5 Health Fee Tips

Understanding Health Fees: A Comprehensive Guide

When it comes to managing your health, understanding the various fees associated with medical care is crucial. Healthcare costs can quickly add up, and being unaware of the fees you’re being charged can lead to financial strain. In this article, we’ll delve into the world of health fees, exploring what they are, why they’re charged, and most importantly, how you can navigate them effectively.

What Are Health Fees?

Health fees refer to the costs associated with healthcare services. These can range from consultation fees with your doctor, costs of medical tests and examinations, hospital stay charges, to fees for surgical procedures. Understanding the breakdown of these fees is essential for managing your healthcare expenses wisely.

Types of Health Fees

There are several types of health fees you might encounter: - Consultation Fees: Charged for visits to healthcare professionals. - Diagnostic Fees: For tests and examinations to diagnose conditions. - Treatment Fees: Costs associated with the treatment of medical conditions. - Prescription Fees: Charges for medicines prescribed by healthcare professionals. - Administrative Fees: Sometimes charged for paperwork, billing, and other administrative tasks.

5 Tips for Managing Health Fees

Managing health fees effectively requires a combination of awareness, planning, and sometimes, negotiation. Here are five tips to help you navigate the complex world of health fees:

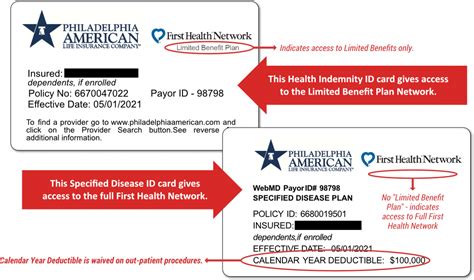

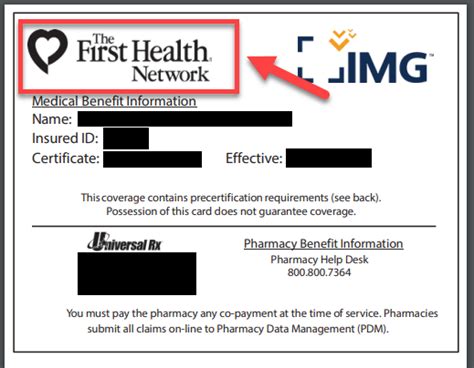

- Understand Your Insurance Coverage: Knowing what your health insurance covers and what it doesn’t is crucial. Always review your policy to understand the out-of-pocket expenses you might incur.

- Shop Around: Healthcare costs can vary significantly from one provider to another. Shopping around for non-emergency procedures can help you find more affordable options.

- Negotiate Fees: In some cases, it’s possible to negotiate fees with healthcare providers, especially for costly procedures. Don’t hesitate to ask if any discounts are available.

- Keep Track of Your Expenses: Maintaining a record of your healthcare expenses can help you identify areas where you can cut costs and plan better for future expenses.

- Preventive Care: Investing in preventive care can save you a significant amount of money in the long run. Regular check-ups and screenings can help prevent more serious (and costly) health issues from arising.

Importance of Transparency in Health Fees

Transparency in health fees is essential for patients to make informed decisions about their care. When you know upfront what you’re being charged for, you can better plan your finances and avoid unexpected medical bills. Always ask for an itemized bill and question any charges you don’t understand.

Health Fee Management Tools and Resources

Several tools and resources are available to help you manage health fees more effectively. These include: - Health Savings Accounts (HSAs): Allow you to set aside pre-tax dollars for medical expenses. - Flexible Spending Accounts (FSAs): Similar to HSAs but contributions are often made pre-tax through your employer. - Online Cost Estimators: Many hospitals and healthcare providers offer online tools to estimate costs of care. - Medical Billing Advocates: Professionals who can help navigate and sometimes reduce your medical bills.

💡 Note: Always review the terms and conditions of any health fee management tool or resource to ensure it aligns with your financial situation and healthcare needs.

Conclusion

Navigating the world of health fees requires patience, knowledge, and sometimes, a bit of negotiation. By understanding the types of health fees, being aware of your insurance coverage, shopping around for care, keeping track of your expenses, and investing in preventive care, you can better manage your healthcare costs. Remember, transparency and planning are key to avoiding financial stress related to health fees. Always seek to understand what you’re being charged for and don’t hesitate to ask questions or seek help when needed.

What is the best way to manage health fees?

+

The best way to manage health fees is through a combination of understanding your insurance coverage, shopping around for non-emergency care, negotiating fees when possible, keeping track of your expenses, and investing in preventive care.

Can health fees be negotiated?

+

Yes, in some cases, health fees can be negotiated, especially for costly procedures or with private healthcare providers. It’s always worth asking if any discounts are available.

What are the benefits of preventive care in managing health fees?

+

Investing in preventive care can save you a significant amount of money in the long run by preventing more serious and costly health issues from arising. Regular check-ups and screenings are key components of preventive care.

Related Terms:

- First Health Network providers

- First Health Network eligibility

- First Health Network provider portal

- First Health Network phone number

- TVP Health First Health network