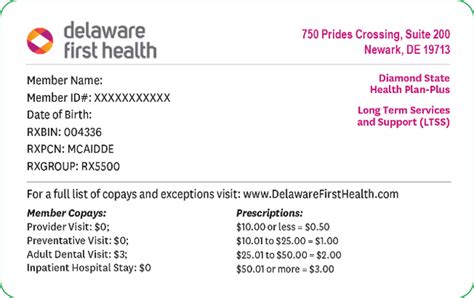

Delaware First Health Insurance provides a range of options for individuals and families seeking comprehensive healthcare coverage. With various plans to choose from, it’s essential to understand the different types of insurance, their benefits, and how to select the best option for your specific needs. In this article, we’ll delve into the world of Delaware First Health Insurance, exploring the available options, their features, and the factors to consider when making a decision.

Understanding Delaware First Health Insurance Plans

Delaware First Health Insurance offers several plans, each with its unique set of benefits and drawbacks. The primary plans include: * Individual and Family Plans: These plans are designed for individuals and families who are not covered by their employer or other group health plans. * Group Health Plans: These plans are designed for employers who want to provide health insurance to their employees. * Medicare Plans: These plans are designed for individuals who are eligible for Medicare, including those with disabilities and those aged 65 and older. * Medicaid Plans: These plans are designed for low-income individuals and families who meet specific eligibility requirements.

Key Features of Delaware First Health Insurance Plans

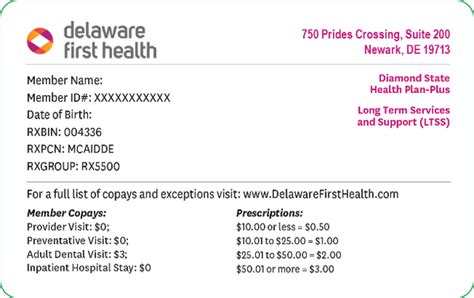

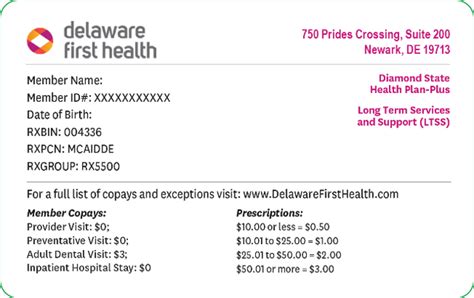

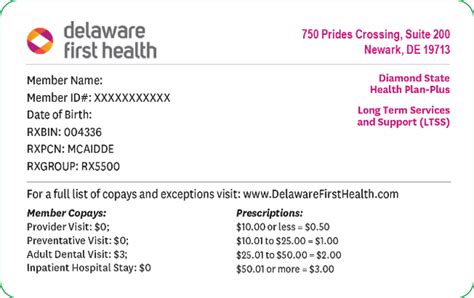

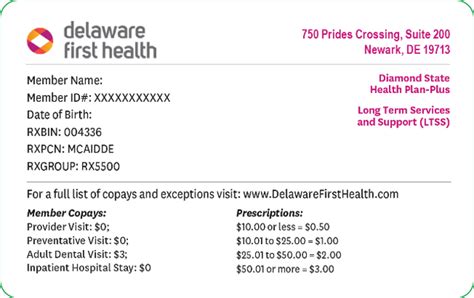

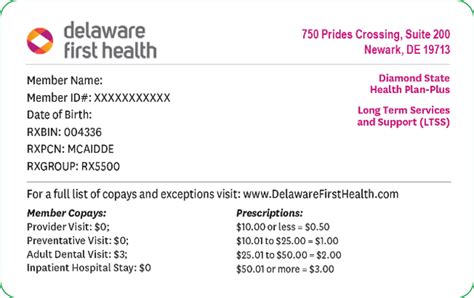

When selecting a Delaware First Health Insurance plan, it’s crucial to consider the following key features: * Network Providers: Delaware First Health Insurance has a network of participating providers, including primary care physicians, specialists, and hospitals. It’s essential to ensure that your preferred healthcare providers are part of the network. * Prescription Drug Coverage: Many plans offer prescription drug coverage, including generic and brand-name medications. However, the specific medications covered and the associated copays or coinsurance may vary. * Preventive Care Services: Delaware First Health Insurance plans often cover preventive care services, such as routine check-ups, screenings, and vaccinations, without requiring a copay or coinsurance. * Out-of-Pocket Costs: Out-of-pocket costs, including deductibles, copays, and coinsurance, can significantly impact the overall cost of your healthcare. It’s essential to understand these costs and how they apply to your plan.

Factors to Consider When Selecting a Delaware First Health Insurance Plan

When choosing a Delaware First Health Insurance plan, consider the following factors: * Monthly Premium: The monthly premium is the amount you pay each month for your health insurance coverage. * Out-of-Pocket Maximum: The out-of-pocket maximum is the maximum amount you’ll pay for healthcare expenses, excluding premiums, in a given year. * Deductible: The deductible is the amount you must pay before your insurance coverage kicks in. * Network Providers: Ensure that your preferred healthcare providers are part of the plan’s network. * Prescription Drug Coverage: If you take prescription medications, consider the plan’s prescription drug coverage and associated costs.

| Plan Type | Monthly Premium | Out-of-Pocket Maximum | Deductible |

|---|---|---|---|

| Individual and Family Plan | $300-$500 | $6,000-$8,000 | $1,000-$2,000 |

| Group Health Plan | $200-$400 | $4,000-$6,000 | $500-$1,000 |

| Medicare Plan | $100-$300 | $2,000-$4,000 | $0-$500 |

| Medicaid Plan | $0-$100 | $0-$2,000 | $0-$100 |

📝 Note: The plan details and costs listed in the table are examples and may not reflect the actual costs and benefits of Delaware First Health Insurance plans.

Enrolling in a Delaware First Health Insurance Plan

To enroll in a Delaware First Health Insurance plan, follow these steps: * Research and Compare Plans: Research the different plans offered by Delaware First Health Insurance and compare their features, benefits, and costs. * Check Eligibility: Check your eligibility for the plan you’re interested in, including any requirements or restrictions. * Apply for Coverage: Submit an application for the plan you’ve selected, providing all required documentation and information. * Review and Understand Your Plan: Carefully review your plan’s benefits, costs, and features to ensure you understand your coverage.

Delaware First Health Insurance provides a range of options for individuals and families seeking comprehensive healthcare coverage. By understanding the different plans, their features, and the factors to consider when selecting a plan, you can make an informed decision and choose the best option for your specific needs. Remember to carefully review your plan’s benefits, costs, and features to ensure you understand your coverage and can make the most of your healthcare benefits.

What is the difference between a deductible and out-of-pocket maximum?

+

The deductible is the amount you must pay before your insurance coverage kicks in, while the out-of-pocket maximum is the maximum amount you’ll pay for healthcare expenses, excluding premiums, in a given year.

Can I change my Delaware First Health Insurance plan after enrollment?

+

You may be able to change your plan during the annual open enrollment period or if you experience a qualifying life event, such as a change in income or family status.

How do I find a network provider with Delaware First Health Insurance?

+

You can find a network provider by visiting the Delaware First Health Insurance website, using their provider directory tool, or contacting their customer service department for assistance.

Related Terms:

- Delaware First Health Provider Portal

- Delaware First Health login

- Delaware First Health address

- Delaware First Health phone number

- Delaware First Health Claims address

- Delaware First Health reviews