Health

5 Ways Enrich Health Insurance

Introduction to Health Insurance

In today’s fast-paced world, having a comprehensive health insurance plan is crucial for individuals and families alike. Health insurance provides financial protection against medical expenses, ensuring that you receive the best possible care without breaking the bank. With the ever-increasing costs of healthcare, it’s essential to have a robust health insurance plan that covers various aspects of medical care. This article will delve into the world of health insurance, exploring five ways to enrich your health insurance plan and make it more effective and beneficial.

Understanding Health Insurance

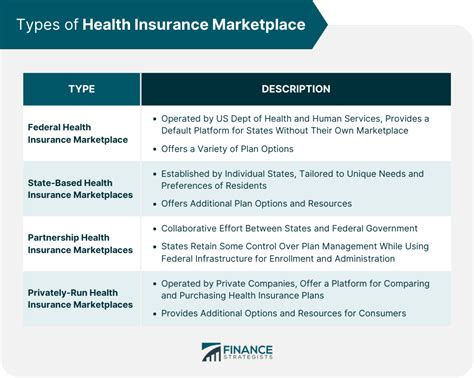

Before we dive into the ways to enrich your health insurance plan, it’s essential to understand the basics of health insurance. Health insurance is a type of insurance that covers the cost of medical and surgical expenses incurred by the insured. It provides financial protection against unexpected medical bills, ensuring that you receive the necessary care without worrying about the costs. There are various types of health insurance plans available, including individual plans, family plans, group plans, and medicare plans. Each plan has its unique features, benefits, and limitations, making it crucial to choose the right plan that suits your needs.

5 Ways to Enrich Health Insurance

Now that we’ve understood the basics of health insurance, let’s explore five ways to enrich your health insurance plan: * Add Critical Illness Rider: A critical illness rider provides additional coverage for critical illnesses such as cancer, heart attack, and stroke. This rider can be added to your existing health insurance plan, providing lump-sum payment in case of diagnosis of a critical illness. * Increase Sum Insured: Increasing the sum insured can provide enhanced coverage and financial protection against medical expenses. It’s essential to review your sum insured regularly and increase it as per your requirements. * Add Top-Up Plan: A top-up plan provides additional coverage over and above your existing health insurance plan. It’s an affordable way to increase your coverage without having to purchase a new plan. * Opt for Super Top-Up Plan: A super top-up plan provides coverage for multiple hospitalizations, unlike a top-up plan that provides coverage for a single hospitalization. It’s an ideal option for individuals who require frequent hospitalizations. * Choose a Plan with Restore Benefit: A restore benefit replenishes the sum insured if it’s exhausted during the policy period. It’s an essential feature that ensures you have adequate coverage throughout the policy period.

Benefits of Enriching Health Insurance

Enriching your health insurance plan can provide numerous benefits, including: * Enhanced Financial Protection: Enriching your health insurance plan can provide additional financial protection against medical expenses, ensuring that you receive the best possible care without breaking the bank. * Increased Coverage: Enriching your health insurance plan can provide increased coverage for various medical expenses, including hospitalization, surgery, and critical illnesses. * Reduced Out-of-Pocket Expenses: Enriching your health insurance plan can reduce out-of-pocket expenses, ensuring that you don’t have to pay for medical expenses from your pocket. * Improved Healthcare: Enriching your health insurance plan can provide access to better healthcare, ensuring that you receive the best possible treatment and care.

Conclusion

In conclusion, enriching your health insurance plan is essential to ensure that you have adequate coverage against medical expenses. By adding a critical illness rider, increasing the sum insured, adding a top-up plan, opting for a super top-up plan, and choosing a plan with restore benefit, you can enhance your health insurance plan and make it more effective and beneficial. Remember to review your health insurance plan regularly and make necessary changes to ensure that you have adequate coverage against medical expenses.

What is health insurance?

+

Health insurance is a type of insurance that covers the cost of medical and surgical expenses incurred by the insured.

What are the benefits of enriching health insurance?

+

Enriching health insurance provides enhanced financial protection, increased coverage, reduced out-of-pocket expenses, and improved healthcare.

How can I enrich my health insurance plan?

+

You can enrich your health insurance plan by adding a critical illness rider, increasing the sum insured, adding a top-up plan, opting for a super top-up plan, and choosing a plan with restore benefit.

Related Terms:

- Security Health Plan

- Security Health Plan Marketplace

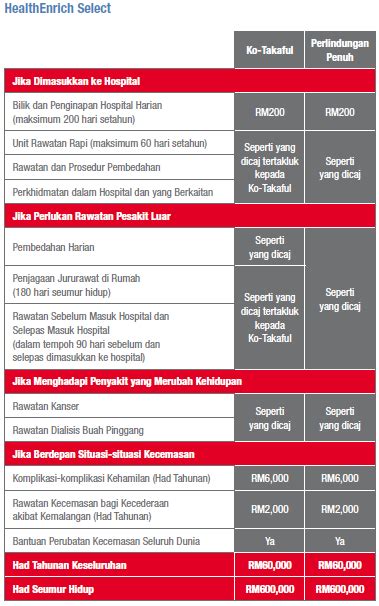

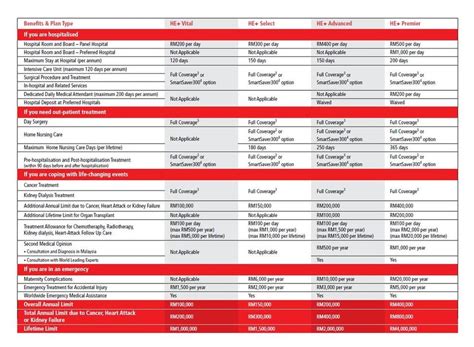

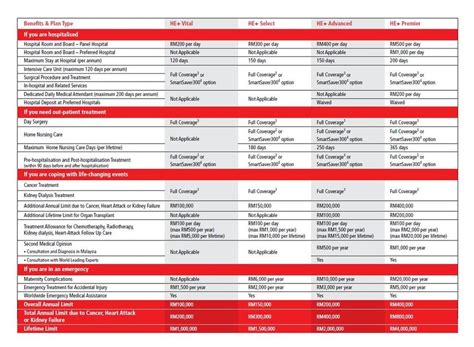

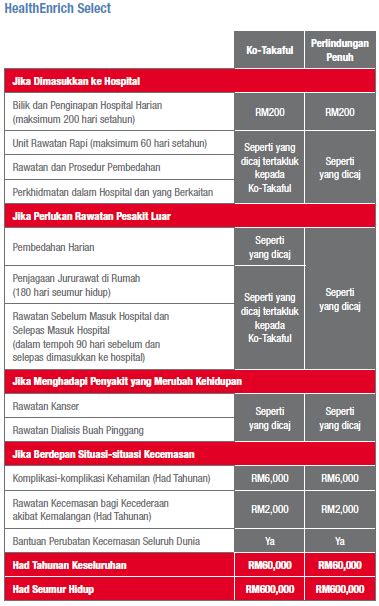

- Health enrich select full coverage

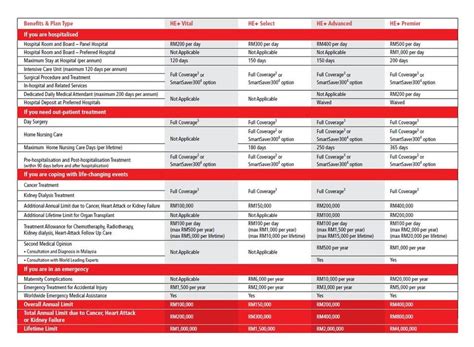

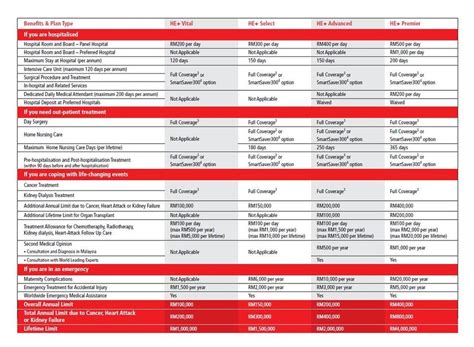

- Health enrich plus vital prubsn

- Health enrich advance

- prudential health enrich vital