5 Ways Enroll Health Insurance

Introduction to Health Insurance Enrollment

Enrolling in health insurance is a crucial step towards securing your financial and physical well-being. With the numerous options available, it can be overwhelming to choose the right plan. In this article, we will explore the different ways to enroll in health insurance, highlighting the key aspects of each method. Whether you are an individual, family, or business owner, understanding these enrollment options will help you make an informed decision.

Understanding Health Insurance Plans

Before diving into the enrollment process, it’s essential to understand the various types of health insurance plans available. These include: * Individual and Family Plans: Designed for individuals and families who are not covered by their employer. * Group Plans: Offered by employers to their employees, often with a shared cost. * Medicaid and CHIP: Government-funded programs for low-income individuals and families. * Medicare: A federal program for seniors and certain younger people with disabilities.

5 Ways to Enroll in Health Insurance

Here are five common ways to enroll in health insurance:

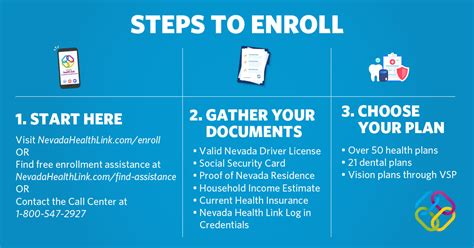

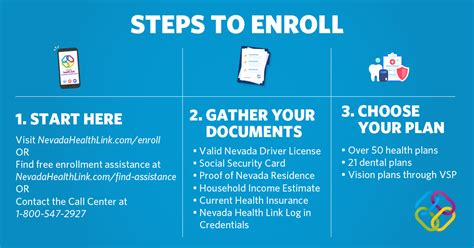

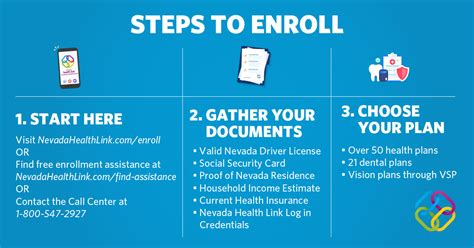

- Online Enrollment: Many insurance providers offer online enrollment options, allowing you to browse plans, compare prices, and sign up from the comfort of your own home. This method is convenient and often includes tools to help you find the best plan for your needs.

- Phone Enrollment: If you prefer a more personal touch, you can enroll in health insurance over the phone. This method allows you to ask questions and receive guidance from a representative.

- In-Person Enrollment: Meeting with an insurance agent or broker in person can provide a more comprehensive understanding of the plans and their benefits. This method is ideal for those who value face-to-face interaction and personalized advice.

- Mail-In Enrollment: For those who prefer a more traditional approach, mail-in enrollment is still an option. This method involves completing a paper application and mailing it to the insurance provider.

- Employee Enrollment: If your employer offers group health insurance, you can enroll through your company’s benefits department. This method often includes a shared cost and may offer more comprehensive coverage.

Key Considerations for Health Insurance Enrollment

When enrolling in health insurance, there are several key considerations to keep in mind: * Network Providers: Ensure that your preferred healthcare providers are part of the insurance network. * Deductibles and Copays: Understand the out-of-pocket costs associated with your plan. * Coverage Limitations: Review the plan’s coverage limitations and exclusions. * Premium Costs: Calculate the total premium cost, including any subsidies or tax credits.

| Plan Type | Network Providers | Deductibles and Copays | Coverage Limitations | Premium Costs |

|---|---|---|---|---|

| Individual and Family Plans | Vary by plan | Vary by plan | Vary by plan | Vary by plan |

| Group Plans | Often includes a larger network | Shared cost with employer | May have fewer limitations | Shared cost with employer |

| Medicaid and CHIP | Government-funded network | Low or no out-of-pocket costs | Income-based eligibility | Government-funded |

| Medicare | Federal program with a large network | Vary by plan | Age and disability-based eligibility | Government-funded with possible supplemental costs |

💡 Note: It's essential to carefully review and compare the different health insurance plans before making a decision.

As you navigate the health insurance enrollment process, remember to prioritize your needs and budget. By understanding the various enrollment options and plan types, you can make an informed decision that secures your health and financial well-being.

In the end, enrolling in health insurance is a critical step towards protecting yourself and your loved ones from the financial burden of medical expenses. By considering the different enrollment options and plan types, you can find the perfect plan that meets your unique needs and budget. With the right health insurance plan, you can enjoy peace of mind and focus on maintaining a healthy and happy life.

What is the difference between individual and group health insurance plans?

+

Individual health insurance plans are designed for individuals and families who are not covered by their employer, while group health insurance plans are offered by employers to their employees, often with a shared cost.

How do I know which health insurance plan is right for me?

+

To find the right health insurance plan, consider your budget, health needs, and preferred healthcare providers. You can also compare plans and seek guidance from an insurance agent or broker.

Can I enroll in health insurance at any time?

+

No, health insurance enrollment is typically limited to specific periods, such as the annual open enrollment period or special enrollment periods triggered by qualifying life events.

Related Terms:

- First enroll health insurance reviews

- First Enroll health insurance login

- first enroll health plan cancellation policy

- First Enroll health insurance NJ

- First enroll health insurance providers

- First Enroll lawsuit update