EMI Health Insurance Benefits

Understanding EMI Health Insurance Benefits

Health insurance is a vital aspect of financial planning, providing individuals and families with protection against unexpected medical expenses. One popular method of paying for health insurance is through Equated Monthly Installments (EMI). EMI health insurance benefits offer a convenient and affordable way to manage healthcare costs. In this article, we will delve into the world of EMI health insurance, exploring its benefits, features, and advantages.

What is EMI Health Insurance?

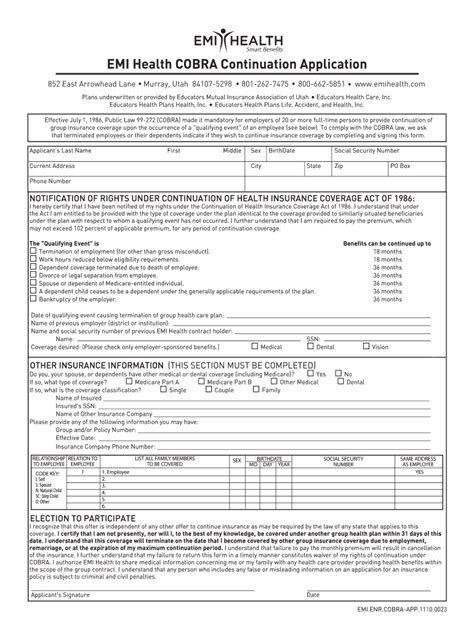

EMI health insurance refers to the process of paying health insurance premiums in monthly installments, rather than as a lump sum. This approach allows policyholders to budget for their healthcare expenses more effectively, reducing the financial burden of premium payments. EMI health insurance plans are designed to provide comprehensive coverage for various medical expenses, including hospitalization, surgery, and outpatient treatments.

Benefits of EMI Health Insurance

The benefits of EMI health insurance are numerous and significant. Some of the key advantages include:

- Affordability: EMI health insurance makes it easier to afford health insurance premiums, as the cost is spread over several months.

- Convenience: Policyholders can manage their finances more effectively, as the monthly installments are predictable and manageable.

- Comprehensive coverage: EMI health insurance plans often provide comprehensive coverage for various medical expenses, including hospitalization, surgery, and outpatient treatments.

- Tax benefits: Policyholders may be eligible for tax benefits under Section 80D of the Income Tax Act, which can help reduce their tax liability.

- Financial protection: EMI health insurance provides financial protection against unexpected medical expenses, ensuring that policyholders do not have to dip into their savings or take on debt.

Features of EMI Health Insurance Plans

EMI health insurance plans typically offer a range of features, including:

- Coverage for pre-existing conditions: Many EMI health insurance plans provide coverage for pre-existing conditions, subject to certain terms and conditions.

- No-claim bonus: Policyholders may be eligible for a no-claim bonus, which can increase the sum insured or reduce the premium payable.

- Free health check-ups: Some EMI health insurance plans offer free health check-ups, which can help policyholders monitor their health and detect potential health issues early.

- Alternative treatment coverage: Some plans may provide coverage for alternative treatments, such as Ayurveda, Unani, and homeopathy.

- Global coverage: Some EMI health insurance plans offer global coverage, which can provide policyholders with access to quality medical care while traveling abroad.

How to Choose the Right EMI Health Insurance Plan

Choosing the right EMI health insurance plan can be a daunting task, with so many options available in the market. Here are some tips to help you make an informed decision:

- Assess your needs: Consider your age, health, and financial situation to determine the level of coverage you require.

- Compare plans: Compare different EMI health insurance plans to find the one that best meets your needs and budget.

- Check the policy terms: Carefully review the policy terms, including the coverage, exclusions, and waiting period.

- Look for add-ons: Consider add-ons, such as critical illness coverage or personal accident coverage, to enhance your policy.

- Check the insurer’s reputation: Research the insurer’s reputation, including their claim settlement ratio and customer service.

Common Mistakes to Avoid When Buying EMI Health Insurance

When buying EMI health insurance, there are several common mistakes to avoid, including:

- Not disclosing pre-existing conditions: Failing to disclose pre-existing conditions can lead to claim rejection or policy cancellation.

- Not reading the policy terms: Not reading the policy terms can lead to misunderstandings and unexpected surprises.

- Not comparing plans: Not comparing plans can lead to buying a policy that does not meet your needs or budget.

- Not checking the insurer’s reputation: Not checking the insurer’s reputation can lead to poor customer service or claim settlement issues.

- Not reviewing the policy regularly: Not reviewing the policy regularly can lead to outdated coverage or inadequate protection.

📝 Note: It is essential to carefully review the policy terms and conditions before buying an EMI health insurance plan to avoid any unexpected surprises.

Conclusion and Final Thoughts

In conclusion, EMI health insurance benefits offer a convenient and affordable way to manage healthcare costs. By understanding the benefits, features, and advantages of EMI health insurance, individuals and families can make informed decisions about their healthcare needs. Remember to assess your needs, compare plans, and carefully review the policy terms to find the right EMI health insurance plan for you.

What is EMI health insurance?

+

EMI health insurance refers to the process of paying health insurance premiums in monthly installments, rather than as a lump sum.

What are the benefits of EMI health insurance?

+

The benefits of EMI health insurance include affordability, convenience, comprehensive coverage, tax benefits, and financial protection.

How do I choose the right EMI health insurance plan?

+

To choose the right EMI health insurance plan, assess your needs, compare plans, check the policy terms, look for add-ons, and check the insurer’s reputation.

Related Terms:

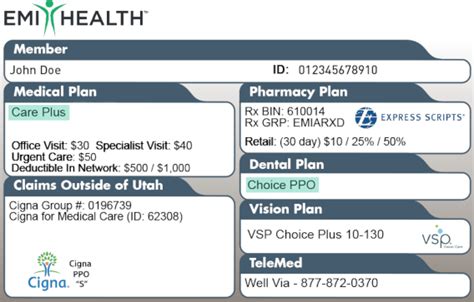

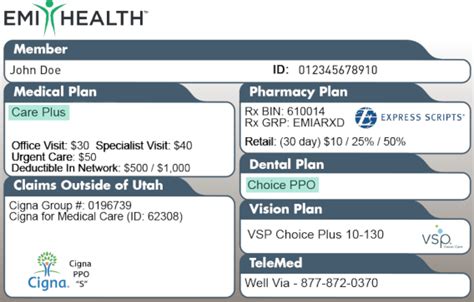

- EMI Health provider portal

- EMI Health provider phone number

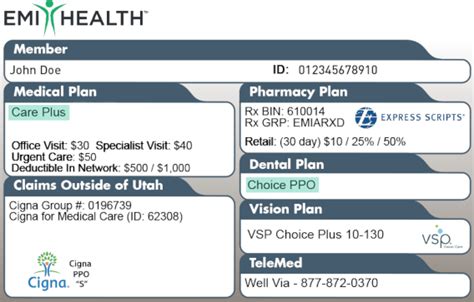

- EMI Health Cigna

- where is emi health accepted

- emi health provider portal

- emi health provider search