5 Army Finance Tips

Introduction to Army Finance

Managing finances is a crucial aspect of life, and it becomes even more critical when serving in the army. Army personnel face unique financial challenges due to their irregular income, frequent deployments, and the need to support their families. In this article, we will discuss five essential army finance tips to help military personnel make the most of their money and achieve financial stability.

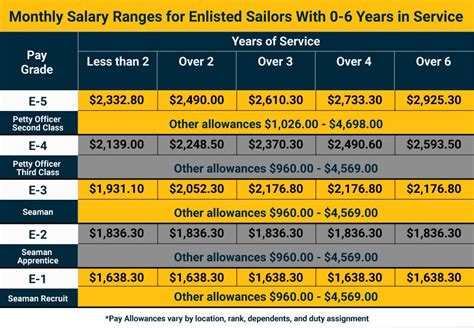

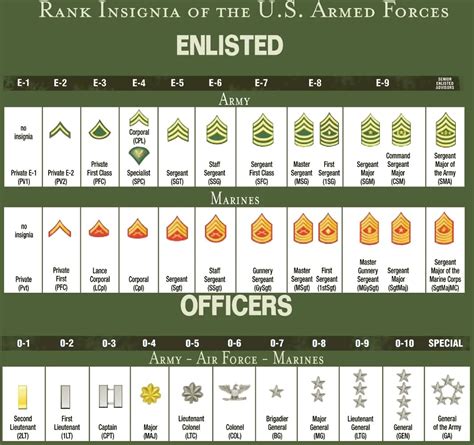

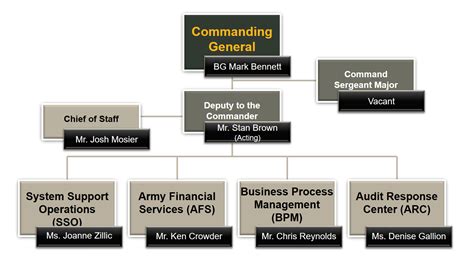

Understanding Army Pay and Benefits

Before we dive into the finance tips, it’s essential to understand the army pay and benefits structure. Army personnel receive a basic pay, which varies based on their rank and time in service. In addition to basic pay, they also receive allowances for housing, food, and other expenses. Understanding these benefits is crucial to making informed financial decisions. The army also offers various benefits, such as access to on-base facilities, healthcare, and education assistance.

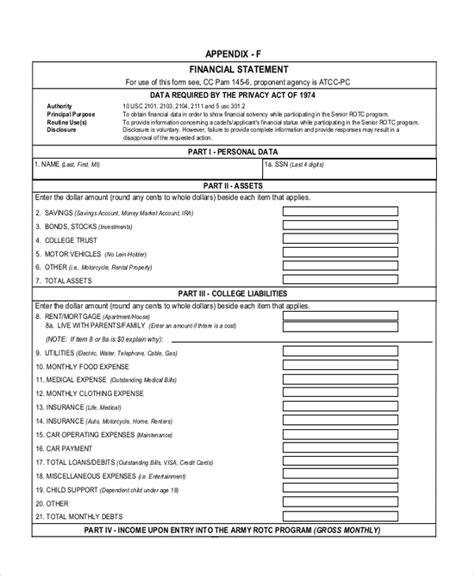

Tip 1: Create a Budget

Creating a budget is the first step towards managing finances effectively. A budget helps track income and expenses, making it easier to identify areas where costs can be cut. Army personnel should consider their irregular income and variable expenses when creating a budget. They should also prioritize essential expenses, such as housing, food, and transportation, over discretionary expenses like entertainment and hobbies.

Tip 2: Build an Emergency Fund

Building an emergency fund is vital for army personnel, as they may face unexpected expenses due to deployments or other military-related activities. An emergency fund provides a financial safety net in case of unexpected events, such as medical emergencies or car repairs. Aim to save 3-6 months’ worth of expenses in an easily accessible savings account.

Tip 3: Take Advantage of Army Benefits

The army offers various benefits that can help personnel save money and achieve financial stability. For example, the Thrift Savings Plan (TSP) is a retirement savings plan that offers tax benefits and low fees. Army personnel can also take advantage of on-base facilities, such as grocery stores and gas stations, which often offer lower prices than off-base alternatives.

Tip 4: Manage Debt Effectively

Managing debt is a critical aspect of army finance, as high-interest debt can quickly become overwhelming. Army personnel should focus on paying off high-interest debt, such as credit card balances, as soon as possible. They can also consider consolidating debt into lower-interest loans or balance transfer credit cards. Additionally, avoiding new debt is crucial, as it can quickly add up and become difficult to manage.

Tip 5: Plan for the Future

Finally, army personnel should plan for the future by setting long-term financial goals. This may include saving for retirement, paying for education expenses, or buying a home. They can take advantage of army benefits, such as the Post-9⁄11 GI Bill, to help achieve these goals. It’s also essential to review and update insurance coverage, including life insurance and disability insurance, to ensure that dependents are protected in case of unexpected events.

| Benefit | Description |

|---|---|

| Basic Pay | Varies based on rank and time in service |

| Allowances | Housing, food, and other expenses |

| Thrift Savings Plan (TSP) | Retirement savings plan with tax benefits and low fees |

| Post-9/11 GI Bill | Education assistance for army personnel and their dependents |

💡 Note: Army personnel should regularly review and update their financial plans to ensure they are on track to meet their financial goals.

In summary, managing finances is a critical aspect of life for army personnel. By understanding army pay and benefits, creating a budget, building an emergency fund, taking advantage of army benefits, managing debt effectively, and planning for the future, army personnel can achieve financial stability and make the most of their money.

What is the Thrift Savings Plan (TSP)?

+

The Thrift Savings Plan (TSP) is a retirement savings plan that offers tax benefits and low fees to army personnel.

How can I manage debt effectively?

+

Managing debt effectively involves paying off high-interest debt, consolidating debt, and avoiding new debt. Army personnel can also consider balance transfer credit cards or debt consolidation loans.

What is the Post-9⁄11 GI Bill?

+

The Post-9⁄11 GI Bill is an education assistance program that provides financial support to army personnel and their dependents for education expenses.

Related Terms:

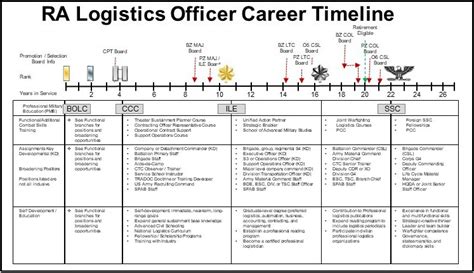

- Army Finance Officer

- British Army Finance jobs

- Military Accountant salary

- Army jobs Officer

- Army Engineer

- Army Accountant