USAA Health Insurance Options

Introduction to USAA Health Insurance Options

The United Services Automobile Association (USAA) is a well-established financial services company that offers a wide range of insurance products, including health insurance, to its members. USAA health insurance options are designed to provide affordable and comprehensive coverage to active and retired military personnel, as well as their families. In this article, we will delve into the details of USAA health insurance options, including the types of plans available, benefits, and eligibility requirements.

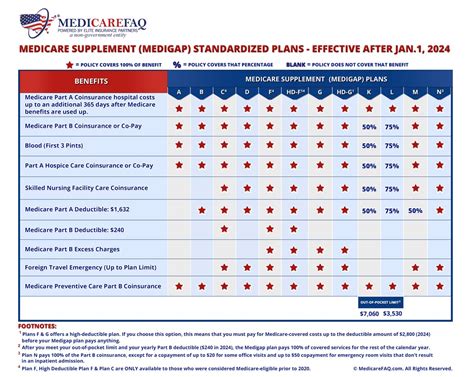

Types of USAA Health Insurance Plans

USAA offers several types of health insurance plans to cater to the diverse needs of its members. These plans include: * TRICARE Supplement Insurance: This plan is designed for active-duty military personnel and their families, as well as retired military personnel who are eligible for TRICARE. * Medicare Supplement Insurance: This plan is designed for retired military personnel who are eligible for Medicare. * Short-Term Medical Insurance: This plan provides temporary health insurance coverage for individuals who are between jobs, waiting for other coverage to start, or need temporary coverage. * Dental and Vision Insurance: These plans provide coverage for dental and vision care, including routine check-ups, fillings, and vision exams.

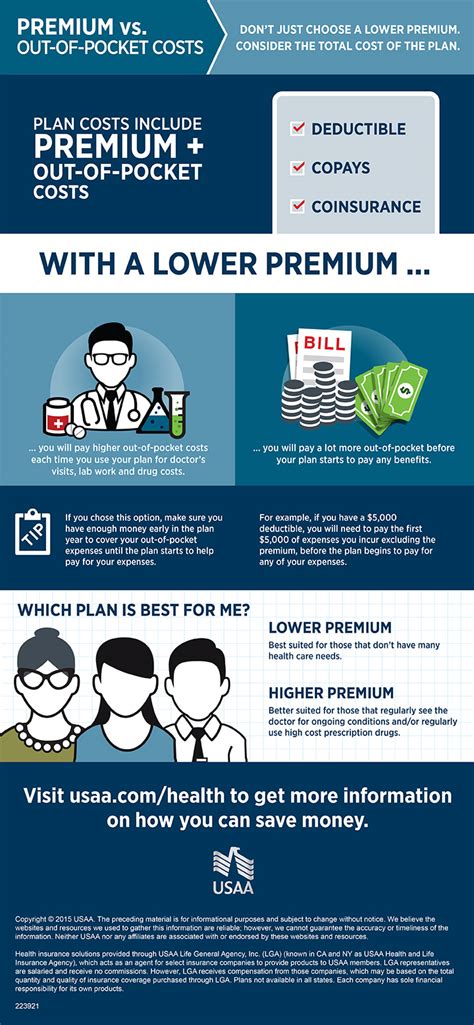

Benefits of USAA Health Insurance Plans

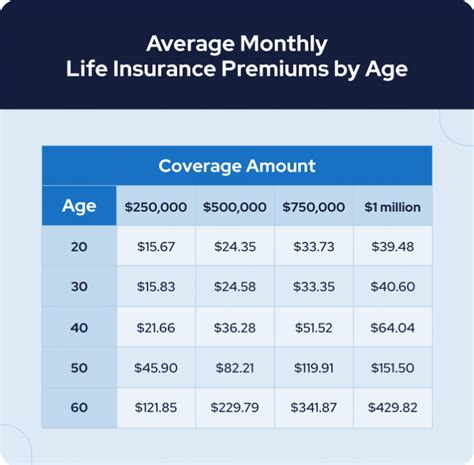

USAA health insurance plans offer several benefits, including: * Comprehensive coverage: USAA health insurance plans provide comprehensive coverage for medical expenses, including doctor visits, hospital stays, and prescription medications. * Affordable premiums: USAA health insurance plans offer competitive premiums, making them an affordable option for military personnel and their families. * Network of providers: USAA has a large network of providers, including doctors, hospitals, and specialists, making it easy to find a provider in your area. * 24⁄7 customer service: USAA offers 24⁄7 customer service, making it easy to get help when you need it.

Eligibility Requirements for USAA Health Insurance Plans

To be eligible for USAA health insurance plans, you must meet certain requirements, including: * Active-duty military personnel: You must be an active-duty military personnel to be eligible for USAA health insurance plans. * Retired military personnel: You must be a retired military personnel to be eligible for USAA health insurance plans. * Family members: Family members of active-duty and retired military personnel may also be eligible for USAA health insurance plans. * TRICARE eligibility: You must be eligible for TRICARE to be eligible for USAA TRICARE Supplement Insurance.

How to Apply for USAA Health Insurance Plans

To apply for USAA health insurance plans, you can follow these steps: * Visit the USAA website: Visit the USAA website to learn more about their health insurance plans and to apply online. * Call USAA customer service: You can also call USAA customer service to apply over the phone. * Visit a USAA office: You can also visit a USAA office in person to apply for health insurance.

📝 Note: It's essential to carefully review the eligibility requirements and benefits of each plan before applying to ensure you choose the best plan for your needs.

Comparison of USAA Health Insurance Plans

The following table compares the different USAA health insurance plans:

| Plan | Eligibility | Coverage | Premiums |

|---|---|---|---|

| TRICARE Supplement Insurance | Active-duty military personnel and their families, retired military personnel | Comprehensive coverage for medical expenses | Competitive premiums |

| Medicare Supplement Insurance | Retired military personnel eligible for Medicare | Comprehensive coverage for medical expenses | Competitive premiums |

| Short-Term Medical Insurance | Individuals between jobs, waiting for other coverage to start, or need temporary coverage | Temporary health insurance coverage | Affordable premiums |

| Dental and Vision Insurance | Active-duty and retired military personnel and their families | Coverage for dental and vision care | Affordable premiums |

As we summarize the key points, it’s essential to note that USAA health insurance options provide affordable and comprehensive coverage to military personnel and their families. The plans offer various benefits, including comprehensive coverage, affordable premiums, and a network of providers. To choose the best plan, it’s crucial to carefully review the eligibility requirements and benefits of each plan. By doing so, you can ensure you select the plan that best meets your needs and provides the necessary coverage for you and your family.

What is the eligibility criteria for USAA health insurance plans?

+

To be eligible for USAA health insurance plans, you must be an active-duty military personnel, retired military personnel, or a family member of an active-duty or retired military personnel.

What types of health insurance plans does USAA offer?

+

USAA offers several types of health insurance plans, including TRICARE Supplement Insurance, Medicare Supplement Insurance, Short-Term Medical Insurance, and Dental and Vision Insurance.

How do I apply for USAA health insurance plans?

+

You can apply for USAA health insurance plans by visiting the USAA website, calling USAA customer service, or visiting a USAA office in person.

Related Terms:

- USAA health insurance monthly cost

- USAA health insurance reviews

- USAA insurance

- USAA health insurance provider portal

- USAA health insurance cost Reddit

- USAA dental insurance