5 Disney Health Insurance Tips

Introduction to Disney Health Insurance

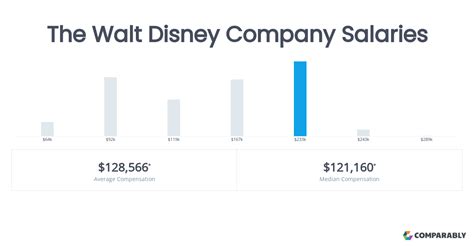

Disney health insurance is a vital aspect of employee benefits for those working at The Walt Disney Company. As one of the largest and most renowned entertainment companies in the world, Disney offers a comprehensive health insurance plan to its employees, ensuring they receive the best possible care. With a wide range of coverage options and benefits, Disney health insurance is designed to provide employees with peace of mind and financial security. In this article, we will explore five essential tips to help Disney employees make the most of their health insurance plan.

Understanding Your Coverage Options

When it comes to Disney health insurance, it’s essential to understand the different coverage options available. Disney offers a range of plans, including medical, dental, vision, and life insurance. Each plan has its unique benefits and coverage limits, so it’s crucial to review and compare the options to choose the best plan for your needs. Consider factors such as premium costs, deductibles, copays, and coinsurance to ensure you select a plan that fits your budget and provides adequate coverage.

Tips for Maximizing Your Benefits

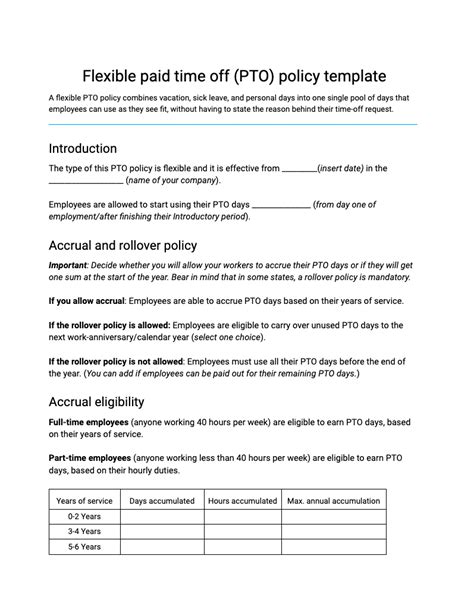

To get the most out of your Disney health insurance, follow these five tips: * Take advantage of preventive care services: Disney health insurance covers a range of preventive care services, including routine check-ups, screenings, and vaccinations. These services can help you stay healthy and detect potential health issues early. * Use in-network providers: Using in-network providers can help reduce your out-of-pocket costs and ensure you receive the best possible care. Disney has a network of participating providers, so be sure to check the list before seeking medical attention. * Keep track of your expenses: Keeping track of your medical expenses can help you stay on top of your costs and ensure you’re getting the most out of your insurance plan. Consider using a health savings account (HSA) or flexible spending account (FSA) to set aside pre-tax dollars for medical expenses. * Don’t forget about wellness programs: Disney offers a range of wellness programs, including fitness classes, health coaching, and disease management programs. These programs can help you stay healthy, reduce your risk of chronic disease, and improve your overall well-being. * Review and update your coverage regularly: Your health insurance needs may change over time, so it’s essential to review and update your coverage regularly. Consider factors such as changes in your family size, income, or health status to ensure you have the right level of coverage.

Additional Resources and Support

Disney provides a range of resources and support to help employees navigate their health insurance plan. These include: * Online portals: Disney offers online portals where employees can access their insurance information, view claims, and manage their benefits. * Customer service: Disney has a dedicated customer service team available to answer questions and provide support. * Health education programs: Disney offers health education programs and workshops to help employees make informed decisions about their health and wellness.

| Plan | Premium Cost | Deductible | Copay |

|---|---|---|---|

| Medical Plan A | $500/month | $1,000/year | $20/visit |

| Medical Plan B | $700/month | $500/year | $30/visit |

| Dental Plan | $50/month | $100/year | $10/visit |

💡 Note: The above table is a sample and actual costs may vary depending on the plan and location.

In summary, Disney health insurance is a valuable benefit that provides employees with comprehensive coverage and financial security. By understanding your coverage options, taking advantage of preventive care services, using in-network providers, keeping track of your expenses, and reviewing your coverage regularly, you can maximize your benefits and get the most out of your Disney health insurance plan. Additionally, don’t forget to take advantage of wellness programs and utilize the resources and support available to help you navigate your plan.

What is the difference between an HSA and FSA?

+

An HSA (Health Savings Account) is a savings account that allows you to set aside pre-tax dollars for medical expenses, while an FSA (Flexible Spending Account) is a type of savings account that allows you to set aside pre-tax dollars for medical expenses, but must be used within a certain timeframe.

Can I change my insurance plan during the year?

+

No, you can only change your insurance plan during the annual open enrollment period, unless you experience a qualifying life event, such as getting married or having a child.

How do I find an in-network provider?

+

You can find an in-network provider by visiting the Disney health insurance website and using the provider search tool, or by contacting customer service for assistance.

Related Terms:

- Walt Disney World employees

- Disney employee free tickets

- Disney health insurance 2024

- Disney employee park benefits

- Disney employee benefits 2024

- Working for Disney