5 Ways First Health PPO

Introduction to First Health PPO

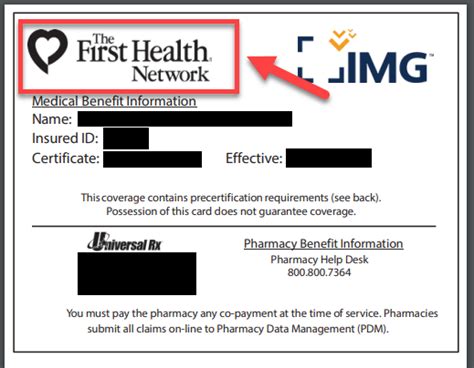

The First Health PPO, or Preferred Provider Organization, is a type of health insurance plan that offers a network of healthcare providers who have agreed to provide discounted services to plan members. This type of plan is designed to provide flexibility and cost savings to individuals and families who need medical care. In this article, we will explore 5 ways that First Health PPO can benefit those who enroll in the plan.

What is a PPO Plan?

A PPO plan is a type of health insurance that allows members to receive medical care from a network of participating providers. These providers have agreed to accept a discounted rate for their services, which helps to keep costs lower for plan members. PPO plans typically offer more flexibility than other types of health insurance plans, such as HMOs (Health Maintenance Organizations), because they allow members to see any healthcare provider they choose, both in and out of network.

Benefits of First Health PPO

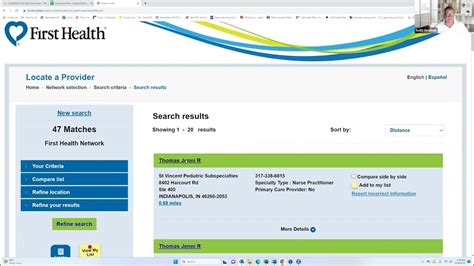

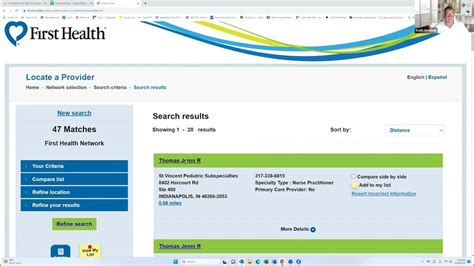

There are several benefits to enrolling in a First Health PPO plan. Here are 5 ways that this type of plan can benefit members: * Flexibility: First Health PPO plans offer members the flexibility to see any healthcare provider they choose, both in and out of network. This means that members can choose to see a specialist or receive care from a provider who is not part of the network, although they may pay a higher rate for these services. * Cost Savings: PPO plans are designed to provide cost savings to members. By receiving care from participating providers, members can take advantage of discounted rates for medical services. * Network of Providers: First Health PPO plans offer a large network of participating providers, which means that members have access to a wide range of healthcare services and specialists. * Preventive Care: Many First Health PPO plans cover preventive care services, such as annual physicals and screenings, at no additional cost to members. * Out-of-Network Coverage: First Health PPO plans typically offer out-of-network coverage, which means that members can receive medical care from providers who are not part of the network, although they may pay a higher rate for these services.

How to Choose a First Health PPO Plan

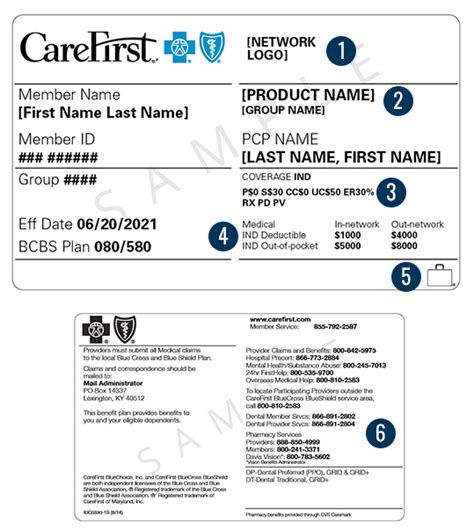

Choosing a First Health PPO plan can be a complex process, but there are several factors to consider when making a decision. Here are a few things to keep in mind: * Network of Providers: Consider the network of providers offered by the plan. Are your current healthcare providers part of the network? * Cost: Consider the cost of the plan, including premiums, deductibles, and copays. * Coverage: Consider the types of medical services that are covered by the plan, including preventive care and out-of-network coverage. * Maximum Out-of-Pocket: Consider the maximum out-of-pocket costs associated with the plan, which can help you budget for medical expenses.

👍 Note: It's always a good idea to carefully review the terms and conditions of a health insurance plan before enrolling, to make sure you understand the benefits and limitations of the plan.

Summary of Key Points

In summary, First Health PPO plans offer a range of benefits to members, including flexibility, cost savings, and access to a large network of healthcare providers. When choosing a First Health PPO plan, it’s essential to consider factors such as the network of providers, cost, coverage, and maximum out-of-pocket costs. By carefully reviewing the terms and conditions of a plan, individuals and families can make informed decisions about their health insurance needs.

What is a PPO plan?

+

A PPO plan is a type of health insurance that allows members to receive medical care from a network of participating providers, while also offering the flexibility to see providers outside of the network.

How do I choose a First Health PPO plan?

+

When choosing a First Health PPO plan, consider factors such as the network of providers, cost, coverage, and maximum out-of-pocket costs. It's also essential to carefully review the terms and conditions of the plan to ensure you understand the benefits and limitations.

What are the benefits of a First Health PPO plan?

+

The benefits of a First Health PPO plan include flexibility, cost savings, access to a large network of healthcare providers, coverage for preventive care, and out-of-network coverage.

In final consideration, First Health PPO plans offer a range of benefits to individuals and families who need medical care. By understanding the key features and benefits of these plans, individuals can make informed decisions about their health insurance needs and choose a plan that meets their unique requirements. Whether you’re looking for flexibility, cost savings, or access to a large network of healthcare providers, a First Health PPO plan may be an excellent option to consider.

Related Terms:

- First Health Network providers

- First Health PPO Aetna

- First Health insurance phone number

- first health ppo customer service

- first health ppo scam

- first health owned by aetna