5 Health Insurance Numbers

Introduction to Health Insurance Numbers

When it comes to health insurance, understanding the key numbers involved is crucial for making informed decisions about your coverage. From premiums to deductibles, and from copays to coinsurance, there are several important figures to consider. In this article, we will delve into five essential health insurance numbers that you should be familiar with to navigate the complex world of health insurance effectively.

1. Premiums

The first and perhaps most obvious number is your premium. This is the amount you pay each month to maintain your health insurance coverage. Premiums can vary widely based on factors such as your age, health status, location, and the type of plan you choose. Understanding your premium is essential because it directly affects your budget and financial planning. It’s also important to note that while a lower premium might seem appealing, it could mean higher out-of-pocket costs when you need medical care.

2. Deductible

Another critical number is your deductible, which is the amount you must pay out of pocket for healthcare expenses before your insurance plan starts to pay its share of costs. For example, if your deductible is 1,000, you will need to pay the first 1,000 of your medical expenses yourself. After reaching this threshold, your insurance coverage kicks in, and you will typically only be responsible for copays or coinsurance for subsequent services. Deductibles can significantly impact your upfront healthcare costs, so it’s vital to consider them when selecting a plan.

3. Copays

Copays, or copayments, are fixed amounts you pay for specific healthcare services after meeting your deductible. For instance, you might have a 20 copay for doctor visits or a 50 copay for prescription medications. Copays are a way for insurance companies to share the cost of care with you, making healthcare more affordable. Understanding your copays can help you anticipate and budget for routine medical expenses.

4. Coinsurance

Coinsurance refers to the percentage of medical expenses that you pay after meeting your deductible. For example, if your plan has a 20% coinsurance for hospital stays, this means you will pay 20% of the costs, and your insurance will cover the remaining 80%. Coinsurance rates can vary depending on the service and the specifics of your insurance plan. It’s essential to understand your coinsurance rates to predict your out-of-pocket costs accurately.

5. Out-of-Pocket Maximum

Lastly, the out-of-pocket maximum is a crucial number that represents the maximum amount you will pay for healthcare expenses within a calendar year. This includes deductibles, copays, and coinsurance but does not typically include premiums. Once you reach this maximum, your insurance plan covers 100% of eligible expenses for the remainder of the year. Knowing your out-of-pocket maximum can provide peace of mind and help you plan for the worst-case scenario in terms of medical expenses.

📝 Note: It's essential to review your insurance policy documents carefully to understand all the associated costs and benefits. Sometimes, what seems like the cheapest option based on premiums alone can end up being more expensive due to higher deductibles, copays, or coinsurance rates.

In summary, understanding these five health insurance numbers—premiums, deductibles, copays, coinsurance, and out-of-pocket maximum—is vital for navigating the healthcare system effectively and making informed decisions about your health insurance coverage. By considering these factors, you can better anticipate and manage your healthcare costs, ensuring that you have the protection you need without breaking the bank.

What is the main difference between copays and coinsurance?

+

Copays are fixed amounts paid for specific services, whereas coinsurance is a percentage of the medical expenses paid after meeting the deductible.

How do I choose the right health insurance plan based on these numbers?

+

Consider your budget, health needs, and potential risks. If you expect high medical expenses, a plan with higher premiums but lower deductibles and out-of-pocket costs might be preferable. Conversely, if you’re relatively healthy, a lower-premium plan with higher deductibles could save you money.

Can I change my health insurance plan if I find it’s not suitable after understanding these numbers?

+

Typically, you can change your plan during the annual open enrollment period or if you experience a qualifying life event, such as losing your current coverage, getting married, or having a baby. It’s crucial to review and understand the terms of your plan and the options available to you.

Related Terms:

- First Health PPO

- First Health Aetna

- First health insurance login

- health first provider telephone number

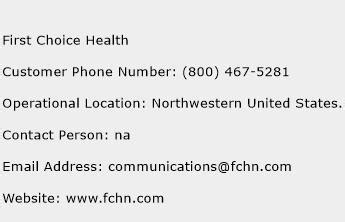

- first health insurance contact number

- healthfirst 800 number